| End-User Guide > Application Processing > Origination > Application Collateral |

While processing an application, users are able to input loan collateral information.

Collateral is collected within user-defined application screens and panels that may appear in the following locations:

|

Depending on the configuration of collateral screens, actual screen content and names may vary. The images and processes listed below may not reflect an institution’s loan terms screen. Refer to the following processes for example purposes only. |

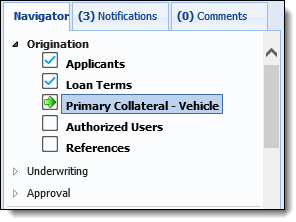

Depending on the configuration of the workflow model, the Workflow may contain the option to add, edit, and delete application collateral. When proceeding through an application’s workflow, collateral information may be collected in user-defined application screens that exclusively contain collateral panels. Application screens may also be configured with a combination of applicant, loan, and collateral panels. Both of these application screen types may be configured to a workflow’s Origination category.

|

For more information on adding collateral, refer to the Adding Collateral section. |

Depending on the configuration of the workflow model, the Application Navigator may contain a screen that allows users to identify collateral. Upon selecting the collateral screen, users are able add, edit, and delete the collateral to be added to the loan application.

|

For more information on adding collateral, refer to the Adding Collateral section. |

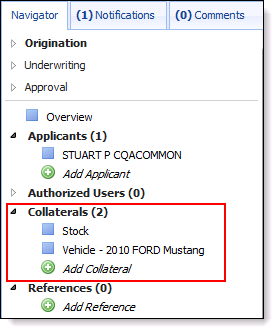

When collateral is added to an application, the collateral records appear in the Application Navigator for easy access. Each collateral record is added to the Collaterals list located beneath the Workflow. If multiple collaterals are assigned to the application, a number corresponding to the amount of collaterals displays next to the Collaterals heading.

|

For the Collaterals section to be available, a collateral screen must be mapped to the Workflow Model. |

In addition to indexing each collateral record, users are able to add, edit, and delete collateral to an application from the Collaterals screen.

There are two methods to add collateral:

|

For more information on adding collateral, refer to the Adding Collateral section. |

Collateral actions include the following:

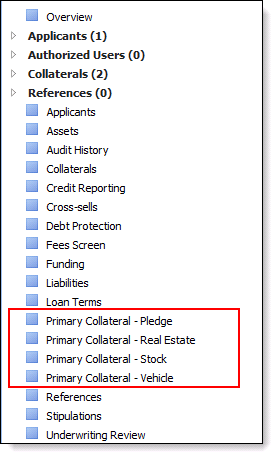

When processing an application, collateral information may be collected through panels that are configured to user-defined application screens. There are two types of panels that may be configured to an application screen:

|

The application screen(s) that contain these panels may be assigned to both the Workflow and screens sections. |

Additionally, collateral may be added from the Collaterals section in the Application Navigator.

|

|

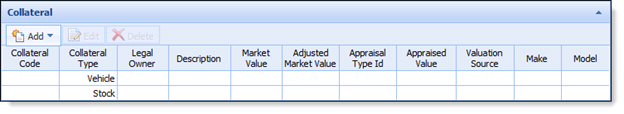

The collaterals panel is a user-defined grid that displays various pieces of collateral information across multiple collaterals.

The collaterals panel contains a toolbar that allows users to perform the following functions:

| Icon | Description |

|

Allows a user to add collateral to the application. When collateral is added, a row is added to the collateral grid. |

|

Allows a user to edit collateral currently on the application. |

|

Allows a user to remove collateral from the application. When collateral is deleted, a row is removed from the collateral grid. |

If vehicle collateral is being added via a Collaterals panel, a save must be performed prior to clicking Valuate. Failure to click Save may result in a second collateral record being added to the application. One collateral record is complete, including the valuation result and vehicle details, and the other is incomplete, only including the valuation results. If this situation should occur, delete the incomplete record.

Upon successfully adding collateral to the collateral grid, the collateral also populates in the Collaterals grouping located in the Application Navigator.

A descriptive collateral panel is a user-defined panel that is able to collect information for a single piece of collateral. Descriptive collateral panels may be used for all collateral types and added to any user-defined application screen.

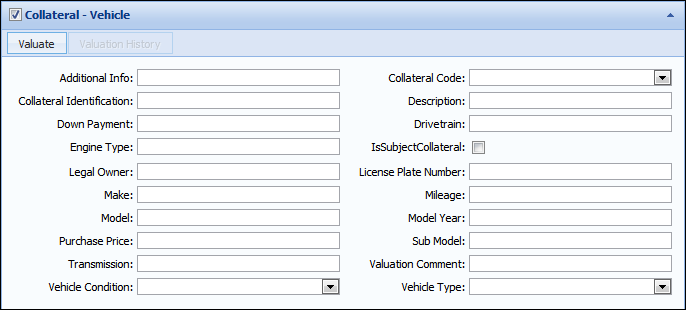

Upon navigating to the Vehicle Collateral panel, users are required to select a check box to indicate vehicle collateral is being added. Once the check box is selected, a window titled Add Vehicle Collateral appears which prompts users to select either New Valuation or Enter Manually.

When processing vehicle valuations:

- Click New Valuation to process a new valuation with KBB/NADA. Upon clicking New Valuation, the Valuation screen opens in the workspace.

- Click Enter Manually to navigate to the Vehicle Collateral panel. From the Vehicle Collateral panel, users are able to run a valuation or enter valuation information that was pulled externally.

If the vehicle valuation information is manually entered, the Valuation History button is disabled. If a valuation is later performed with the NADA/KBB connector, the manually entered information is not stored in Valuation History as this functionality only retains valuations processed via a connector.

Collateral can be added to a loan application by clicking Add Collateral from the Application Navigator. The Add Collateral option is located beneath the Workflow section and indexed under Collaterals.

At this time, the collateral type selected appears under the Collaterals section.

Icon Description Allows a user to add collateral to the application. When collateral is added, a row is added to the collateral grid. Allows a user to edit collateral currently on the application. Allows a user to remove collateral from the application. When collateral is deleted, a row is removed from the collateral grid.

At this time, the collateral type selected appears under the Collaterals section.

When processing an application, collateral information may be edited. Editing collateral provides users the opportunity to revisit collateral that has been previously added to the application and update the accuracy of the information previously provided. Collateral may be edited within:

After an application has been decisioned or disbursed, users may revisit the screen containing the collateral grid to update collateral information if editability rights have been granted.

After an application has been decisioned or disbursed, users may revisit the screen containing the descriptive collateral panel to update collateral information if editability rights have been granted.

When processing an application, collateral information may be deleted from the application. Deleting collateral provides users the ability to remove collateral from an application that is no longer relevant. Collateral may be deleted within:

|

Users are unable to delete a collateral record from an application using a descriptive collateral panel. Users are able to delete values that are entered in a descriptive collateral panel field, however, removing information from all of a descriptive collateral panel’s fields does not delete a collateral record. |

When processing an application, users are able to input the following types of loan collateral:

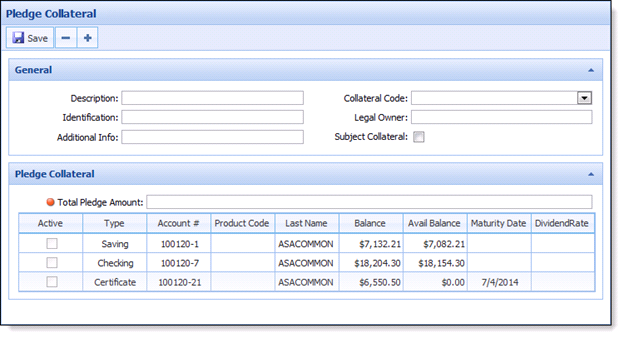

Depending on the screen’s configuration, users may be able to select the core account that is to be held as collateral from a Pledge Collateral grid. Additionally, users may be able to provide additional information about the pledge in fields such as Description, Identification and Legal Owner.

The Pledge Collateral grid contains Asset information for all applicants stored on the Core Processor. Information within this grid includes the Account Type, Account Number, Balance, Available Balance, and Maturity Date.

|

The Loan Origination module updates the Core Processor with the hold information on the Pledge Collateral at Disbursement. |

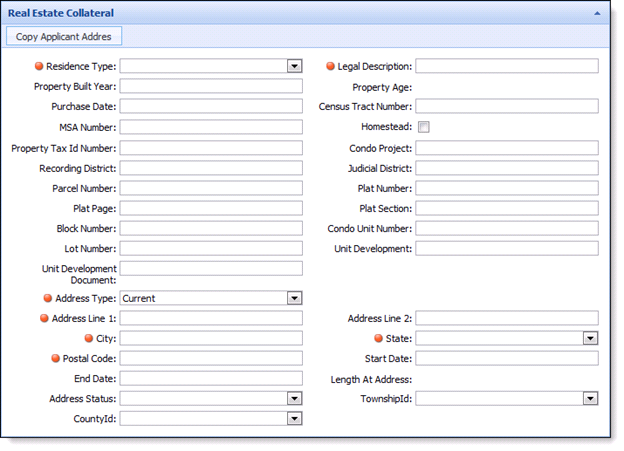

When adding real estate collateral to a loan application, users are prompted to input various types of information on the property being used to collateralize the loan. This information is able to be collected in collateral or application panels.

Depending on the configuration of the real estate collateral screen, it may contain panels to collect the following information:

Additional panels or screens may be configured to record optional real estate information such as:

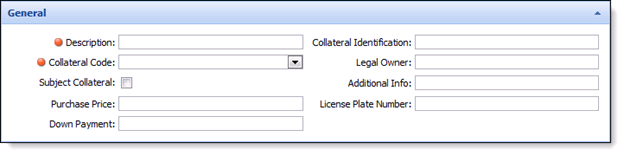

Within a Real Estate Collateral screen, a general panel may be configured to capture basic collateral information.

Basic real estate collateral fields such as Description, Collateral Code, and Legal Owner may appear in this panel.

Complete all required fields and continue entering real estate collateral information in subsequent panels.

Within a Real Estate Collateral screen, a valuation panel may be configured to capture the real estate valuation information.

Collecting valuation information allows users to record important real estate valuation information such as Market Value, Appraised Value, Appraisal Date, Available Equity, Equity Lending Cap, Tax Value, and Last Assessment Date.

|

When a number greater than or equal to 1,000 is entered in the Equity Lending Cap field, an arithmetic overthrow error is received. |

Complete all fields required to accurately valuate the real estate collateral. Once complete, continue entering real estate collateral information in the subsequent panels.

Within a Real Estate Collateral screen, a panel may be configured to capture the location information for the real estate collateral.

Collecting property location information allows users to record important real estate location information such as Residence Type, Census Tract Number, Recording District, Street Address, City, State, Postal Code, Township, and County.

Complete all fields required to accurately locate the real estate collateral. Once complete, continue entering real estate collateral information in the subsequent panels.

If there are multiple applicant addresses associated with the application, they populate within Copy from Applicant window.

Errantly selecting the Set as Principal Dwelling field may prevent credit insurance premiums and debt protection fees from being financed. For more information refer to the Debt Protection section within the Loan Terms topic.

Clicking Copy prompts the Lifecycle Management Suite to check if the Is Total Monthly Expense flag is set to false for the address being copied. If the Is Total Monthly Expense flag is set to false, the Monthly Expense Amount and Balance are set to zero for the copy of the address, but can be updated through the Applicant Address panel.

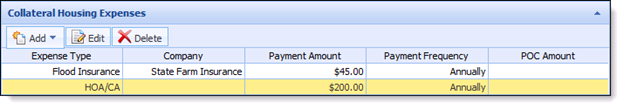

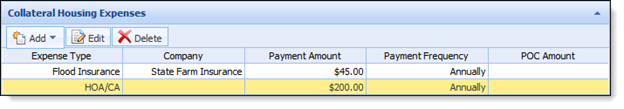

Within a Real Estate Collateral screen, the Collateral Housing Expense grid-panel may be configured to capture any additional housing-related expense information.

|

The housing expense data collected within this panel may be used to record and calculate escrow payment information. |

This grid enables users to indicate payment, policy and coverage information for additional housing-related expenses such as:

The additional housing expense grid contains a toolbar that allows users to perform the following functions:

| Icon | Description |

|

Allows a user to add additional housing-related expenses record. When an additional housing-related expense is added, a row is added to the grid. |

|

Allows a user to edit additional housing-related expenses currently on the application. |

|

Allows a user to remove additional housing-related expenses from the application. When an additional housing-related expense is deleted, a row is removed from the grid. |

Adding Additional Housing Expenses

Adding Additional Housing Expenses

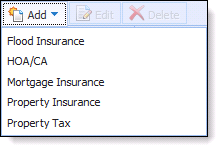

Clicking the Add button displays a drop down list allowing users to select the expense type. Indicate the type of expense by clicking the desired type from the drop down list.

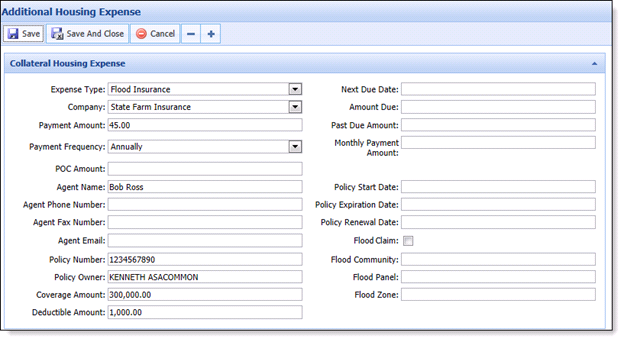

When the type of expense has been selected, the Additional Housing Expense screen opens in a new window. Within the Additional Housing Expense screen, complete all fields associated with the housing expense.

When all applicable fields have been completed, finalize the housing expense addition by clicking Save and Close at the top of the screen. When the collateral window closes, the additional housing expense populates in the grid.

When each collateral housing expense is saved, the following fields ared calculated:

| Field | Calculation | ||

| Cushion Amount |

Monthly Payment Amount * Cushion

|

||

| Months Collected |

Number of months difference between the last escrow disbursement payment (Next Due Date minus term for payment frequency) for the housing expense and the Start Date. Terms (calculated as a whole number) include:

|

||

| Due at Closing |

IF IsIncludedInEscrow = true

ELSE use current calculation logic for Due At Closing

|

||

| Annual Disbursement Amount | Monthly Payment Amount * 12 |

When an application is calculated, the following escrow values are calculated:

| Field | Description | Calculation |

| Start Date | Captures when the Escrow payments begin being received. | Application.FirstDueDate |

| Total Monthly Payment Amount to Escrow | Captures the total of Monthly Payment Amount for all housing expenses. | Total of Monthly Payment Amount for all housing expenses where IsIncludedInEscrow is true. |

| Total Cushion Amount | Captures the total of Cushion Amount for all housing expenses. | Total of Cushion Amount for all housing expenses where IsIncludedInEscrow is true |

| Escrow Low Point | Captures the Low Point amount from the Aggregate Analysis calculations | Refer to the Aggregate Analysis section within this topic. |

| Initial Deposit | Captures the total amount the lender is allowed to collect at closing to establish the escrow account. | Total Cushion Amount + Escrow Low Point |

| Total Due At Closing | Captures the total of Due At Closing for all housing expenses. | Total of Due At Closing for all housing expenses where IsIncludedInEscrow is true |

| Aggregate Adjustment | Captures the amount the lender must "credit" the borrower at closing, so they don’t collect more than the initial payment amount. | Initial Deposit - Total Due At Closing |

| Total Annual Disbursement | Captures the total of Annual Disbursements for all housing expenses. | Total of Annual Disbursed Amount for all housing expenses where IsIncludedInEscrow is true |

| Payment Amount Including Escrow | Captures the loan payment amount including escrow. | Application.PaymentAmount + (TotMthlyPaymentAmount / # of payments in a month based on Application.PaymentFrequency) |

The Aggregate Analysis calculation is a basic balance sheet for the escrow account that starts with the month from the Start Date field.

|

In the example below, the Start Date is in January and the Total Cushion Amount is $300.00. |

| Month make a row for each month, beginning with the month from Start Date, for the next 13 | Payment into Escrow Account TotMnthlyPaymentAmount | Payment from Escrow Account Amounts paid out of the escrow account, for housing expenses, in the months they are due. | Initial Balance Amount in the account at the end of each month. | Low Point Determine when the account reaches the lowest balance. | Secondary Balance Low Point Amount** + Initial Balance (** as a positive amount) | Final Balance TotCushionAmt + Low Point Amount |

| $0.00 | $150.00 | $450.00 | ||||

| January | $150.00 | $150.00 | $300.00 | $600.00 | ||

| February | $150.00 | $300.00 - (tax) | $0.00 | $150.00 | $450.00 | |

| March | $150.00 | $150.00 | $300.00 | $600.00 | ||

| April | $150.00 | $300.00 | $450.00 | $750.00 | ||

| May | $150.00 | $300.00 - (tax) | $150.00 | $300.00 | $600.00 | |

| June | $150.00 | $300.00 | $450.00 | $750.00 | ||

| July | $150.00 | $450.00 | $600.00 | $900.00 | ||

| August | $150.00 | $300.00 - (tax) | $300.00 | $450.00 | $750.00 | |

| September | $150.00 | $450.00 | $600.00 | $900.00 | ||

| October | $150.00 | $600.00 | $750.00 | $1050.00 | ||

| November | $150.00 | $300.00 - (tax) $600.00 - (ins) |

($150.00) | ($150.00) | $0.00 | $150.00 |

| December | $150.00 | $0.00 | $150.00 | $300.00 | ||

| January | $150.00 | $150.00 | $300.00 | $450.00 |

|

Once an Escrow Account Number is determined, enter the account number in the Escrow Account Number field. The dates and calculations are disbursed to the account number indicated when the application is disbursed. |

|

Housing expenses flagged to be included in escrow, also populate within the Escrow Summary panel. |

Editing Additional Housing Expenses

Editing Additional Housing Expenses

Deleting Additional Housing Expenses

Deleting Additional Housing Expenses

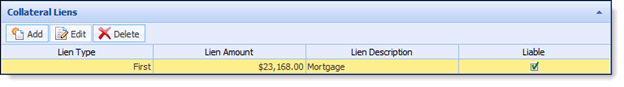

Within a Real Estate Collateral screen, a grid may be configured to capture any additional liens on the collateral.

The lien information grid enables users to indicate existing lien information on the collateral such as Lien Type, Lien Amount and Lien Description.

|

The lien grid/panel may also be configured to Pledge, Stock and Vehicle collateral screens. |

The lien information grid contains a toolbar that allows users to perform the following functions:

| Icon | Description |

|

Allows a user to add existing lien information to a collateral record. When lien information is added, a row is added to the grid. |

|

Allows a user to edit lien information currently on the application. |

|

Allows a user to remove lien information from the application. When lien information is deleted, a row is removed from the grid. |

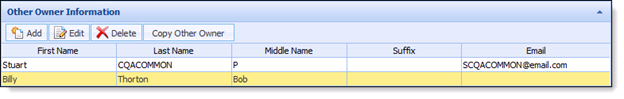

Within a Real Estate Collateral screen, a grid may be configured to capture the additional owners of the collateral.

The Other Owner Information grid allows users to indicated additional owner of the collateral and capture information such as Name, Address, Phone Number, and Email Address for each.

|

The other owner information grid/panel may also be configured to Pledge, Stock, and Vehicle collateral screens. |

The other owner information grid contains a toolbar allowing users to perform the following functions:

| Icon | Description | ||

|

Allows a user to add other owner information to a collateral record. When other owner information is added, a row is added to the grid. | ||

|

Allows a user to edit other owner information currently on the application. | ||

|

Allows a user to remove other owner information from the application. When other owner information is deleted, a row is removed from the grid. | ||

|

Allows a user add an additional owner by copying information from previously added collateral records with multiple collateral owners.

|

Adding Other Owner Information

Adding Other Owner Information

Editing Other Owner Information

Editing Other Owner Information

Deleting Other Owner Information

Deleting Other Owner Information

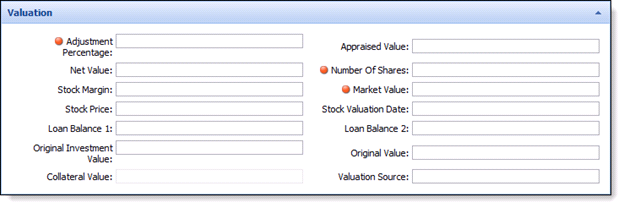

When adding stock collateral to a loan application, users are prompted to input various types of information on the stocks/shares being used to collateralize the loan. This information can be collected in collateral or application panels.

Depending on the configuration of the user-defined screen, it may contain panels to record the following information:

Depending on the configuration of the stock collateral screen, a general panel may be configured to capture basic collateral information.

Basic stock collateral fields such as Description, Collateral Code, Legal Owner, Stock Collateral Type, and Stock Certificate Numbers may appear in this panel.

Complete all required fields and continue entering stock collateral information in subsequent panels.

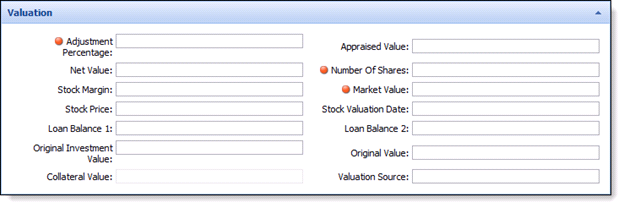

Depending on the configuration of the stock collateral screen, a valuation panel may be configured to capture the stock valuation information.

Collecting valuation information allows users to record important stock valuation information such as Adjustment Percentage, Market Value, Appraised Value, Stock Price, Stock Margin, and Stock Valuation Date.

Complete all fields required to accurately valuate the stock collateral. Once complete, continue entering stock collateral information in the subsequent panels.

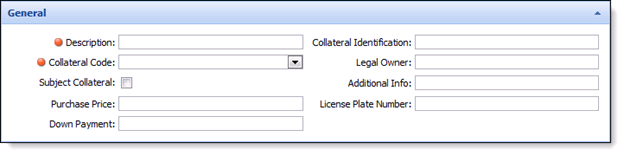

When adding vehicle collateral to a loan application, users are prompted to input information on the vehicle being used to collateralize the loan. This information is able to be collected in collateral or application panels.

Depending on the configuration of the user-defined screen, it may contain panels to record the following:

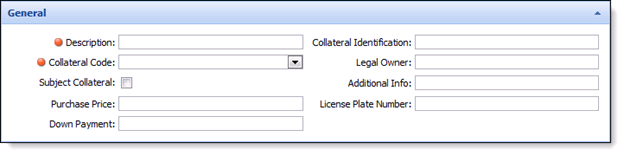

Depending on the configuration of the vehicle collateral screen, a general panel may be configured to capture basic collateral information.

Basic vehicle collateral fields such as Description, Collateral Code, Legal Owner, and Purchase Price may appear in this panel.

Complete all required fields and continue entering vehicle collateral information in subsequent panels.

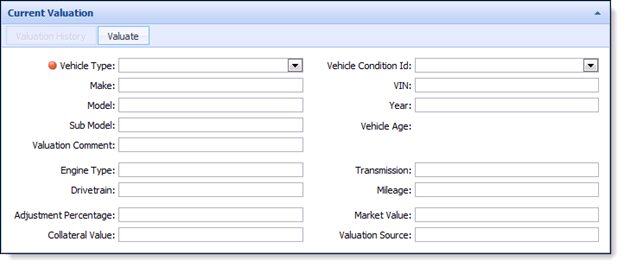

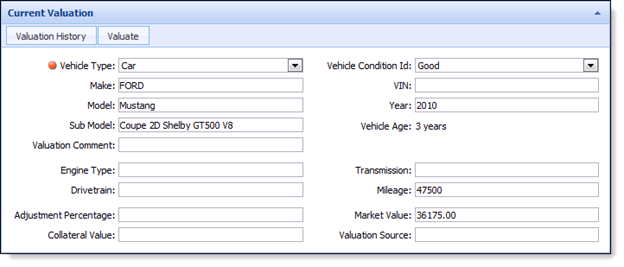

Depending on the configuration of the vehicle collateral screen, a valuation panel may be configured to capture the vehicle valuation information.

Collecting valuation information allows users to record important vehicle valuation information such as VIN, Vehicle Type, Vehicle Condition, Make, Model, Sub Model, and Collateral Value. Complete a vehicle valuation and input any other fields required to accurately valuate the vehicle collateral.

The valuation panel may be configured with the following buttons:

| Icon | Description |

|

Allows a user to process a vehicle valuation. |

|

Allows a user to review the details of previously processed vehicle valuation. |

Information that is manually entered on the Collateral screen does not migrate to the Valuation screen. It should be a user’s best practice to click the Valuate button prior to entering vehicle collateral information so the vehicle information does not need to be entered a second time.

The required fields that appear in the Valuation screen vary according to the selections made in the Valuation Source and Vehicle Type fields.

Field Name Details Valuation Source Select appropriate vendor from drop down list (e.g. NADA, KBB). Vehicle Type Select appropriate option from drop down list (e.g. Car, Truck, Boat, Motorcycle). This list is filtered by the selected options available under Valuation Source. Year Enter the year of the vehicle. Vehicle Age Displays the rounded vehicle age (in years only) according to the Vehicle age calculation month parameter set on the Solution.Lending page. VIN VIN is not required to get a valuation but may be entered if it is available.

If the VIN is entered and the Valuation Source is set to NADA or KBB, the user does not need to enter any other information about the vehicle, except the Mileage. Valuation Comment Enter a comment specific to this Valuation.

This is not a required field. Make Select appropriate option from drop down list (e.g. Chevrolet, Ford, Jeep). This list is filtered based on the vehicle Year that was entered. Model Select appropriate option from drop down list (e.g. Impala, Focus, Wrangler). This list is filtered based on the vehicle Year and Make that was selected. Sub-Model (Trim) Select appropriate option from the drop down list (e.g. Sedan, Coupe). This list is filtered based on the vehicle Year, Make and Model selected. Engine Type Select the appropriate option from drop down list (e.g. V-6). Transmission Select the appropriate option from drop down list (e.g. Automatic, Manual). Drivetrain Select the appropriate option from drop down list (e.g. FWD, AWD). Vehicle Condition Select the condition of the vehicle. For example: Excellent, Good. Mileage Enter the mileage of the vehicle. If not known, leave blank and the average mileage for the vehicle age is used for valuation purposes.

Button Description Valuate Processes the valuation request. The returned default value populates the Market Value field. All values and options returned from the valuation source show in the Results and Vehicle Options boxes. Save Saves the valuation to the application. Cancel Cancels the valuation process. Set as Market Value Select a specific Value Type to be used as the Market Value for the application.

If vehicle collateral is being added via a Collaterals panel, a save must be performed prior to clicking Valuate. Failure to clicking Save may result in a second collateral record being added to the application. One collateral record is complete, including the valuation result and vehicle details, and the other is incomplete, only including the valuation results. If this situation should occur, delete the incomplete record.

Vehicle collateral added via the People and Collateral section or Descriptive Collateral Panel are not required to save prior to performing a valuation. A second collateral should not be added to the application.

The standard vehicle options are pre-selected. Cancel the selections that may not apply to the vehicle.

If the Mileage is unknown, the valuation connector inputs an assumed mileage based upon the age of the vehicle.

Depending on the configuration of the vehicle collateral screen, a Valuation History button may be configured to display previous vehicle valuation results.

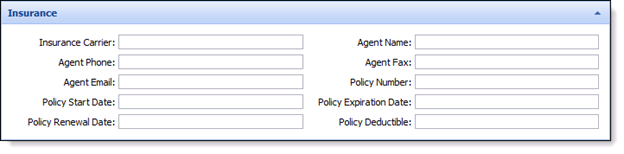

Depending on the configuration of the vehicle collateral screen, a panel may be configured to capture insurance information for the collateral.

Collecting insurance information allows users to record important insurance information such as Insurance Carrier, Policy Number, Policy Expiration Date, and Policy Deductible. Complete all required fields and continue entering vehicle collateral information in subsequent panels.