| End-User Guide > Application Processing > Origination > Pulling Credit > HTML Credit Report Formats |

The HTML credit report formats provide financial institutions with a detailed and organized credit report experience that includes color-coded indicators for both credit score and major/minor derogatory indicators on tradelines, the ability to group criteria in the report, and the ability to expand and collapse the information that appears on the screen when viewing a report.

This topic provides an overview of the HTML formats that are available to display when credit is pulled in the Lifecycle Management Suite.

|

The information captured in a credit report is determined by the credit bureau. This topic provides an overview of the features and styles of the HTML formats available using Luxor's CreditSharp tool, and does not include information for each field and section that displays in a credit report. For more information on each field and section of a credit report, please see the help documentation for the applicable credit bureau. |

CreditSharp provides two HTML formats to organize how data appears in the credit report. HTML credit reports are able to be populated in one of the following formats:

With the Common01 format, data is organized into a separate credit report for each applicant. The Lending01 format has the same overall appearance, but groups all primary and secondary data into one report.

For example, when a joint credit report is pulled using the Common01 format, tradeline information for each applicant is populated separately within two different sections; the accounts for primary are listed within one section, while the accounts for the joint are listed within the other section. In the Lending01 format, the report displays one tradeline section that includes accounts for both the primary and joint applicant.

In addition to determining how a credit report is formatted, institutions are able to select a tradeline style for each format. This style determines the information that displays on each trade's summary line in the report. The following tradeline styles are available for each HTML format:

|

For an overview of each tradeline style, please see the Tradeline Styles section in this topic. |

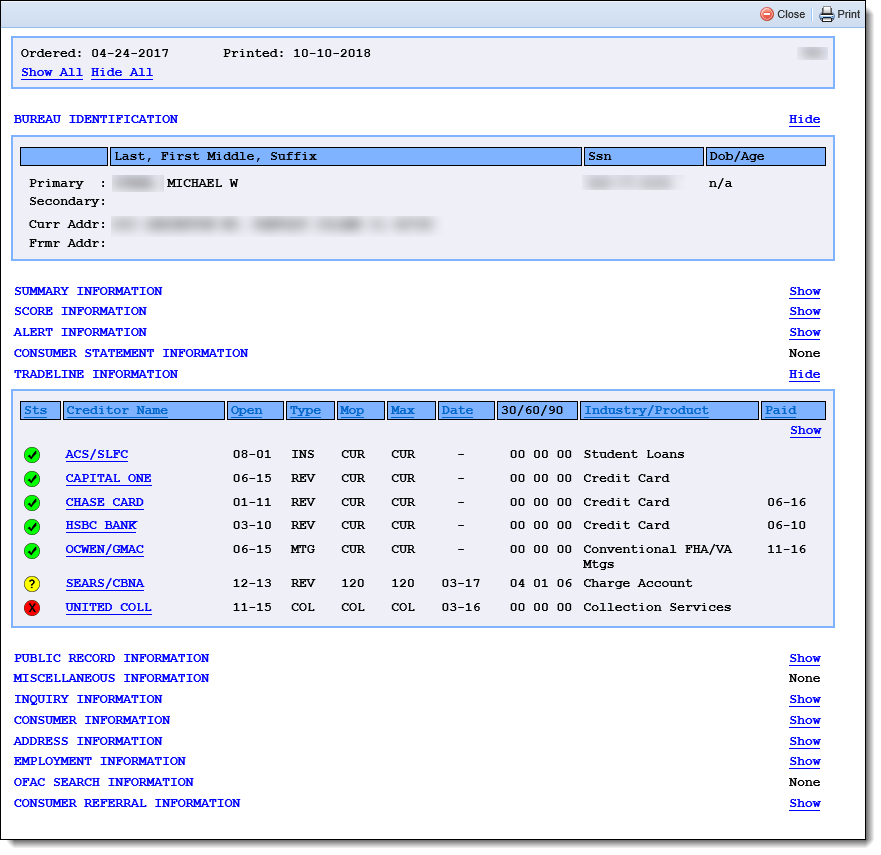

Below is an example of a credit report displayed in the HTML Common01 – Tradeline01:

|

The format in which a credit report displays in the Lifecycle Management Suite is determined by the system administrator. This value is set within the Credit Report Format Parameter that appears in the Underwriting tab of the Origination page in System Management (System Management > Modules > Origination). Please see the Origination topic in this guide for more information. |

HTML credit report layouts enable institutions to determine both the format of the credit report, as well as the data that appears in each summary line of the Tradeline Information section. Using an HTML format, institutions are also provided with the following features:

|

The credit score and tradeline status indicators are NOT displayed in color when an HTML credit report is printed. |

In addition to the credit report format and tradeline style, institutions are able to determine if credit report data, or tradeline information, is grouped by specific criteria in the report.

By default, tradeline information is listed in alphabetical order by Creditor Name, and credit report data is organized according to the format selected. If desired, system administrators can configure HTML credit reports to further group data by the following credit report criteria:

|

The criteria used to group credit report or tradeline data is determined by the system administrator. This value is set within the Credit Report Grouping Parameter that appears in the Underwriting tab of the Origination page in System Management (System Management > Modules > Origination). Please see the Origination topic in this guide for more information. |

|

To maintain the existing sort configuration in credit reports, set the Credit Report Grouping parameter to System (default). |

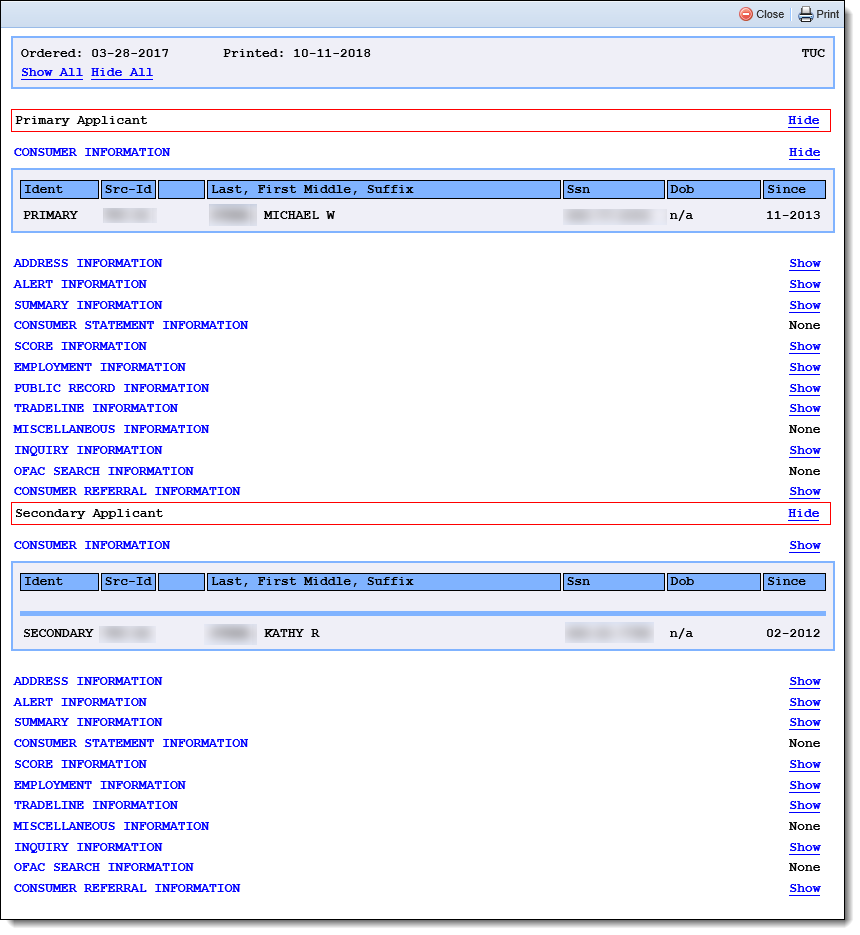

The Id Match option groups data by applicant in the credit report, and displays a separate section for secondary applicants. Each section is clearly identified as Primary Applicant and Secondary Applicant, as shown in the following example:

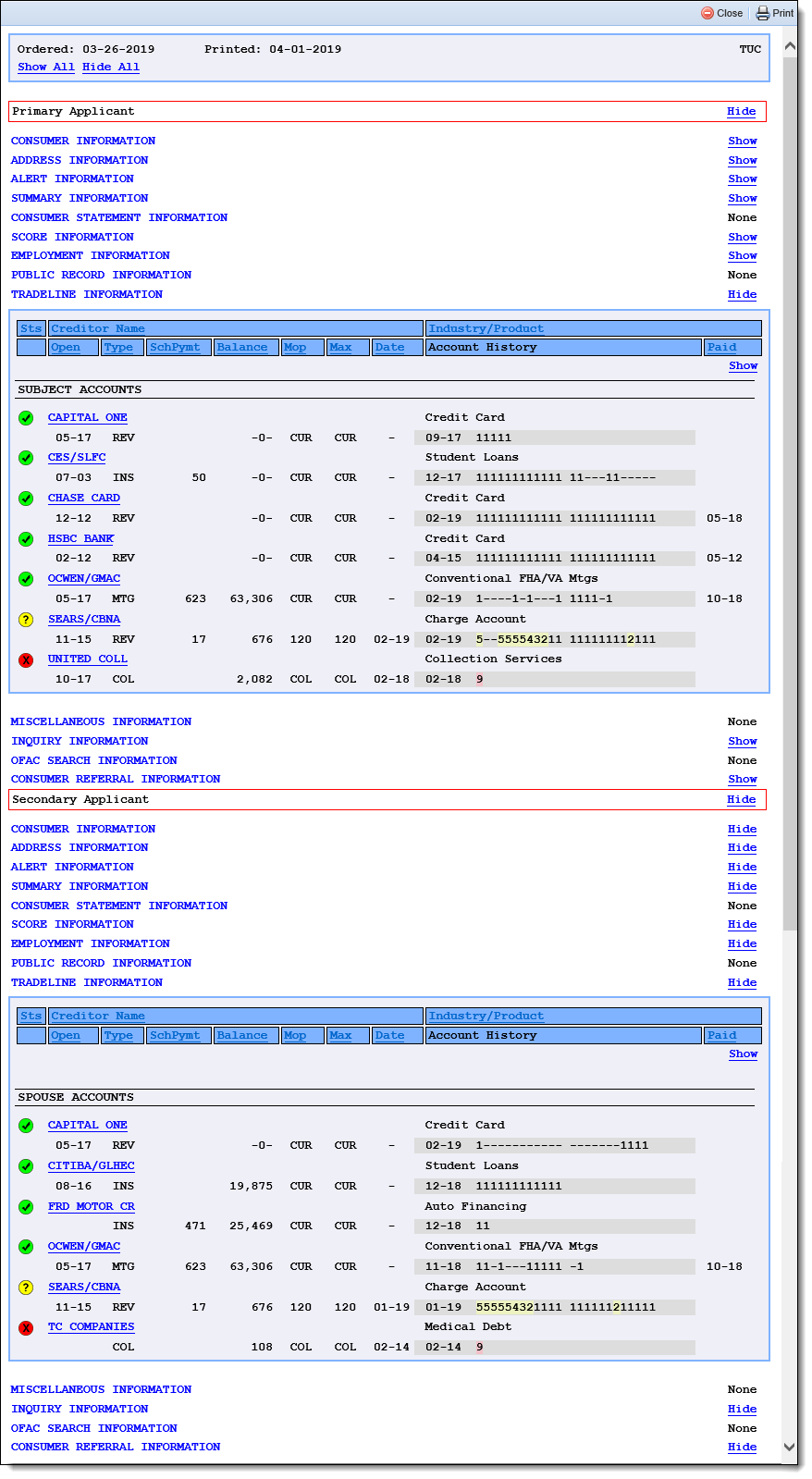

Similar to the Id Match option, the Id Match 2 option groups data by applicant in the credit report, and displays a separate section for secondary applicants; however this option also sorts tradeline data by Subject and Spouse Accounts in the Tradeline Information section, as shown below:

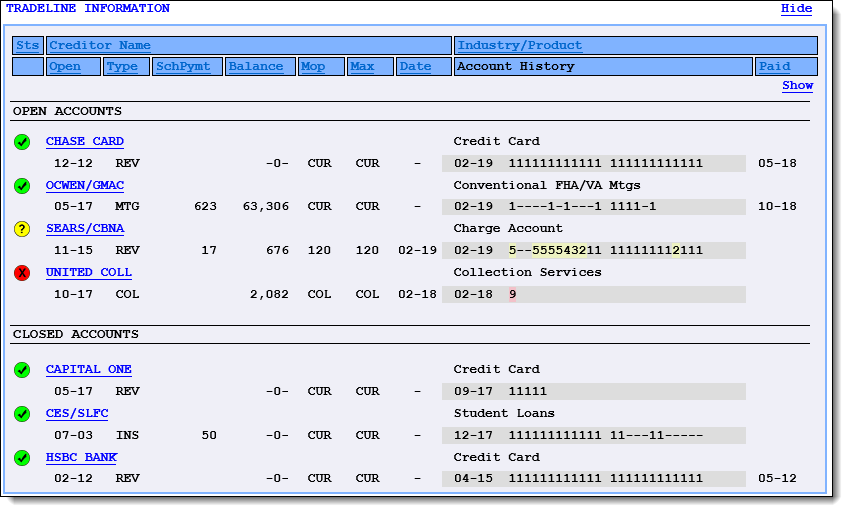

The Open/Closed option groups tradeline information according to whether the account is listed as open or closed with the credit bureau.

The Derogatory Accounts option groups tradeline information according to whether the account is listed as derogatory or current with the credit bureau.

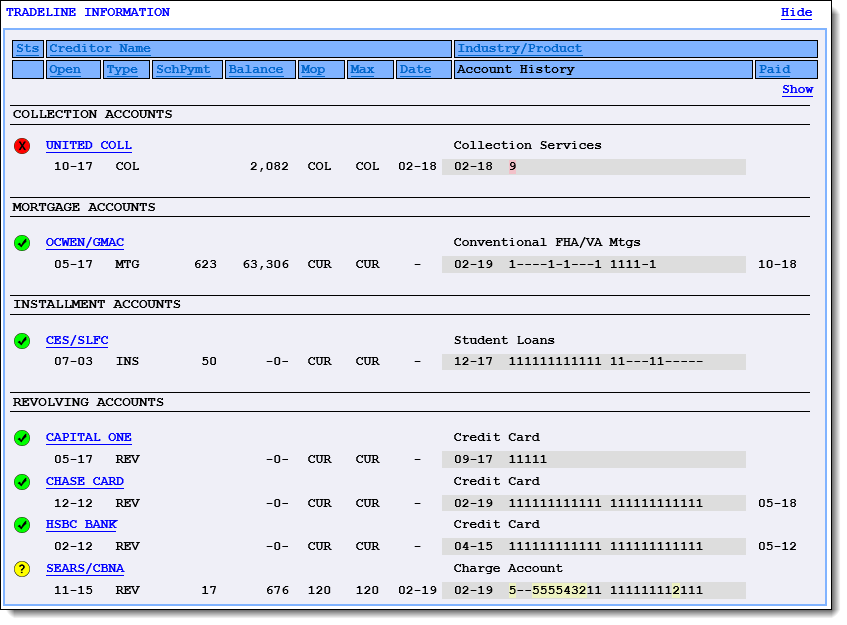

The Account Type option groups tradeline information by the type of account on record with the credit bureau. With this option, four groups are added to the Tradeline Information section to organize data by the following account types: Collections Accounts, Mortgage Accounts, Installment Account, and Revolving Accounts.

|

If none of the liabilities on a tradeline fall under an account type, a message of None found appears in the section for that account type. |

HTML formats provide an organized and collaborative view of an applicant's credit history that is not only detailed, but also interactive, with expandable and collapsible sections, and clickable headers that allow tradeline information to be quickly re-sorted.

Each format and tradeline style presents a different view of an applicant's credit information in expandable and collapsible sections. Each section of the credit report includes Hide and Show links that can be used to expand and collapse the individual sections of a credit report.

|

If desired, all sections of the report can be collapsed or expanded at once by clicking the Hide All or Show All link at the top of the report. |

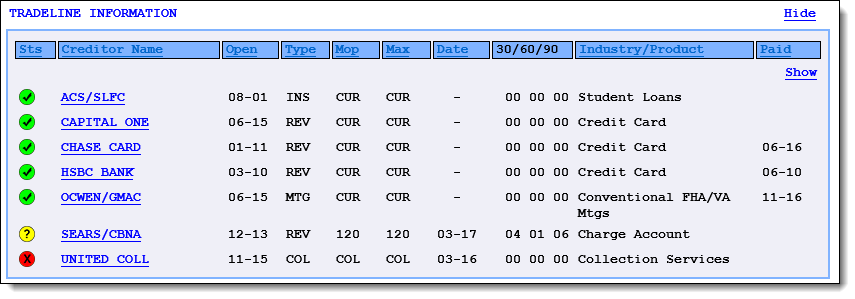

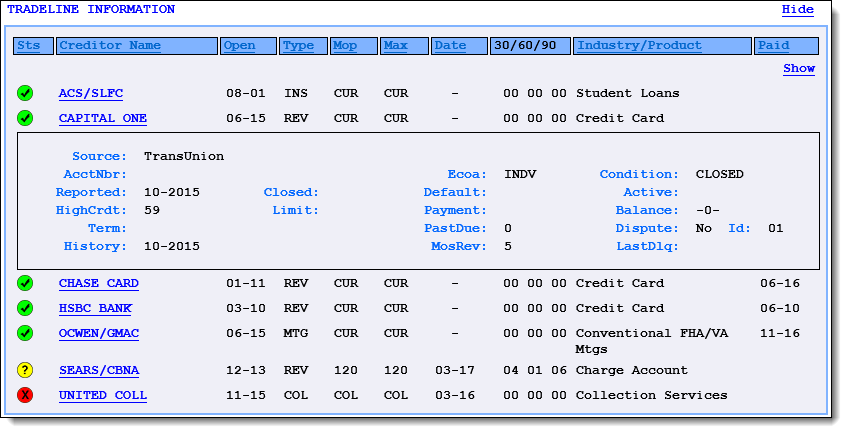

Within the Tradeline Information section, the expand/collapse behavior provides the ability to individually display details for each trade by clicking the creditor's name. For example, clicking the link for CHASE CARD expands the tradeline details as shown below:

|

If desired, the Show link within the top of the Tradeline Information section can be clicked to expand the details for all of the trades at once. When all tradelines are expanded, the Show link updates to Hide to enable the ability to re-collapse the information for each trade. |

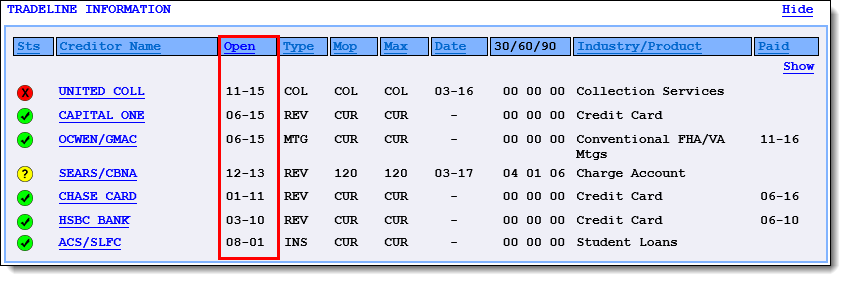

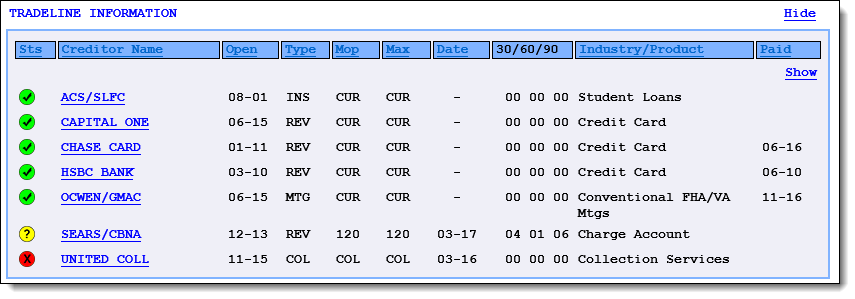

If desired, the information for a specific column can be re-sorted by clicking the column header. For example, clicking Open automatically organizes the trades by open date, and displays the most recently opened trade at the top of the section:

While the organization and style of a credit report differs by HTML format, similar data populates within the Tradeline Information section for each tradeline style. When credit is pulled in the Lifecycle Management Suite, the tradeline information displays in a collapsed view as shown in the below example of the HTML Common01 – Tradeline01 format:

The Tradeline Information section includes the following columns of data in the collapsed view:

| Column | Description | ||||||||

| Sts |

Displays a colored indicator to identify the status of the trade. The icon that appears for a trade is determined by the Manner of Payment (Mop) associated with the account. Reference the table below for an overview of each icon that may appear within this column:

|

||||||||

| Creditor Name | Displays the name of the creditor who provided the information to the bureau. | ||||||||

| Open |

Displays the month and year that the tradeline was opened.

|

||||||||

| Type | Displays a three character representation of the type of credit reported in the tradeline, such as INS for installment, or REV for revolving. | ||||||||

| Balance |

Displays the outstanding balance on the account.

|

||||||||

| Mop |

Displays a three character representation of the Manner of Payment associated with the account, such as CUR to identify an account as current, or 030 to identify an account that has a payment marked 30 days late. |

||||||||

| Max | Displays a three character representation of the maximum delinquency reported for the tradeline, such as 030 for a tradeline with a maximum delinquency of 30 days. | ||||||||

| Date |

Displays the month and year of the maximum delinquency reported for the tradeline.

|

||||||||

| 30/60/90 |

Displays three columns that each include a numerical counter of the number of times the borrower has been 30, 60 or 90 days delinquent making a payment on the account. |

||||||||

| Account Number |

Displays the account number associated with the tradeline.

|

||||||||

| Industry/Product | Displays the operating industry associated with the product/service extended by the creditor. | ||||||||

| Paid | Displays the month and year of the most recent payment made on the tradeline. |

To access additional information for a trade, click the creditor's name to expand the details as shown below:

|

For more information on the expand and collapse behavior in a HTML credit report, please see the Expand and Collapse Behavior section in this topic. |

|

The information that populates for each trade is determined by the credit bureau. For more information on each of the fields that display in the collapsed and/or expanded view of the tradeline information section, please see the help documentation for the applicable credit bureau connector. |

As previously mentioned, there are two HTML formats, Common01 and Lending01, and six tradeline styles available for each format. The following section provides an overview and example of each tradeline style.

|

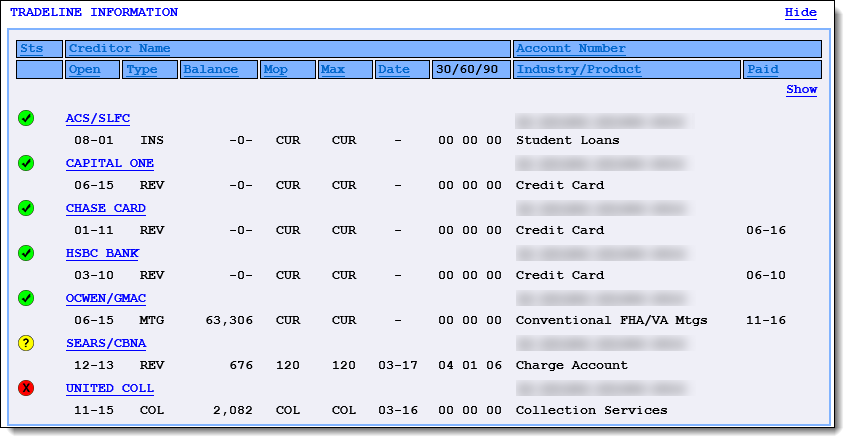

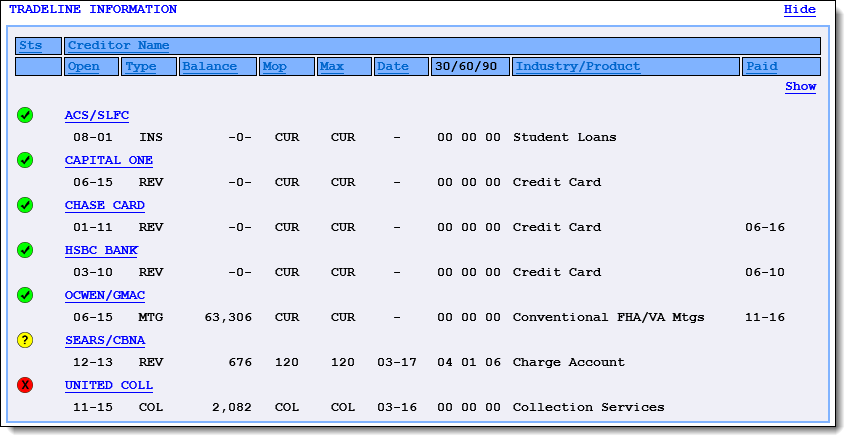

The examples below illustrate a collapsed view of the Tradeline Information section for each tradeline style available for the HTML Common01 format.

|

The Tradeline01 style is the default tradeline style for the Common01 HTML format. This style displays information in a single summary line.

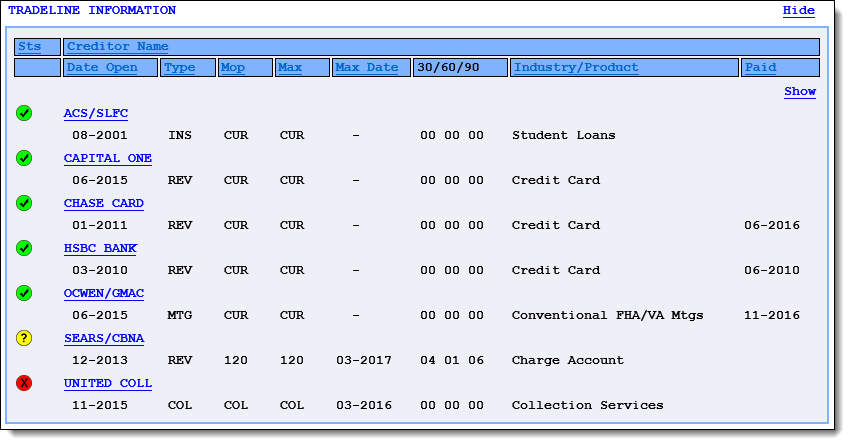

The Tradeline02 style displays information in two summary lines; the first line displays the Creditor and the second line displays the additional tradeline data.

The Tradeline03 style displays information in two summary lines; the first line displays the Creditor and Account Number, and the second line displays the additional tradeline data.

The Tradeline04 style displays information in two summary lines; the first line displays the Creditor and Account Number, and the second line displays the additional tradeline data, including the balance on the account.

The Tradeline05 style displays information in two summary lines; the first line displays the Creditor, and the second line displays the additional tradeline data, including the balance on the account.

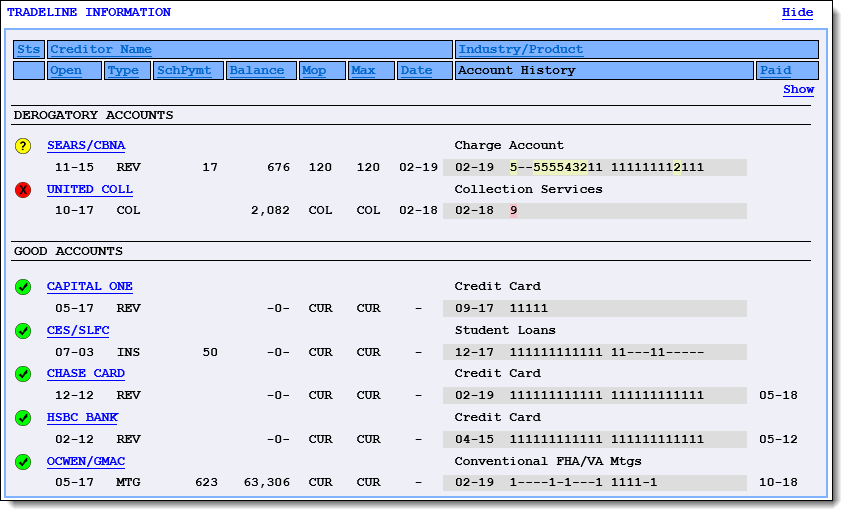

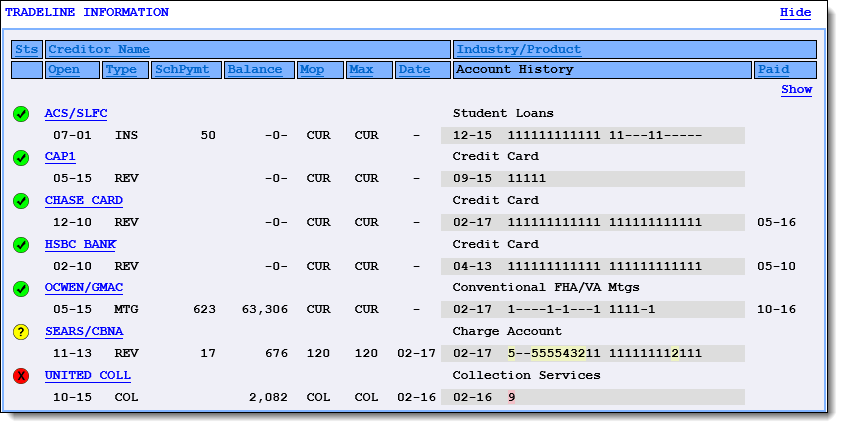

The Tradeline06 style displays information in two summary lines; the first line displays the Creditor and Product, and the second line displays the additional tradeline data, including the scheduled payment amount and account payment history.

|

With this tradeline style, the 30/60/90 buckets are removed, but the Account History provides a color-coded overview of any delinquent payments in the tradeline. For example, in the image below, MOP codes 2 - 5 are highlighted yellow for the SEARS/CBNA trade to identify payments that are 30, 60, 90, and 120 late. MOP code 9 is highlighted red for the UNITED COLL trade to identify a payment that is in Charge Off/Collection. |

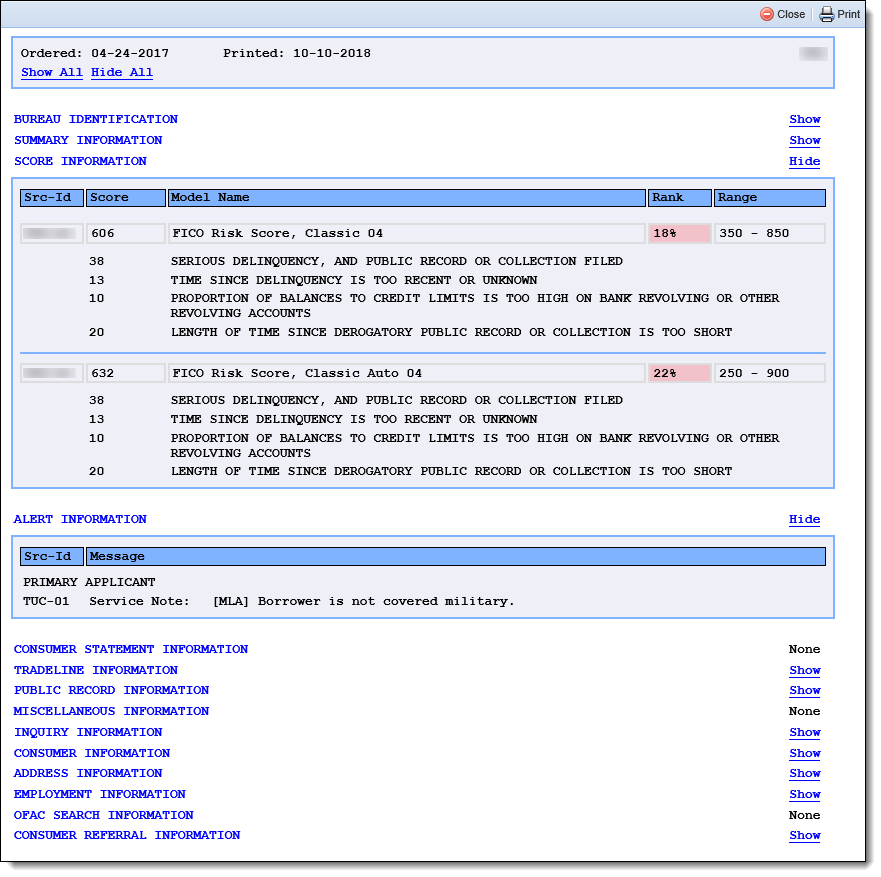

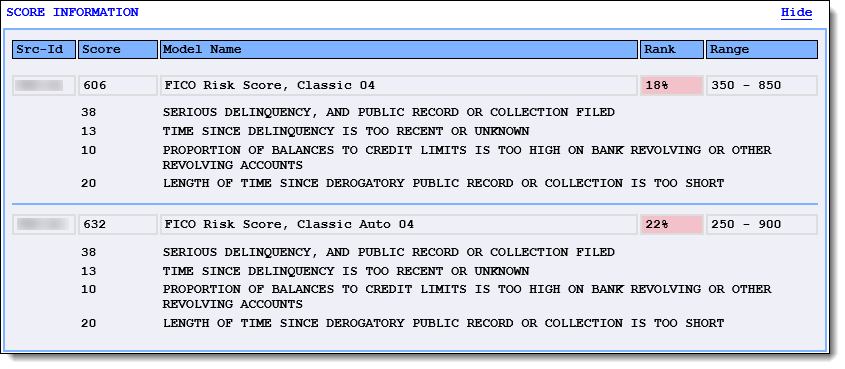

When a credit report is displayed in a HTML format, a color-coded indicator appears under the Rank column in the Score Information section. This indicator provides the ability to easily identify the percentile in which an applicant's credit score ranks at the credit bureau, in relation to the scores calculated for all consumers.

The Credit Score indicator is a single-colored bar that illustrates a percentile range from 0 to 100. The bar displays the percentage, and a color to identify whether the applicant 's credit score is considered below, at, or above average.

Each color identifies the following:

| Color | Description | Example |

| Red | Below Average |  |

| Yellow | Average |  |

| Green | Above Average |  |