| End-User Guide > Application Processing > Post-Decision > Approval > Cross-Sells |

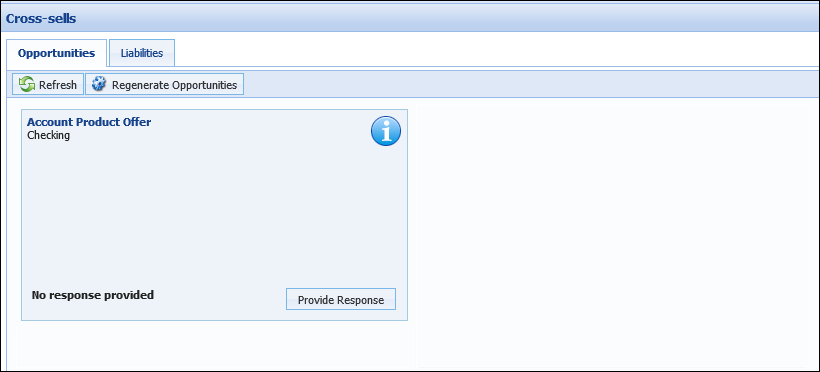

Cross-sells provides users an interface to sell additional account products, therefore providing additional value to the applicant's relationship with the institution. Cross-Sells are opportunities generated within the Lifecycle Management Suite by the rules engine. The opportunities that generate are based on the decision models and varies across applications. When an application has been approved, users are able to navigate to the Cross-sells screen to offer the opportunities generated.

|

In addition to the Cross-sells screen, a Cross-sell panel is available to provide users with the ability to offer existing cross-sell opportunities and generate new non-loan cross-sells. For details about the Cross-sell panel, please see the Underwriting Review topic of the Lifecycle Management Suite User Guide. |

This topic includes the following information:

The Cross-sell screen is divided into two tabs: Opportunities and Liabilities.

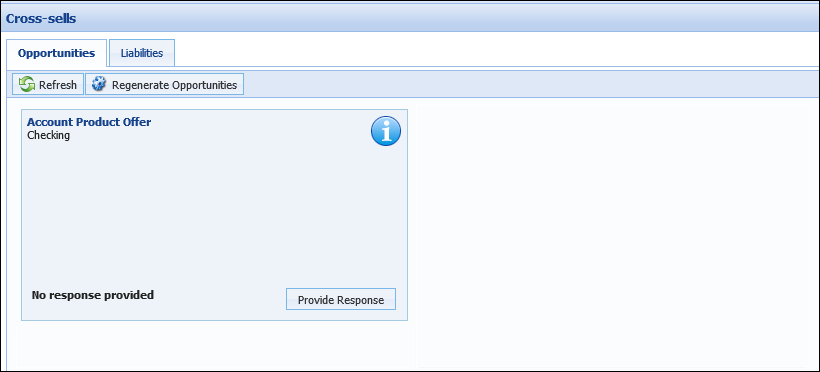

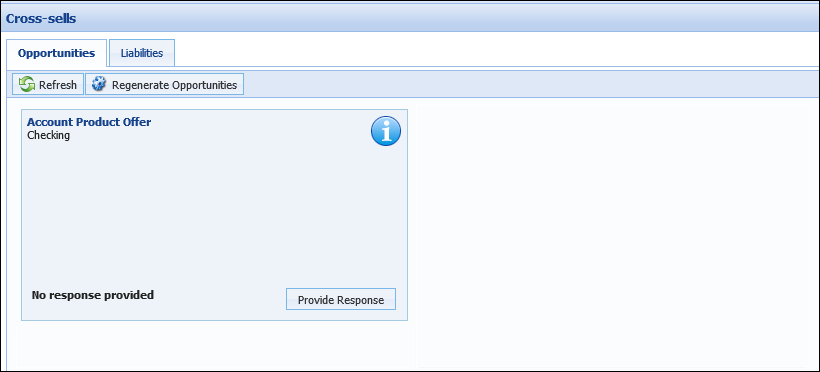

The Opportunities tab displays the approved cross-sell opportunities that have generated for the applicant. Each opportunity is presented within a card that displays product details, such as: Cross-sell Amount, Monthly Payment, Credit Line, Term, and Rate.

|

Cross-sell Amount, Monthly Payment, Credit Line, Term, and Rate are not displayed for account product offers. |

|

If an account product is already added to the application, the same product is not generated as a cross-sell. |

At the top of the Opportunities tab, a toolbar displays three buttons.

| Button | Description | ||

|

Allows users to view the most recent cross-sell opportunities. | ||

|

Allows users to initiate the cross-sell generation process. Clicking this button allows users to manually generate offers, if cross-sells have not been generated by Event Processing. If cross-sells have been generated by Event Processing, clicking this button reprocesses all offers.

|

Beneath the toolbar, the generated cross-sells are itemized within cards that are sorted according to opportunity type:

|

Within each opportunity type grouping, cross-sells are sorted by Date Created. |

Account cross-sell offer cards highlight the details of each account cross-sell and allow users to perform actions. These cards contain the following functional areas:

|

The format and action buttons within each card are consistent, however the details presented vary according to the type of opportunity. |

Within the Opportunity and Product section, the type of cross-sell opportunity displays in bold text.

|

Account product offers are not denoted with an icon. |

Beneath the opportunity type, the name of the cross-sell product is displayed.

The Script and Action section displays the following icons:

| Icon | Description | ||

|

Allows users to view the Sales Script configured for the cross-sell product. Clicking this icon opens the sales script in a pop-up window.

|

|||

|

Allows a user to delete a cross-sell offer.

|

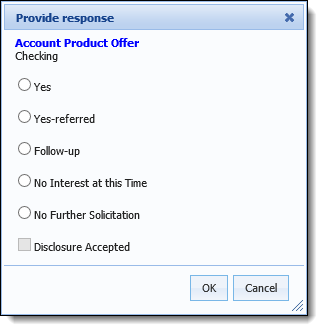

The Response section allows users to view and provide responses for each cross-sell offer.

On the right side of this section, users are able to provide cross-sell offer responses by clicking  . Upon clicking this button, the Provide Response pop-up window opens.

. Upon clicking this button, the Provide Response pop-up window opens.

Select the check box to indicate the desired response.

|

If Follow-up is selected, a field dynamically appears which requires users to provide a follow-up date. |

On the left side of this section of the card, the offer's response displays in bold. If the offer is Yes or Yes Referred, the child application status also displays.

|

The Liabilities tab does not populate with existing liability information for account cross-sells. |

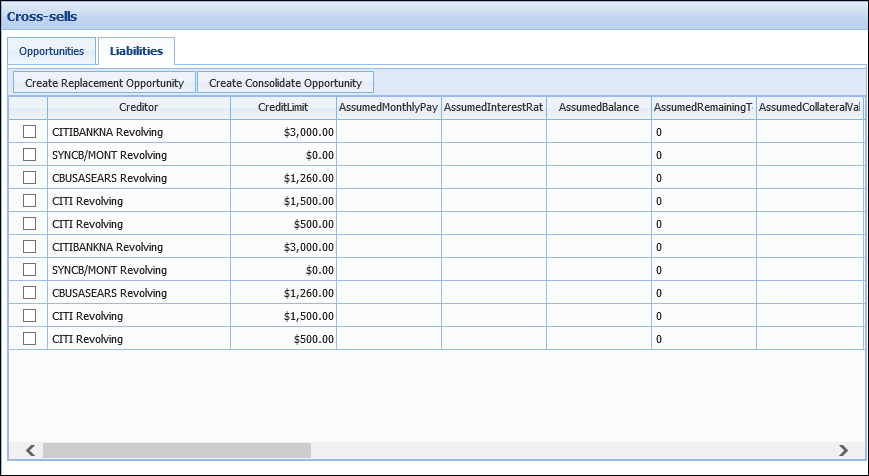

The Liabilities tab contains a grid that lists existing liabilities from an applicant’s credit report. The liabilities that populate in this list are not linked to a Replacement or Consolidation Offer. Each liability imported populates as a new row within the liabilities grid.

|

For a liability to populate in this section, it must be classified as an expense and have an ECOA code of I, J, S or U. Additionally, a liability cannot have a concurrent application. |

Users are able to select liabilities from this grid to manually create Replacement and Consolidation Offers. Once liabilities have been selected for Replacement or Consolidation Offers, they are removed from the Liabilities tab.

This grid displays liability attributes within the following columns:

| Column Name | Description | ||

| Creditor | Displays the name of this financial institution that holds the liability. | ||

| Credit Limit | Displays the credit limit of the liability. | ||

| Assumed Monthly Payment | Displays the assumed monthly payment based on the assumed interest rate and balance. | ||

| Assumed Interest Rate | Displays the assumed interest rate for the liability. | ||

| Assumed Balance | Displays the assumed balance of the liability. | ||

| Assumed Remaining Amount | Displays the assumed remaining loan amount of the liability. | ||

| Assumed Collateral Value | Displays the assumed collateral value of the liability. | ||

| Is Housing | Displays a check box that indicates if a liability is a housing expense. | ||

| Adjustment Percentage |

Indicates what percent of the product or liability is to be included in the cross-sell decision.

|

||

| Maturity Date | Displays the maturity date of the liability. | ||

| Balloon Due Date | Displays the balloon due date of the liability. | ||

| Balloon Amount | Displays the balloon amount of the liability. | ||

| Past Due | Displays the past due balance of the liability. | ||

| Adjusted Balance | Displays the adjusted balance of the liability based on the % Include value. | ||

| Adjusted Monthly Payment | Displays the adjusted payment of the liability based on the % Include value. | ||

| Payment Frequency | Displays the payment frequency of the liability. | ||

| Trade Category | Indicates the liability category such as Automobile or Credit Card. | ||

| Account Number |

Displays the liability's account number.

|

||

| ECOA Code | Displays the liability's ECOA Code. | ||

| Status | Displays a liability's delinquency status. | ||

| Last Reported Date | Displays the date when a liability was last reported to the credit bureau. | ||

| Description | Displays any further information about the liability. | ||

| Open Date | Indicates the date the liability was opened. |

Above the Liabilities grid, a toolbar allows users to perform the following functions:

| Button | Description |

|

Allows a user to replace a single applicant liability at another institution with a loan. |

|

Allows a user to consolidate multiple applicant liabilities into a single loan. |

|

For more information on the functionality of these buttons, refer to the Generating Cross-sell Opportunities section. |

The following cross-sell types may be presented within the Cross-sell screen's Opportunities tab:

Account offers are cross-sells for account products. These offers many include products such as Certificates of Deposit, IRA's and Preferred Checking accounts.

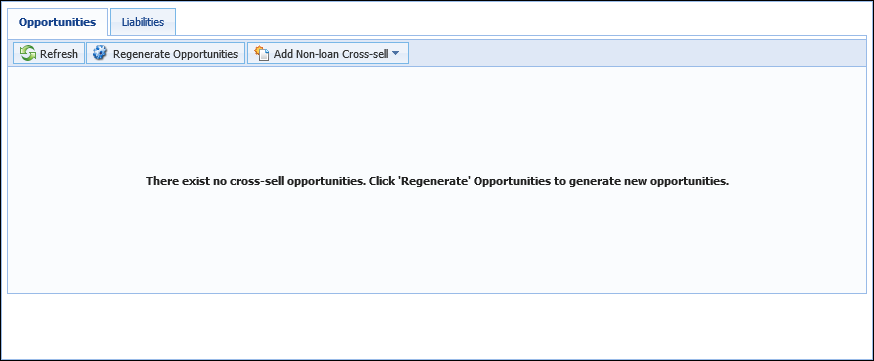

Cross-sell opportunities are generated manually through  or automatically through Event Processing.

or automatically through Event Processing.

Upon navigating to the Cross-sells screen, users are notified that no cross-sell opportunities currently exist.

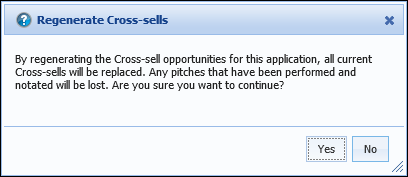

To generate cross-sells, click  within the Cross-sells toolbar. A notification appears which alerts users that continuing causes all existing cross-sell to be overwritten. Click Yes.

within the Cross-sells toolbar. A notification appears which alerts users that continuing causes all existing cross-sell to be overwritten. Click Yes.

Cross-sells generate and populate within the Opportunities tab.

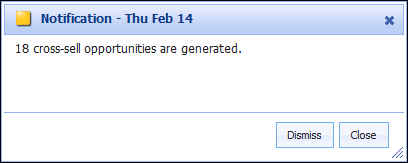

Cross-sell products may be generated by the system-defined Process Cross-sells on Approval event and action pair or a custom pair created by the institution. Upon completing the defined event, such as Application Approval, cross-sells are processed. Once all cross-sell opportunities have been generated, a Notification alerts users that cross-sells have been generated.

To ignore the cross-sell opportunities Notification, click Dismiss to remove the Notification. Click Close to acknowledge and retain the Notification.

Navigate to the Cross-sell screen via the workflow or manually select the screen to work the cross-sells that were generated.

|

The StopCrossSellAction rule prevents cross-sell opportunities from generating on applications and child applications. |

Cross-sell offers may be processed directly within the Offer Card, by clicking Provide Response.

.

.

If the account product is later removed from the application via the Add Account Product screen, the response displayed within the cross-sell offer card is changed to Declined.

Accepting Account cross-sell offers adds the account product to the current "parent" application. A separate "child" application is not created for account product cross-sells.