| Administrator Guide > Recovery Process Overview > Interest Administration |

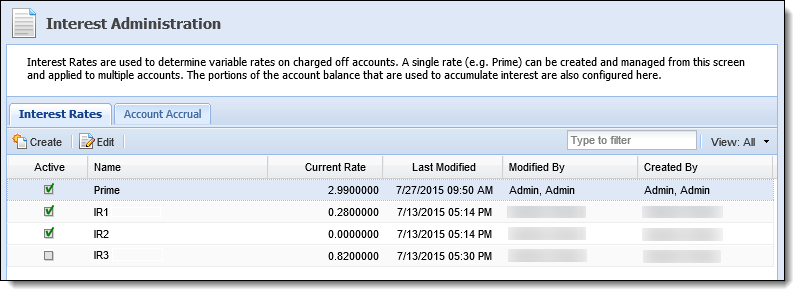

The Interest Administration page in System Management (System Management > Recovery > Interest Administration) provides administrators with the ability to define variable rates on charged-off accounts. The Lifecycle Management Suite's Recovery module supports account accrual and past Effective dates, which are also configured and maintained through Interest Administration.

|

The Interest Administration page is only available in System Management when the Recovery module is active in the Lifecycle Management Suite. |

The Interest Administration page contains two tabs, Interest Rates and Account Accrual, that are used to create and maintain interest rate and interest accumulation attributes. By default, the Interest Rates tab is selected upon navigating to the Interest Administration page.

Listed below are the Interest Administration attributes and the actions that can be taken while managing interest rates in System Management:

The Interest Rates tab provides administrators with the ability to create and maintain interest rates in the Lifecycle Management Suite. This functionality allows financial institutions to customize the flexible interest rates that are available across the institution.

|

The Interest Rates defined within this tab are available for selection when charging off an account in the workspace. They are also available within Interest Rate Details screens, if the Interest Rate Type field is added to the screen. |

Interest rate information is displayed within the following columns in the Interest Rates tab:

| Column Name | Description |

| Active | Displays a  if the interest rate is currently active in the Lifecycle Management Suite. if the interest rate is currently active in the Lifecycle Management Suite. |

| Name | Displays the name/type of interest rate (e.g. Prime). |

| Current Rate | Displays the current rate (%) defined for the interest rate. |

| Last Modified | Denotes when the last modification was made to the interest rate. |

| Modified By | Denotes the user who made the last modification to the interest rate. |

| Created By | Denotes the user who created the interest rate in the Lifecycle Management Suite. |

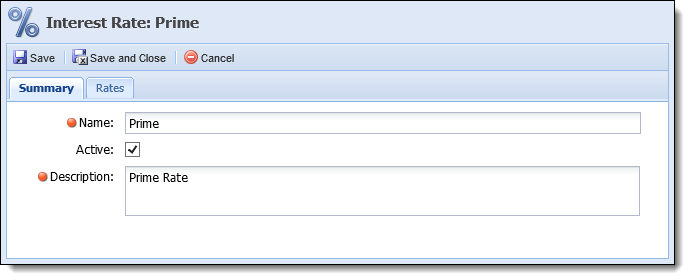

All interest rates share common attributes that are defined while creating or editing an interest rate.

General attributes are located within the Summary tab.

Information is displayed within the following fields:

| Field | Description |

| Name | Enter the name of the interest rate. This field is required. |

| Active | Select the Active check box to activate the interest rate in the Lifecycle Management Suite. |

| Description | Enter the description of the interest rate. This field is required. |

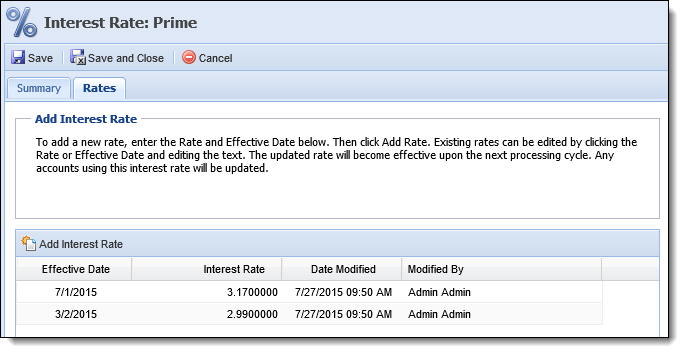

Rate attributes are located within the Rates tab and provide administrators with the ability to create new rates and edit existing rates for the interest rate.

|

The Rates tab is not enabled until an interest rate is created and saved within the Summary tab. |

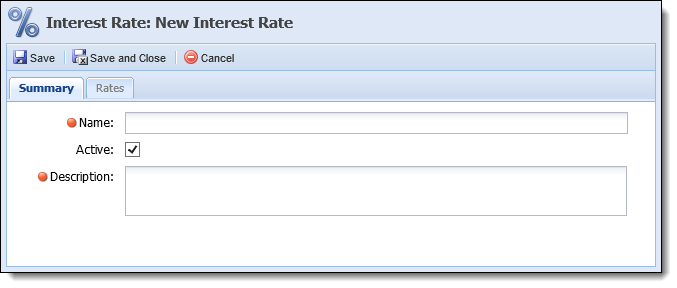

To create a new interest rate, click  within the Interest Rates tab of the Interest Administration page. The New Interest Rate window appears.

within the Interest Rates tab of the Interest Administration page. The New Interest Rate window appears.

Define the general attributes within the Summary tab and click  . A confirmation message appears stating the rate was successfully saved. Click OK to close the confirmation message.

. A confirmation message appears stating the rate was successfully saved. Click OK to close the confirmation message.

Upon a successful save of the interest rate, the Rates tab becomes enabled. Navigate to the Rates tab and click  .

.

Upon clicking Add Interest Rate, a blank row is added to the bottom of the grid. Click within the Effective Date and Interest Rate columns of the row to define the following information:

| Field | Description | ||||

| Effective Date |

Enter, or select from the calendar, the date the rate is effective in the Lifecycle Management Suite.

|

||||

| Interest Rate | Enter the interest rate. |

|

The Date Modified and Modified By columns are automatically updated by the Lifecycle Management Suite upon clicking Save or Save and Close. |

When finished creating the interest rate, click  or

or  . Click

. Click  to return to the Interest Administration page without saving any changes. Upon clicking Save and Close, the new interest rate is added to the Interest Rates tab of the Interest Administration page.

to return to the Interest Administration page without saving any changes. Upon clicking Save and Close, the new interest rate is added to the Interest Rates tab of the Interest Administration page.

To edit an existing interest rate, double-click or highlight the interest rate within the Interest Rates tab and click  . The Edit Interest Rate window appears.

. The Edit Interest Rate window appears.

Edit any information within the Summary and Rates tabs and click  or

or  . Click

. Click  to return to the Interest Administration page without saving any changes.

to return to the Interest Administration page without saving any changes.

|

When an interest rate is modified, nightly processing recalculates interest on accounts that use the interest rate. For details on the recalculation process for variable interest rates, please see the Process to Recalculate Variable Interest Rates section in the Interest Accrual topic of the Administrator Guide. |

Interest rates cannot be deleted; they can only be made inactive.

|

An inactive interest rate does not accrue interest even if it is set to become the active interest rate for a recovery account or repayment plan. |

To deactivate an interest rate, double-click or highlight the interest rate within the Interest Rates tab and click  . The Edit Interest Rate window appears.

. The Edit Interest Rate window appears.

Clear the Active check box and click  or

or  . Click

. Click  to return to the Interest Administration page without saving any changes.

to return to the Interest Administration page without saving any changes.

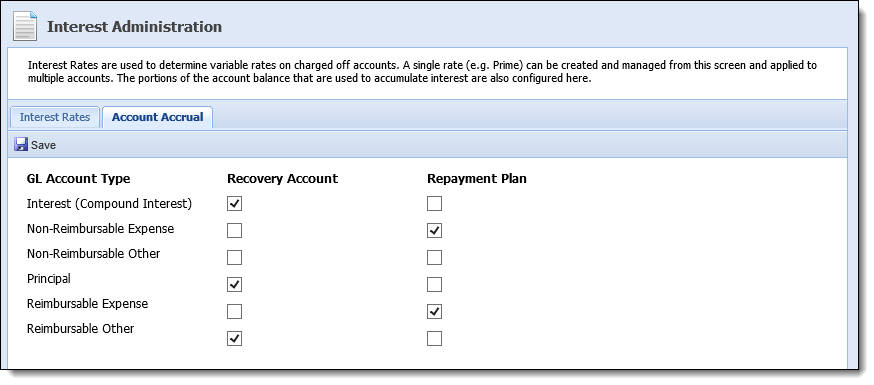

The Account Accrual tab provides the ability for administrators to indicate when interest is accumulated for each GL Account Type/portion of the account balance. This functionality allows financial institutions to customize account accrual behavior to fit their business needs and to accommodate the regulations for their state.

|

The GL Account Types displayed on the Account Accrual tab are hard-coded and cannot be changed. |

The Account Accrual tab contains check boxes to indicate whether or not interest is accrued on Recovery Accounts and Repayment Plans for each GL Account Type. For example, in the above screen shot, interest is only being charged on interest for Recovery Accounts. Interest is not being charged on interest for Repayment Plans.

|

The recovery and repayment plan Account Accrual attributes defined within this tab are available within Interest Rate Details screens, if the GL Account Type Accrue fields are added to the screen. |

When finished defining how interest is accrued, click  . A confirmation message appears stating Account Accrual was successfully saved. Click OK to close the confirmation message.

. A confirmation message appears stating Account Accrual was successfully saved. Click OK to close the confirmation message.