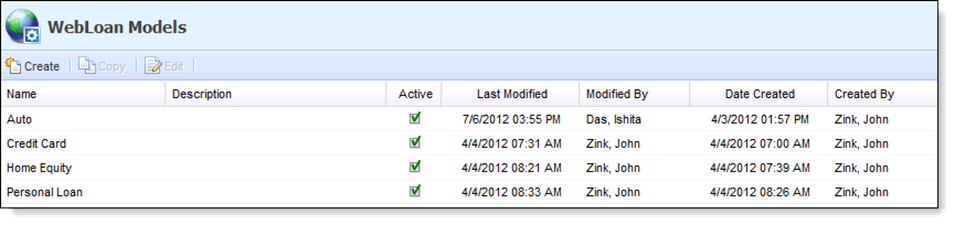

WebLoan Models

Navigation to WebLoan Models: System Navigation>Lending>WebLoan>WebLoan Models

WebLoan Models allows the administrator to configure the workflow screens for WebLoan applications. The WebLoan Models serve as the basis for the information displayed on the WebLoan Applicant Site. The panels of information collected within each Model can differ based on the customers' requirements.

To create a WebLoan Model, click Create.

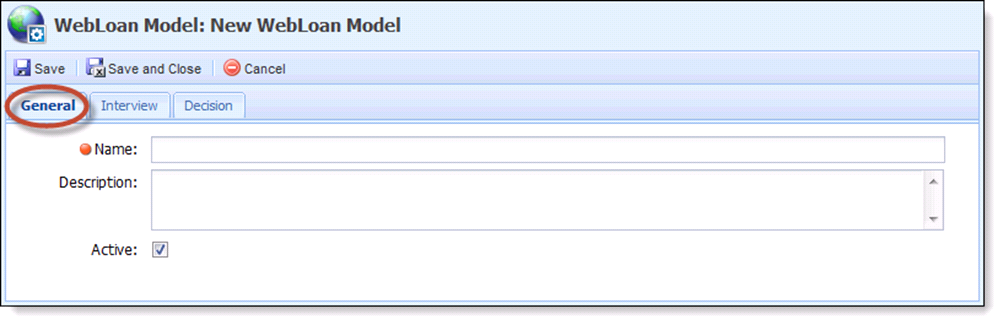

- Enter the Name of the WebLoan Model, write a description, and verify that the Active box is checked.

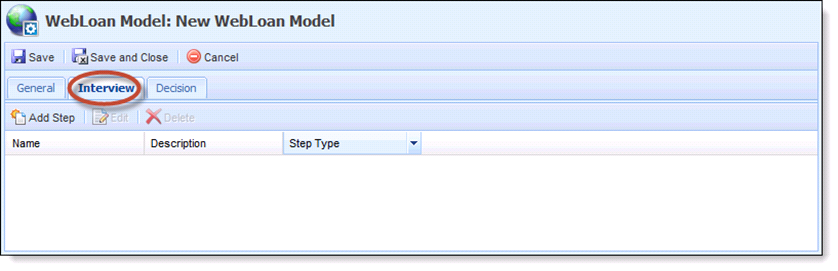

The Interview tab contains steps that are processed when an application is started. The steps are processed in the order they appear in the grid. Drag and drop the steps within the grid to change the order of execution.

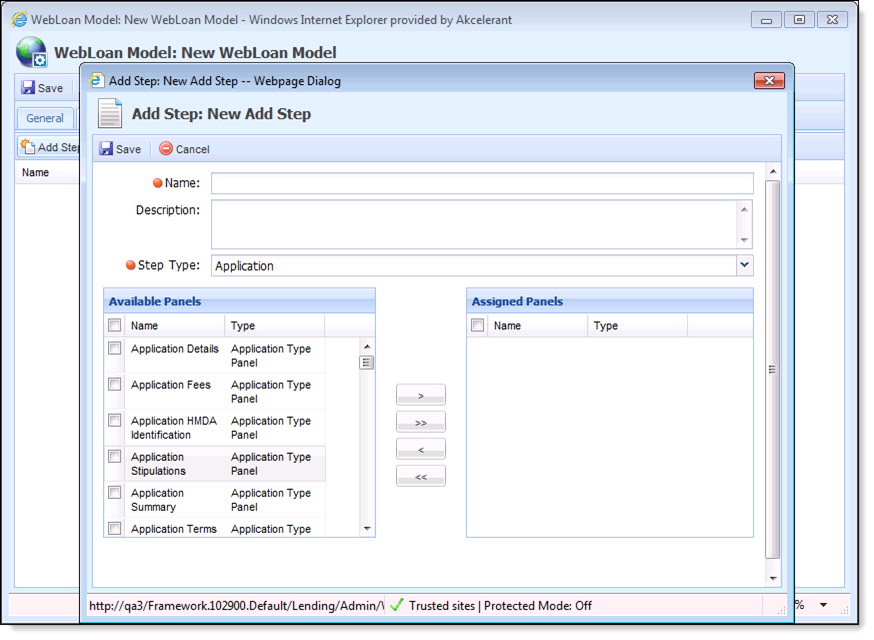

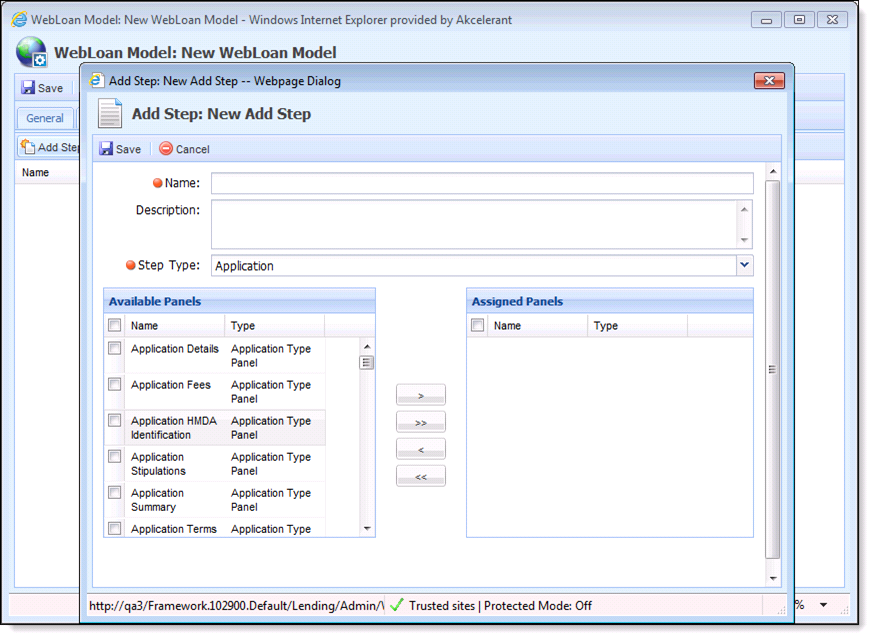

- Click Add Step.

- Enter the Name of the step.

- Enter the Description of the step (if needed/desired).

- Select the Step Type.

Application allows the user to select predefined general loan information panels or user-defined rich text panels to be displayed.

Applicant allows the user to select predefined applicant information panels or user defined rich text panels to be displayed.

- Select panels to be displayed on the step from the Available Panels box.

- Move selected panels to the Assigned Panels box.

- Click Save to save the step.

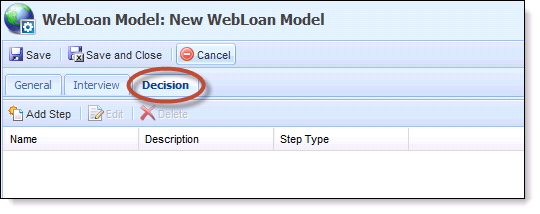

The Decision tab defines the steps that are processed when an application is being processed for a decision. The steps are processed in the order they appear in the grid. Drag and drop the steps within the grid to change the order of execution.

- Click Add Step.

- Enter the Name of the step.

- Enter the Description of the step (if needed/desired).

- Select the Step Type.

Application allows the user to select predefined general loan information or user defined rich text panels to be displayed.

Applicant allows the user to select predefined applicant information panels or user defined rich text panels to be displayed.

- Select panels to be displayed on the step from the Available Panels box.

- Move selected panels to the Assigned Panels box.

|

It is possible to assign panels that contain similar information within the same WebLoan step. For example: Application Summary and Application Summary – No Interest or Payment Information. It should be an institution’s best practice to double-check that similar panels have not been assigned to the same WebLoan step so information is not unnecessarily replicated. |

- Click Save.

Institutions are able to customize their applicant's WebLoan experience by assigning panels to the WebLoan application step. All panels are system-defined and unable to be edited by users. The fields within each panel cannot be added or removed nor can they be made required or not required.

| Panel Name | The lending solution Sections Included | Panel Type | Function | Content Examples | ||

| Applicant Addresses - Current | Applicant Addresses | Applicant | Applicant Addresses | Current, Alternate, and Previous Address 1, City, State, Zip | ||

| Applicant Addresses - Previous | Applicant Addresses | Applicant | Applicant Addresses | Current, Alternate, and Previous Address 1, City, State, Zip | ||

| Applicant Addresses - Alternate | Applicant Addresses | Applicant | Applicant Addresses | Current, Alternate, and Previous Address 1, City, State, Zip | ||

| Applicant Declarations | Applicant Declarations | Applicant | Applicant Declarations | List of Declarations for application to disclose to credit union | ||

| Applicant Identification | Applicant Identification | Applicant | Basic Applicant Demographic Data | First Name, Last Name, TIN, Marital Status | ||

| Applicant Identification - SSN | Applicant Identification | Applicant | Basic Applicant Demographic Data | First Name, Last Name, SSN (NOT TIN), Marital Status | ||

| Applicant Income - Primary | Applicant Income and Employment | Applicant | Income/Employment Information | Type, Amount, Frequency, Start and End Date, Source | ||

| Applicant Income - Other | Applicant Income and Employment | Applicant | Income/Employment Information | Type, Amount, Frequency, Start and End Date, Source | ||

| Applicant Phones | Applicant Phones | Applicant | Applicant Phones | Home, Work and Mobile phones | ||

| Applicant Terms | Loan Terms General, Loan Terms Dates | Application | Requested Loan Data | Date needed by, Term, Requested amount, Promotional Code | ||

| Credit Card Application Terms | Loan Terms General, Loan Terms Dates, Credit Card | Application | Display Loan Terms information as well as required CC data | Date needed by, Term, Requested amount, Credit Card Number, Credit Card Design Type, Credit Card Type, Joint Received Credit Card, Promotional Code | ||

| Credit Card Authorized User | Credit Card Authorized User Identification, Credit Card Authorized User Address, Credit Card Authorized User Phones | Application | Basic Authorized User demographic data | Phone, Address, Name | ||

| Credit Card Authorized User List | Credit Card Authorized User Identification | Application | Names for Authorized Users | First and Last Name | ||

| Application Details | Overview Application Summary, Overview Loan Summary, Applicant Identification, Vehicle Collateral, General Real Estate Collateral, Loan Decision. | Application | Display Application and Loan data | Status, Decision, Product, Loan Amount, Created Date, Promotional Code | ||

| Application Fees | Fees | Application | Detailed Loan Fees | Fee Name, Amount, Finance Charge | ||

| Application HMDA Identification | HMDA Information | Application | Can only collect data on the first two applicants | |||

| Application Stipulations | Underwriting Stipulations | Application | Display-Only view of Stipulations | Stipulation, Required for, Comment, Added by | ||

| Application Summary | Overview Application Summary, Overview Loan Summary, Loan Fees | Application | Display Application and Loan data | Status, Decision, Product, Loan Amount, Created Date, Fee Total | ||

| Application Summary - No Interest or Payment Information | Overview Application Summary, Overview Loan Summary, Loan Fees | Application | Display Application and Loan data without interest or payment details | Status, Decision, Product, Loan Amount, Created Date, Fee Total | ||

| Credit Card Application Summary | Overview Application Summary, Overview Loan Summary, Loan Fees | Application | Display Application and Loan data | Status, Decision, Product, Loan Amount, Created Date, Fee Total | ||

| Credit Card Application Summary - No Interest or Payment Information | Overview Application Summary, Overview Loan Summary, Loan Fees | Application | Display Application and Loan data without interest or payment details | Status, Decision, Product, Loan Amount, Created Date, Fee Total | ||

| Credit Report Authorization | Credit Reporting | Application | Credit Report Authorization | Checkbox to Authorize Pulling Credit | ||

| Document upload and review | Attach Files | Application | Upload and Review Documents |

Name, Description, Browse to File

|

||

| External comments and applicants comments | Comment History, Post Comment | Application | Only for External Comments | Comment, User, Date Created | ||

| Real Estate Identification | Real Estate Collateral General, Real Estate Collateral Valuation | Application | Real Estate Collateral information | Market Value, Current, Alternate, and Previous Address 1, City, State, Zip | ||

| Real Estate Identification with Additional Housing Expenses | Real Estate Collateral General, Real Estate Collateral Valuation, Real Estate Housing Expenses | Application | Real Estate Collateral information with Housing Expense information | This is not to be confused with the Debt Protection insurance. | ||

| Reference List | Reference Identification | Applicant | Names for References | First and Last Name | ||

| References | Reference Identification | Applicant | Basic demographic data for references | First Name, Last Name, Relationship to applicant | ||

| Terms and Conditions Authorization | Terms and Conditions | Application | Terms and Conditions Authorization | Checkbox to Verify Acceptance of Terms and Conditions | ||

| Vehicle Identification with Provider | Vehicle Collateral General, Vehicle COllateral Valuation | Application | Vehicle Collateral information for NADA and KBB valuations | Description, Collateral Code, Year, Make Model | ||

| Vehicle Identification with Provider and Insurance | Vehicle Collateral General, Vehicle Collateral Valuation | Application | Vehicle COllateral information for NADA and KBB valuations | Description, Collateral Code, Year, Make Model, insurance provider information | ||

| Vehicle Identification | Vehicle Collateral General | Application | Vehicle Collateral information | Description, Collateral Code, Year, Make Model | ||

| Vehicle Identification with Insurance | Vehicle Collateral General | Application | Vehicle Collateral information w vehicle insurance provider information | Description, Collateral Code, Year, Make Model, insurance provider information | ||

| Cross-sell | Cross-sells | Application | Other product offerings that may of interest to your applicants | Product Type, Amount, Include in Loan Amount | ||

| Applicant Addresses - Current - StartDT Req. | Applicant Addresses | Applicant | Applicant Addresses | Current, Alternate, and Previous Address 1, City, State, Zip | ||

| Vehicle Identification with Provider - Details not req. | Vehicle Collateral General, Vehicle Collateral Valuation | Application | Vehicle Collateral information for NADA and KBB valuations | Description, Collateral Code, Year, Make Model | ||

| Vehicle Identification with Provider and Insurance - Details not req. | Vehicle Collateral General, Vehicle Collateral Valuation | Application | Vehicle COllateral information for NADA and KBB valuations with vehicle insurance provider information | Description, Collateral Code, Year, Make Model, insurance provider information | ||

| Vehicle Identification - Details not req. | Vehicle Collateral General | Application | Vehicle Collateral Information | Description, Collateral Code, Year, Make Model | ||

| Vehicle Identification with Insurance - Details not req. | Vehicle Collateral General | Application | Vehicle Collateral information with vehicle insurance provider information | Description, Collateral Code, Year, Make Model, insurance provider information | ||

| Real Estate Identification (Purchase Date, County Req.) | Real Estate Collateral General, Real Estate Collateral Valuation | Application | Real Estate Collateral information | Market Value, Current, Alternate, and Previous Address 1, City, State, Zip | ||

| Applicant Income - Primary - Emp, Title, Start date req. | Applicant Income and Employment | Application | Income/Employment information | Type, Amount, Frequency, Start and End Date, Source | ||

| Credit Card Application Terms - No Card Type, Design, or Joint | Loan Terms General, Loan Terms Dates, Credit Card | Application | Display Loan Terms information as well as required CC data | Date needed by, Term, Requested amount, Credit Card Number, Credit Card Design Type, Credit Card Type, Joint Received Credit Card, Promotional Code | ||

| Disclosure Agreement | Disclosure Agreement | Application | Disclosure Agreement Validation | Checkbox to Acknowledge Disclosure Agreement | ||

| Terms and Conditions | Terms and Conditions | Application | Terms and Conditions Authorization | Checkbox to Verify Acceptance of Terms and Conditions | ||

| Vehicle Identification - Collateral Type Only | Vehicle Collateral General | Application | Vehicle Collateral information | Description, Collateral Code, Year, Make Model | ||

| Applicant Identification - three Column | Applicant Identification | Applicant | Basic Applicant Demographic Data | First Name, Last Name, TIN, Marital Status | ||

| Applicant Addresses - Current - StartDt Req. - three Column | Applicant Addresses | Applicant | Applicant Addresses | Current, Alternate, and Previous Address 1, City, State, Zip | ||

| Applicant Addresses - Previous - three Column | Applicant Addresses | Applicant | Applicant Addresses | Current, Alternate, and Previous Address 1, City, State, Zip | ||

| Applicant Income - Other - three Column | Applicant Income and Employment | Applicant | Income/Employment information | Type, Amount, Frequency, Start and End Date, Source | ||

| Application Terms - two COulmn | Loan Terms General, Loan Terms Dates | Application | Requested Loan Data | Date needed by, Term, Requested amount, Promotional Code | ||

| Credit Card Application Terms - two Column | Loan Terms General, Loan Terms Dates, Credit Card | Application | Display Loan Terms information as well as required CC data | Date needed by, Term, Requested amount, Credit Card Number, Credit Card Design Type, Credit Card Type, Joint Received Credit Card, Promotional Code |

Create a WebLoan Model

Create a WebLoan Model General Tab

General Tab