Email Templates

Navigation to Email Templates: System Management>Lending>Email Templates

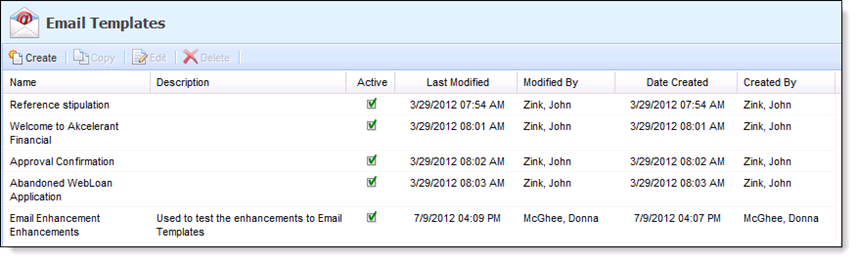

Email notifications can be manually sent from anywhere in the loan application process using Email Templates set up in the Framework.

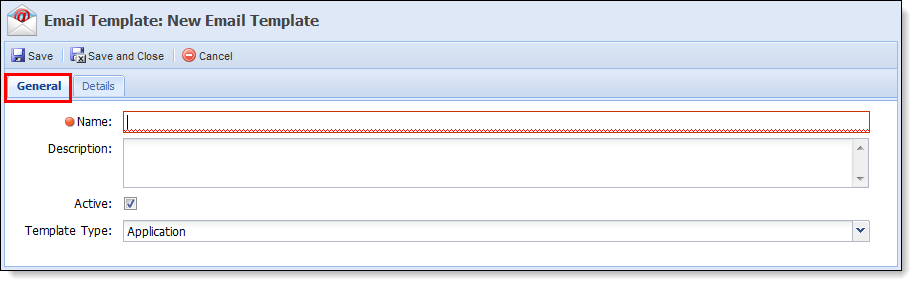

To create an Email template, click Create.

On the General tab users are able to enter the Email Template's basic information. Complete all applicable fields that assist users identify the purpose of the Email Template.

| Field | Description |

| Name | Fill in the Name box (required). |

| Description | Write a short Description (if needed). |

| Active Checkbox | Check the Active Box so the new email template is active in the Framework. |

| Template Type | Select a Template Type--either Application or Counteroffer. |

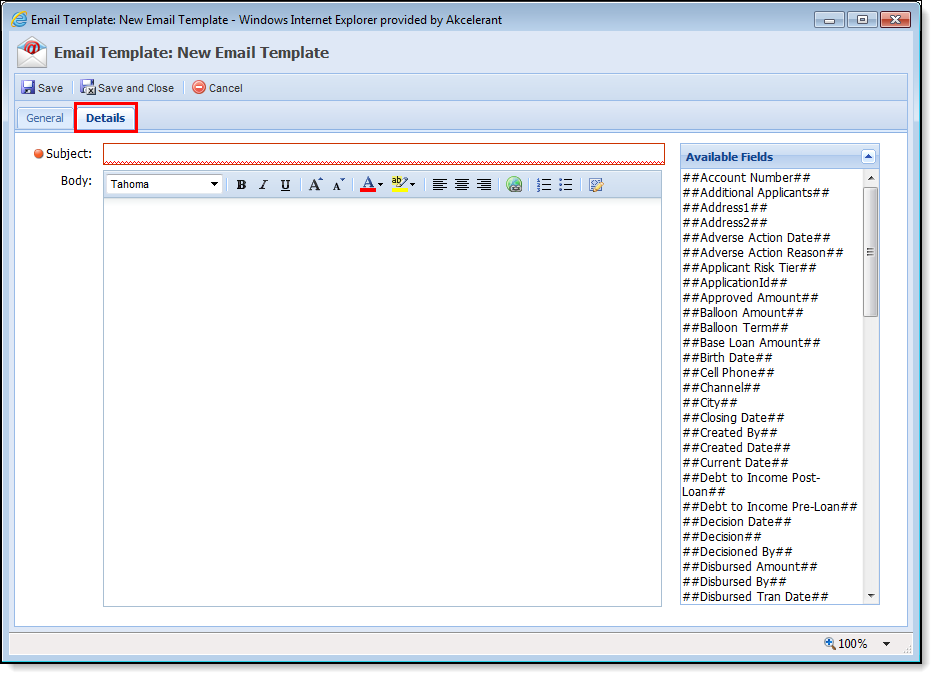

- The Subject and Body can be specified for each template. The “From” email address is customizable and configurable as a solution parameter. For all email templates the administrator can choose the "From" address to be either a System Email or the User’s Email (user who sent the email.)

- The Body contains a Rich Text editor that enables users to create a standard email template that may be sent to applicants.

|

Both Subject and Body may contain any of the Available Fields accessible through the interface. A user can design a template to contain such fields as Application Number, Primary Applicant Name, Created By User Name and so on. |

- Using standard drag and drop functionality, the user can select a field name and drag it into the text, copy and paste a field or manually type the shortcut name for the field into the Body or Subject fields.

-

Click Save and Close. Once saved, this template is accessible to the end-user within an application.

When an Available Field is inserted in an Email Template, the information collected in the corresponding application field appears in the actual email sent to the applicant. The following fields are available to be included in an Email Template:

-

##Account Number##

-

##Additional Applicants##

-

##Address1##

-

##Address2##

-

##Adverse Action Date##

-

##Adverse Action Reason##

-

##Applicant Risk Tier##

-

##ApplicationId##

-

##Approved Amount##

-

##Balloon Amount##

-

##Balloon Term##

-

##Base Loan Amount##

-

##Birth Date##

-

##Cell Phone##

-

##Channel##

-

##City##

-

##Closing Date##

-

##Created By##

-

##Created Date##

-

##Current Date##

-

##Debt to Income Post-Loan##

-

##Debt to Income Pre-Loan##

-

##Decision Date##

-

##Decision##

-

##Decisioned By##

-

##Disbursed Amount##

-

##Disbursed By##

-

##Disbursed Tran Date##

-

##Disbursement Date##

-

##Expiration Date##

-

##Final Decision Date##

-

##Final Loan Amount##

-

##First Due Date##

-

##First Notification Date##

-

##Guarantors##

-

##Home Phone##

-

##Initial Loan Amount##

-

##Interest Rate Actual##

-

##Interest Rate Assigned##

-

##Joint Applicants##

-

##Joint First Name##

-

##Joint Full Name##

-

##Joint Last Name##

-

##Loan Type##

-

##Maturity Date##

-

##Max Cross-sell Amount##

-

##Membership Start Date##

-

##Monthly Payment Amount##

-

##Needed By Date##

-

##Next Contact Date##

-

##Non-Signing Spouses##

-

##Outstanding Stipulation 1##

-

##Outstanding Stipulation 2##

-

##Outstanding Stipulation 3##

-

##Outstanding Stipulation 4##

-

##Outstanding Stipulation 5##

-

##Overall LTV##

-

##Payment Frequency##

-

##Preferred Contact Info##

-

##Preferred Contact Method##

-

##Primary First Name##

-

##Primary Full Name##

-

##Primary Last Name##

-

##Queue##

-

##Recommended Amount##

-

##Rejection Reason 1##

-

##Rejection Reason 2##

-

##Rejection Reason 3##

-

##Rejection Reason 4##

-

##Rejection Reason 5##

-

##Requested Amount##

-

##Right Of Rescission Date##

-

##Second Notification Date##

-

##Secured Amount##

-

##Source##

-

##Stage##

-

##State##

System-Defined Email Templates

System-Defined Email Templates

The Framework comes with a variety of standard Email Templates. These templates do not populate within the Email Templates Administrator page, however when configuring emails they are accessible within Rules Management. These templates include the following:

| Email Template Name | Email Template Text |

| Application Status Change | The application ##Application ID## status changed to ##Status## while assigned to ##Queue##. |

| Application Assigned to Queue | The application ##Application ID## has been assigned to queue ##Queue##. |

| Application Count Threshold Exceeded | The queue ##Queue Name## has reached the threshold for total number of applications. It currently has ##Application Count## applications assigned to it. |

| Application Total Time in Queue Exceeded | The application ##Application ID## has exceeded the maximum duration in queue ##Queue##. |

| Application Total Time Since Origination Exceeded | The application ##Application ID## has exceeded the maximum duration since origination while assigned to queue ##Queue##. |

| Application Auto Approved | The application ##Application ID## has been auto approved for ##Primary Full Name##. |

| Application Manually Approved | The application ##Application ID## has been manually approved for ##Primary Full Name##. |

| Application Auto Declined | The application ##Application ID## has been auto declined for ##Primary Full Name##. |

| Application Manually Declined | The application ##Application ID## has been manually declined for ##Primary Full Name##. |

| Cross-sell Opportunity | The application ##Application ID## has a cross-sell for a ##Cross Sell Name## which has been forwarded to you for processing. Please contact ##Username## who sold the product for more information. |

| Application ##Application ID## Unlocked | You no longer have a lock on application ##Application ID##. Any unsaved information may have been lost. To resume editing, please exit and reopen the application. |

| External Comment Received | A comment was received for Application Number ##Application ID## on ##Current Date## from ##Comment Source##. Please review and take any actions necessary to complete the loan application. |

General Tab

General Tab