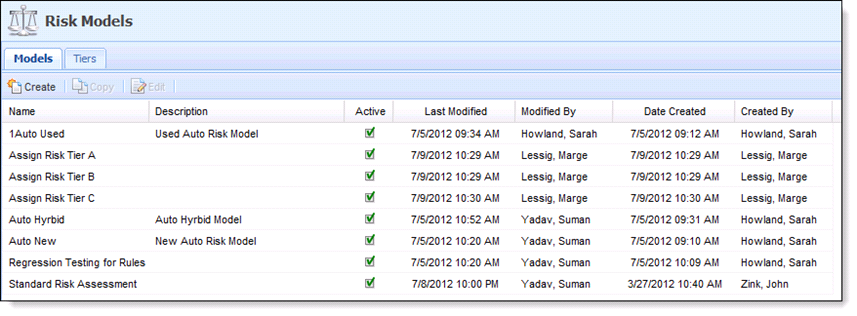

Risk Models

Navigation to Risk Models: System Management>Lending>Risk Models

Risk Models allow the administrator to define a naming convention for risk tiers (e.g. A+, A, B, Platinum, Gold, Silver). The risk tiers are ranked from 1 to N. Risk Models are created to tie appropriate rules together to determine what risk tier to assign to each applicant. Assigned aggregates, a result of risk tiers, are calculated and stored on the applicants' application. These include the high, low and average risk tiers for the application. In addition to the individual applicant’s risk tier, the high, low and average risk tiers can be used in pricing and decisioning of the application, assuming that the Risk Model is executed prior to the Pricing Model and decision model respectively.

One Risk Model is assigned to each Sub-Product; however, the same Risk Model can be assigned to more than one Sub-Product.

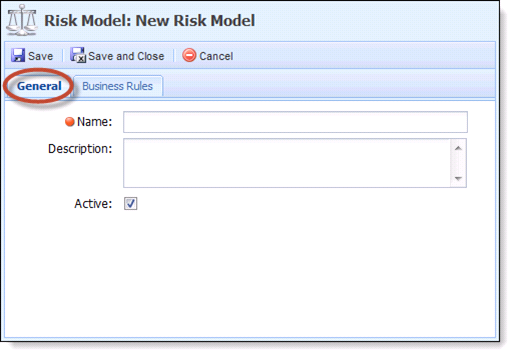

To create a new Risk Model, click Create.

- Enter the name of the Risk Model along with a Description.

- Verify the Active check box is checked.

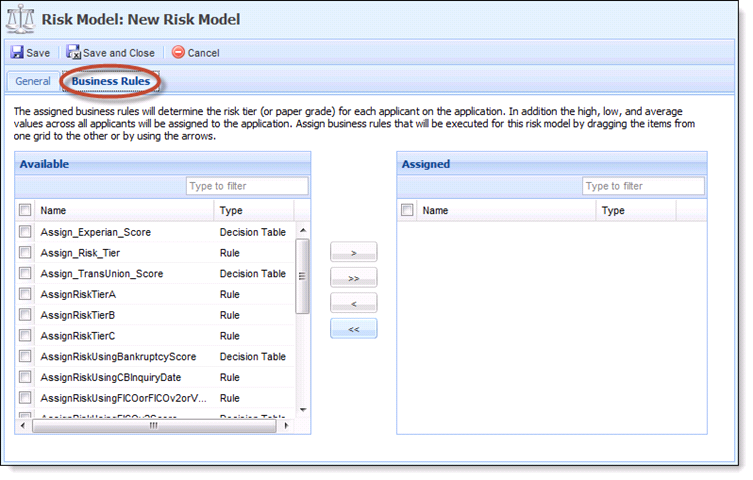

- Select the Business Rules Tab. Select the Business Rules that are appropriate for the Risk Model. Click on the Rule(s) in the Available box and move them to the Assigned box.

- Click Save and Close.

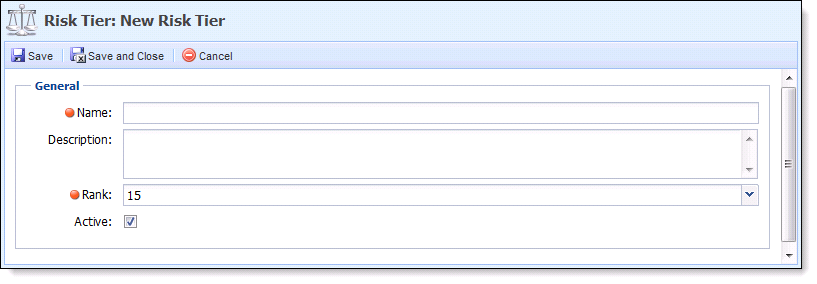

Users are able to define new Risk Tiers and quantify their ranking in terms of other risk tiers. Once risk tiers are created, they are able to be linked to risk models with rules.

To create a new Tier, click the Create button and then follow the below instructions:

| Field | Description |

| Name | Enter the Name of the Tier. |

| Description | Enter a Description (if needed). |

| Rank | Set the numeric rank of the tier. |

| Active Checkbox | Make sure the Active box is checked. |

Create a new Risk Model

Create a new Risk Model General Tab

General Tab