| End-User Guide > Application Processing > Origination > Liabilities |

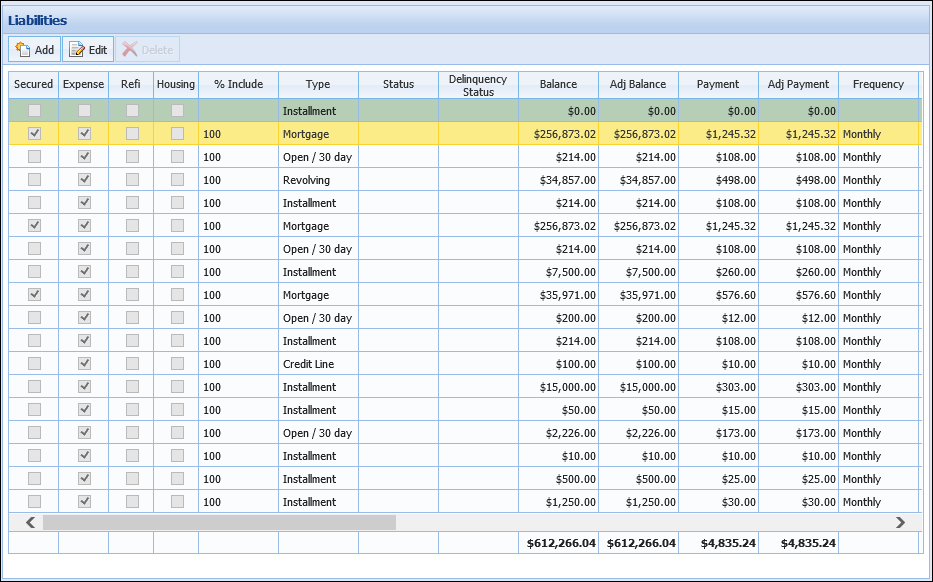

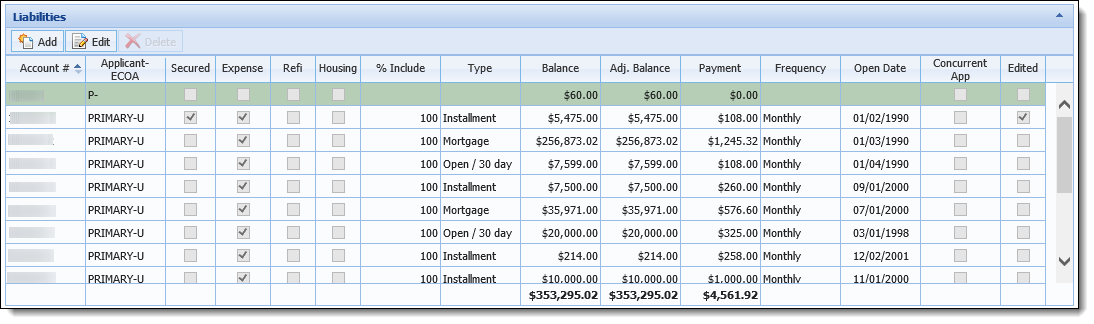

While processing an application, the Loan Origination module is able to capture applicant liabilities. If an applicant is a current account holder, the module searches the core for liabilities. The Loan Origination module also retrieves applicant liabilities from a credit report. If liabilities are located on the core or retrieved from a credit report, the liabilities of each applicant automatically populate within the Liabilities grid that appears in the Liabilities screen and Liabilities panel.

In addition to retrieving liabilities from the institution’s core and credit report, users are able to manually add liabilities that are not held by the institution or tracked by a credit report from the Liabilities screen and Liabilities panel.

|

When an address is added to an application, and Purchase is selected within the Status field in the Applicant Address screen, the address is added to the application as a Mortgage liability. The information populates in the Liabilities grid with the Housing Loan Balance and Monthly Expense amount identified within the Applicant Address screen and the liability is automatically flagged as a secured housing expense. |

The Liabilities screen is a system-defined screen that can be configured to appear in an application by the system administrator.

The Liabilities panel is a system-defined panel that system administrators can configure to appear within an Application screen assigned to the sub-product's workflow model.

Depending on the configuration of the workflow model, the Liabilities screen and/or the Application screen including the Liabilities panel may be assigned to the Workflow and/or Screen section of the Application Navigator.

|

For more information on the Application Navigator, please see the Application Navigator section of the Lifecycle Management Suite Workspace topic. |

|

The Liabilities panel and the Add-On/Refinance panel contain the same data. If the screen that contains the Liabilities panel also contains the Add-On/Refinance panel, data updated on the most-recent panel added to the screen by a system administrator is saved and overwrites the data updated on the other panel. |

Within both the Liabilities screen and Liabilities panel, the first row of data is automatically highlighted green to represent the liability record for the current application.

|

This liability record cannot be edited and is marked secured or unsecured based on the Secured configuration for the application's sub-product. |

A toolbar is located at the top of the screen and panel to provide users with the ability to perform the following functions:

| Icon | Description |

|

Allows a user to add an applicant liability to the current application. |

|

Allows a user to edit an applicant liability that is assigned to the current application. |

|

Allows a user to remove an applicant liability from the current application. |

Within the grid that appears, information for each liability is distributed across the following columns:

|

The Liabilities panel provides administrators with the ability to configure the columns that display in the panel, as well as the label that appears for each column. Additionally, some fields that are available to add to the Liabilities panel do not appear within the Liabilities screen; therefore, the columns of information that appear in the Liabilities screen and panel may differ for each institution. |

|

When liabilities are imported from the core and/or a credit report, not all columns contain a value as some information is not relevant to all liability types. When a liability is added or edited from the Liabilities screen or Liabilities panel, the columns display the value of each completed field. |

| Column/Field | Description | ||||||||||||||||||||||

| Secured |

If an item is identified as a secured liability, the check box is selected. For more information on this functionality, please see the section below:

The Secured column is available within the Liabilities grid to identify a liability as secured or unsecured. As previously mentioned, the information that appears within the Liabilities grid is imported from the core, which is in turn imported from a credit report tradeline or manually added within the Liabilities grid.

When liabilities are imported from the core system, they are marked as unsecured by default. When liabilities are imported from a credit report tradeline, they are identified as secured or unsecured according to the mapping defined in the table below:

When a liability is added or edited from the Liabilities grid, users are able to manually set the value of the Secured field within the Edit Liabilities screen.

Users can identify a liability as secured by selecting the Secured checkbox or identify it as unsecured by deselecting the checkbox. Once the desired Secured value appears for the liability, click

|

||||||||||||||||||||||

| Expense | If the item is identified as an expense, the check box is selected. | ||||||||||||||||||||||

| Refi |

If the item is identified as a refinance, the check box is selected.

|

||||||||||||||||||||||

| Housing | If the item is identified as a housing expense, the check box is selected. | ||||||||||||||||||||||

| % Include |

Indicates the percent of the liability value included as the applicant’s.

|

||||||||||||||||||||||

| Type | Indicates the liability type such as Installment, Mortgage, or Revolving. The values within this field populate from the TRADE_TYPE field lookup. | ||||||||||||||||||||||

| Status | Indicates the status of the liability such as Current or Bankruptcy. The values within this field populate from the TRADE_STATUS field lookup. | ||||||||||||||||||||||

| Delinquency Status |

Indicates the maximum delinquency status of a liability during the last 24 months.

|

||||||||||||||||||||||

| Balance | Indicates the actual balance. A total of all balances is calculated and displayed within the bottom of the grid. | ||||||||||||||||||||||

| Adj. Balance | Indicates the balance of the liability after the being adjusted according to the percent included value. A total of all adjusted balances is calculated and displayed within the bottom of the grid. | ||||||||||||||||||||||

| Payment | Indicates the actual payment amount of the liability. A total of all payments is calculated and displayed within the bottom of the grid. | ||||||||||||||||||||||

| Adj. Payment | Indicates the payment amount after the adjustment according to the percent included value. A total of all adjusted payments is calculated and displayed within the bottom of the grid. | ||||||||||||||||||||||

| Frequency | Indicates the payment frequency of the liability. | ||||||||||||||||||||||

| Applicant - ECOA | Indicates which applicant is the owner of the liability according to the Equal Credit Opportunity Act code indicated on the credit report. | ||||||||||||||||||||||

| Source | Indicates the liability’s source. The application currently being applied for is displayed according to the application number. If the liability’s source is the credit report, the credit bureau providing the information is displayed. | ||||||||||||||||||||||

| Account # |

Indicates the account number of the liability.

|

||||||||||||||||||||||

| Category | Indicates the liability category such as Automobile or Credit Card. The values within this field populate from the TRADE_CATEGORY field lookup. | ||||||||||||||||||||||

| Description | Displays any further information about the liability. | ||||||||||||||||||||||

| Creditor | Indicates the creditor holding the liability. | ||||||||||||||||||||||

| Limit | Indicates the limit of the liability if the liability is an open-ended loan. A total of all limits is calculated and displayed within the bottom of the grid. | ||||||||||||||||||||||

| Maturity Date | Indicates the maturity date of closed-end liabilities. | ||||||||||||||||||||||

| Balloon Amount | Indicates the balloon amount if the liability is a balloon loan. A total of all balloon amounts is calculated and displayed within the bottom of the grid. | ||||||||||||||||||||||

| Balloon Due Dt | Indicates the balloon maturity date if the liability is a balloon loan. | ||||||||||||||||||||||

| Past Due | Indicates the amount the liability is past due. A total of all past due amounts is calculated and displayed within the bottom of the grid. | ||||||||||||||||||||||

| Open Date | Indicates the date that liability was opened. | ||||||||||||||||||||||

| Last Report Date | Indicates the date the liability was last reported to the credit bureau. | ||||||||||||||||||||||

| Concurrent App | Indicates the liability is another application currently being processed in the Loan Origination module. | ||||||||||||||||||||||

| Edited |

If the item has been manually edited within the Liabilities screen or panel, the check box is selected. Reference the table below for an overview of when the Edited check box is selected/deselected during the application process.

|

||||||||||||||||||||||

| Payoff Amount |

Indicates the total payoff amount for the liability.

|

within the Liabilities toolbar. Clicking

within the Liabilities toolbar. Clicking  opens the Add Liabilities screen in a new window.

opens the Add Liabilities screen in a new window.

When Credit Card or Department Store is selected for the Liability category, an

icon appears in the Account # field and all but the last four digits of the credit card number are masked once a user clicks outside of the field. To temporarily unmask the value of the account number, hover of the

icon. Navigating away from the icon once again masks the credit card account number.

When editing the value in the Account # field, the entire credit card account number must be deleted and re-entered. Therefore, once a user clicks within the field, the icon becomes an

to enable the ability to delete the entire account number. Once a number is re-entered and the user clicks outside of the Account # field, the new number appears masked and the

icon is again displayed.

.

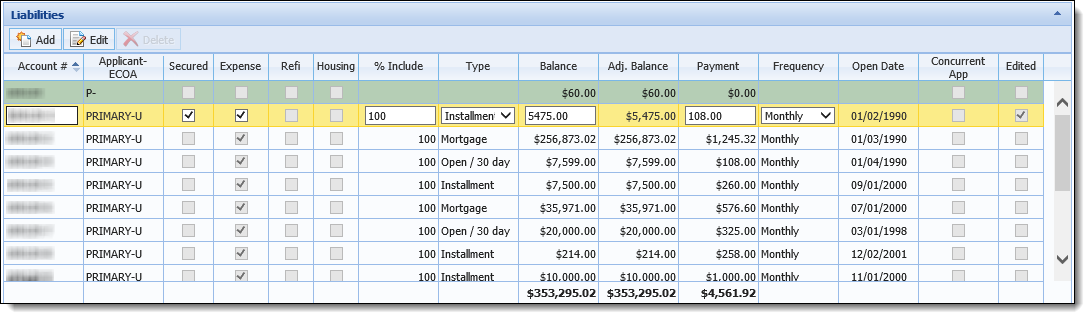

.Users are able to edit liabilities that are populated by the core and/or credit reports as well as liabilities that are manually entered. The Editability of certain fields may differ between the Liabilities screen and Liabilities panel and may also depend on whether the liability was populated from a core, from a credit line, or added manually.

|

By default, some fields, such as Secured and Expense, can only be edited pre-decision. However, the Editability of these fields can be modified by the system administrator in System Management > Origination > Editability. |

The following fields are not editable and appear as read-only within both the Liabilities screen and Liabilities panel:

Within the Liabilities screen, certain fields cannot be edited when a liability is populated from the core or credit report. Reference the table below for an overview of the fields that are able to be edited when a liability is populated by the core, credit report, or added manually from the Liabilities screen:

| How Liability is Populated | Editable Fields |

| Core |

|

| Credit Report |

|

| Manually Added | All fields are editable other than the aforementioned read-only fields. |

To edit a liability within the Liabilities screen:

.

. .

.The Liabilities panel supports inline editing to allow users to modify a liability directly within the Liabilities grid, as well as provides the ability to update additional liability information within the Edit Liabilities window. Clicking within a panel column displays an editable text box or a drop-down to select from a list of options for all editable fields in the panel grid. Clicking the  button at the top of the panel opens the Edit Liabilities screen to modify additional details for the liability.

button at the top of the panel opens the Edit Liabilities screen to modify additional details for the liability.

To edit a liability within the Liabilities panel:

When editing the value in the Account # field for a Credit Card or Department Store liability, the entire credit card account number must be deleted and re-entered; therefore, once a user clicks within the field, the icon becomes an

to enable the ability to delete the entire account number. Once a number is re-entered and the user clicks outside of the Account # field, the new number appears masked and the

icon is again displayed.

Reference the Editable Drop-down Fields section below for an overview of the fields that provide a drop-down list and the location from where the available options in the list are populated:

Field Available Options Address Lists the addresses recorded for each applicant on the application. Address Status Lists the lookup values for the ADDRESS_STATUS lookup in Field Configurations. Category Lists the lookup values for the TRADE_CATEGORY lookup in Field Configurations. Frequency Lists the lookup values for the CB_PAYMENT_FREQUENCY lookup in Field Configurations. Status Lists the lookup values for the TRADE_STATUS lookup in Field Configurations. Type Lists the lookup values for the TRADE_TYPE lookup in Field Configurations.

.

.

|

The Edit Liabilities screen includes the same fields as the Add Liabilities screen. For an overview of the fields that appear in the screen, please see the Adding Liabilities section in this topic. |

|

Clicking  saves the information entered within the Liabilities panel; therefore, when a field is modified within the grid prior to clicking saves the information entered within the Liabilities panel; therefore, when a field is modified within the grid prior to clicking  , the updated value populates for the applicable field in the Edit Liabilities screen. , the updated value populates for the applicable field in the Edit Liabilities screen. |

to retain the updated information.

to retain the updated information. within the top of the screen including the Liabilities panel to retain the modifications.

within the top of the screen including the Liabilities panel to retain the modifications. |

While processing an application, the following liabilities cannot be deleted:

|

To delete a liability:

.

.