| Administrator Guide > Recovery Process Overview |

This topic provides Recovery users and system administrators with an overview of the recovery process as well as the components that make up the recovery lifecycle. This topic contains the following information:

Prior to allowing users to work in the Recovery module, many configurations must be made by system administrators to ensure the financial institution is working with all of the powerful functionality the module provides.

The necessary configurations include:

Please contact Temenos for assistance with turning on the modules in the database.

The first step in the recovery process is charging off an account. When a debt is unlikely to be collected, a financial institution may elect to charge off an account to take the delinquent account off of the financial institution's books. The charge-off process is accomplished through execution of a workflow containing multiple charge-off steps.

|

Charge-off workflow steps are not available for multi-account workflows. |

Prior to charging off an account, required information is captured through pre-charge-off workflow steps. Once this information is gathered, an account can be approved for charge-off and the charge-off process can be initialized.

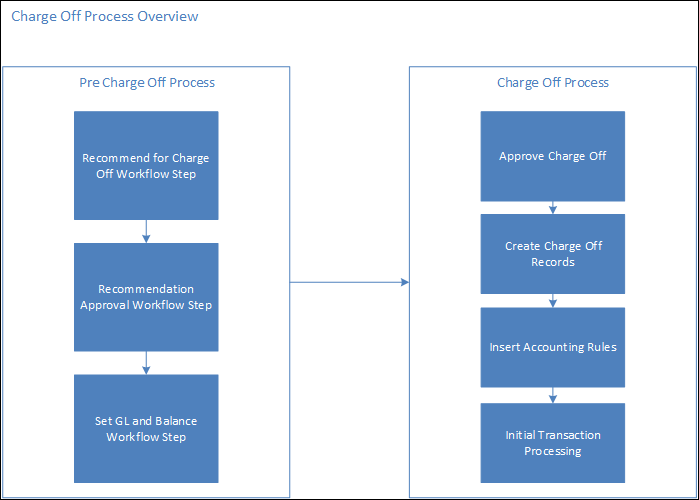

The charge-off process occurs when an account is approved from either the System Management > Recovery > Recovery Approval screen or the Charge-Off Account workflow step. The pre charge-off and the charge-off processes are outlined as follows:

|

The Recovery Approval screen enables administrators to charge-off either individual accounts or multiple accounts in batch. The Charge-Off Account workflow step provides the ability to approve accounts individually as part of a Charge-Off workflow. |

|

System administrators can configure the Pre Charge Off and Post Charge Off events in System Management > Collection > Event Processing to automatically set the value of custom Recovery GL Account fields unique to their institution during the charge off process. For more information, please see the Charge Off Events topic in the Lifecycle Management Suite Administrator Guide. |

Charge-off workflow steps may be configured in individual workflows or combined into one charge-off workflow. Below is an example of a charge-off workflow that has been configured to include all charge-off workflow steps:

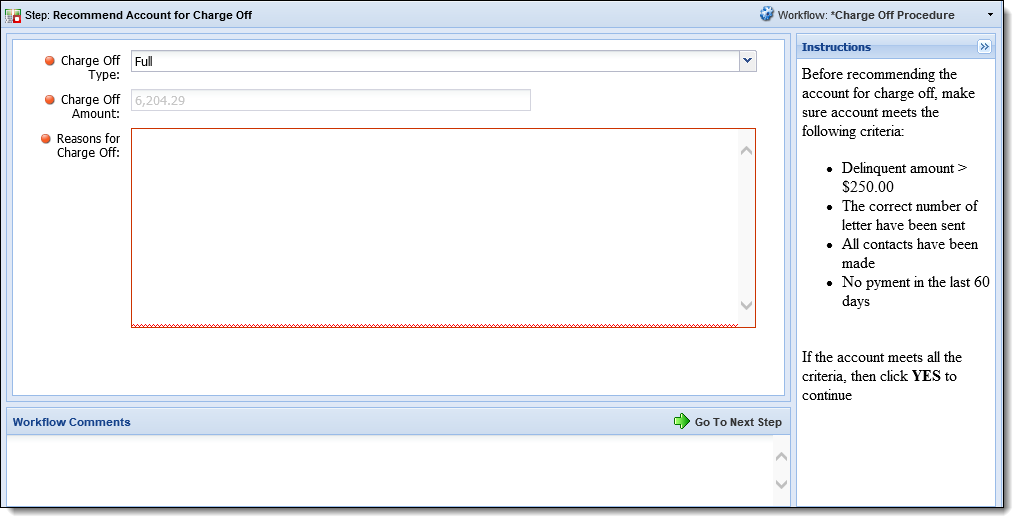

The Recommend for Charge-Off workflow step is used to submit an account for charge-off review. This is the first step that executes when accounts are determined to be uncollectable.

|

The information entered in this workflow step is used to populate the Approve Recommendation workflow step. |

|

If configured by the system administrator in System Management > Collection > Event Processing, the Pre Charge Off Event is triggered when the Recommend for Charge Off workflow step begins. The Pre Charge Off Event sets the value of custom Recovery GL Account fields unique to the institution. For example, rules can be authored that execute when the Pre Charge Off Event is triggered to set an Account field on the Recovery Account, such as Description, to populate with a unique account description.

|

The Recommend for Charge-Off workflow step contains the following fields to capture the information required to initialize the charge-off process for an account:

| Field | Description | ||

| Charge Off Type |

From the drop-down, identify whether the account is being recommended for a full or partial charge-off.

|

||

| Charge Off Amount |

Displays the amount of the charge-off. If the Charge Off Type is Full, the account balance prepopulates within the Charge Off Amount field and is read-only. If the Charge Off Type is Partial, the Charge Off Amount field is enabled and the amount of the charge-off must be provided.

|

||

| Reason for Charge Off | Enter the reason the account is being recommended for charge-off. |

Once all fields are complete, clicking  saves the information entered within the workflow step, validates the charge-off amount, and activates the next step in the workflow.

saves the information entered within the workflow step, validates the charge-off amount, and activates the next step in the workflow.

|

The Metro II Account Status field is set to 97 during the Recommend Charge Off workflow step. |

|

If the account is being recommended for a partial charge-off, a message appears upon clicking  , which identifies the remaining balance available to charge off for the account. The balance that appears in the message is determined by the system administrator, and may display either the full balance remaining on the account, or the difference between the remaining balance and charged off amount. , which identifies the remaining balance available to charge off for the account. The balance that appears in the message is determined by the system administrator, and may display either the full balance remaining on the account, or the difference between the remaining balance and charged off amount.

If an account has been previously recommended for charge-off, but has yet to be approved, a message displays when |

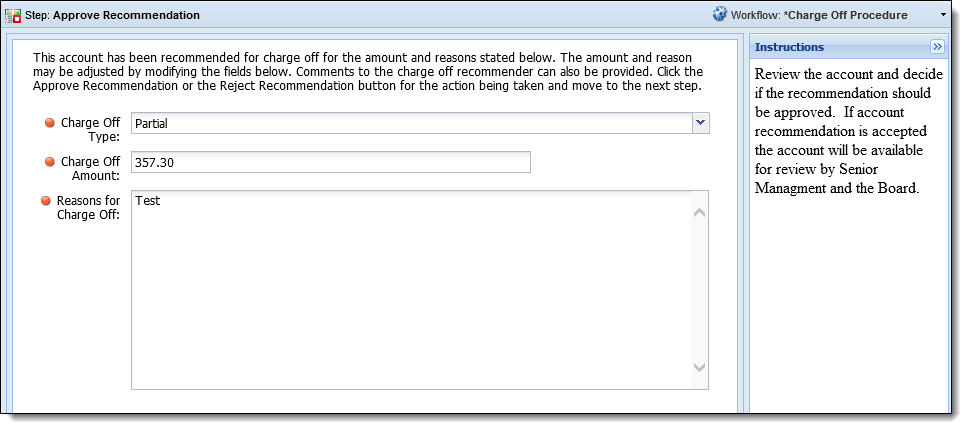

The Recommendation Approval workflow step is used to approve an account that has been recommended for charge-off. This is a required step in the charge-off process providing an opportunity for additional review of an account prior to being charged-off.

|

This workflow step is used in conjunction with the Recommend for Charge Off workflow step. If a Recommend for Charge Off step has not been run on an account, the Recommendation Approval step produces an error when trying to open the workflow step. |

During the charge-off initialization process, the Recommendation Approval workflow step contains the same required fields as the Recommend Account for Charge Off step. This is a decision step that can drive the workflow down different paths, depending on whether the recommendation is approved or rejected.

Once the charge-off information is reviewed, clicking  submits the account for final charge-off review and advances the workflow to the next appropriate step.

submits the account for final charge-off review and advances the workflow to the next appropriate step.

|

Submitting the account for final charge-off review allows the account to be charged off either through the Charge Off Account workflow step or the System Management > Recovery > Recovery Approval screen. |

If the account does not meet the requirements to be charged off, clicking  cancels the charge-off and advances the workflow to the next appropriate step.

cancels the charge-off and advances the workflow to the next appropriate step.

The General Ledger (GL) accounts that are to receive the charged off amount must be identified. This can be accomplished within the information section and GL Allocation grid available in the Set GL and Balance workflow step.

The information section of the Set GL and Balance Workflow Step includes the following fields:

| Field | Description |

| Charge Off Date | Displays the date of the charge-off. |

| Recommended By | Displays the name of the user who recommended the account for charge-off. |

| Charge Off Amount | Displays the amount that has been recommended for charge-off. |

| Total Amount From Grid | Displays the amount currently distributed to the GL accounts in the GL Allocation grid. |

| Remaining Amount | Displays the difference between the Charge Off Amount and the Total Amount From Grid. This amount must be zero or an error is received upon clicking  . . |

The GL Allocation grid distributes the amount being charged off to the General Ledger in the Recovery module. Once the charge-off is approved and the charge-off process runs, the initial balances for the recovery account are set according to this grid.

|

The Principal GL Account and Interest GL Account parameters defined in System Management > Modules > Recovery pre-populate in the GL Allocation grid. The interest and principal amounts are set and displayed according to the following logic:

|

|

When a partial amount is being charged off, the following logic is used to display amounts for the Set GL and Balance workflow step according to the value of the Charge Off Amount Calculation Method parameter in System Management > Modules > Recovery:

|

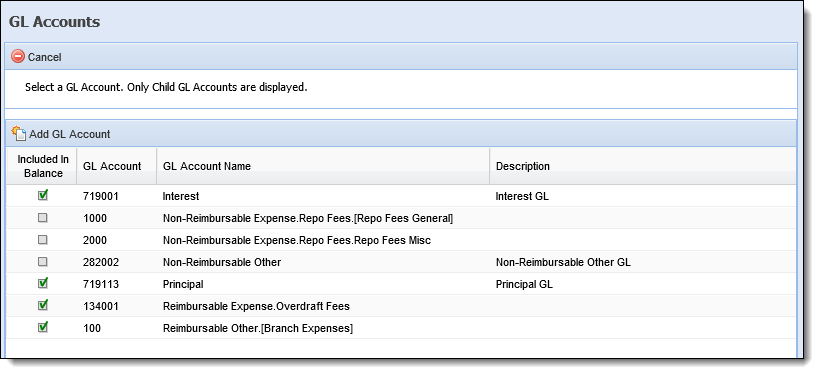

To include additional GL accounts in allocations, click  and select a GL account from the GL Accounts window.

and select a GL account from the GL Accounts window.

|

The information displayed within the GL Accounts window is read-only. |

|

A  displayed in the Included In Balance column indicates that the GL account is included in the charge-off balance. This check box is controlled by the Include Non-Reimbursable In Balance parameter in System Management > Modules > Recovery. If a GL account is added that is not marked as "Included in Balance," its value is added to initial balances through transaction codes, but is not included in the remaining balance. This allows for proper tracking of non-reimbursable amounts for the recovery account. displayed in the Included In Balance column indicates that the GL account is included in the charge-off balance. This check box is controlled by the Include Non-Reimbursable In Balance parameter in System Management > Modules > Recovery. If a GL account is added that is not marked as "Included in Balance," its value is added to initial balances through transaction codes, but is not included in the remaining balance. This allows for proper tracking of non-reimbursable amounts for the recovery account. |

When a GL account has been selected, click  . The GL Allocation grid displayed within the Set GL and Balance workflow step is updated to include the new GL account. Click

. The GL Allocation grid displayed within the Set GL and Balance workflow step is updated to include the new GL account. Click  to close the GL Accounts window once all accounts have been added.

to close the GL Accounts window once all accounts have been added.

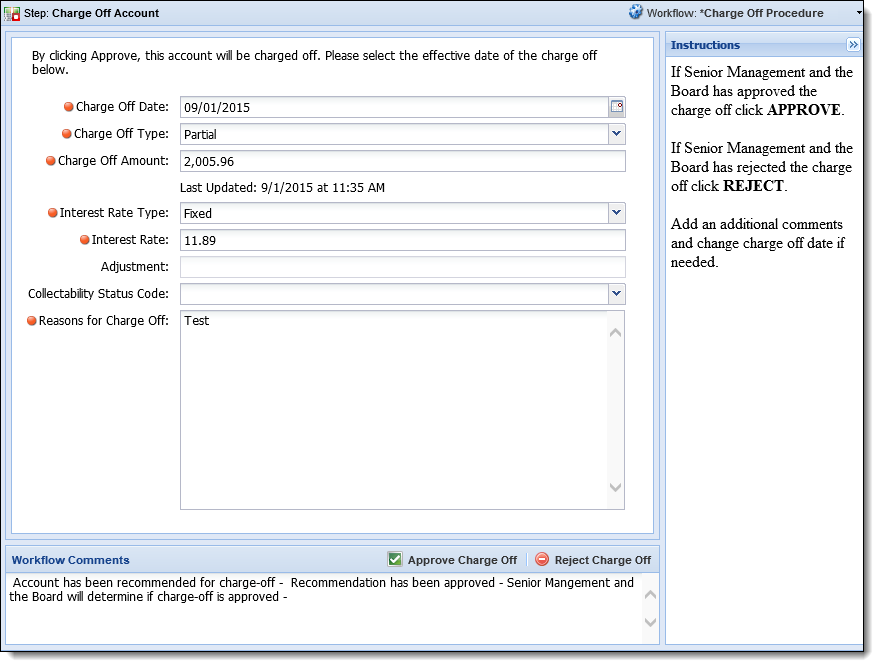

The Charge-Off Account workflow step accepts the charge-off information for an account that was recommended and approved for charge-off.

|

An account can only be charged off if it has not previously been charged off in full. Attempting to charge-off an account that has been previously charged off in full produces an error message. |

|

To execute the Charge-Off Account workflow step, a user must have "Change" access to the Modify Charge Off Properties permission in System Management > Users or be part of a group with "Change" access in System Management > Groups > Security Groups. |

|

In addition to the Charge Off Account workflow step, accounts can be charged off in batch through the System Management > Recovery > Recovery Approval page. |

The Charge-Off Account workflow step contains the information used during the charge-off process to create account records within the Recovery module. The Charge-Off Account workflow step contains the following fields:

| Field | Description | ||

| Charge Off Date |

Displays the date that the account is to be charged off. By default, the current date is displayed, but can be changed by clicking

|

||

| Charge Off Type | Displays the Charge Off Type. By default, the Charge Off Type that has been recommended and approved displays. | ||

| Charge Off Amount | Displays the Charge Off Amount that has been recommended and approved. If the Charge Off Type is Full, this field is read-only. | ||

| Interest Rate Type |

Displays the interest rate type being applied to the account. If there is an existing interest rate on the account, the Interest Rate Type defaults to Fixed. To update the Interest Rate Type to a variable interest rate different from the default rate, select an option from the drop-down list.

|

||

| Interest Rate |

If the Interest Rate Type is Fixed, the Interest Rate field is editable and displays the Interest Rate saved in the Account > Account Information > Principal and Interest > Interest Rate field.

If the Interest Rate Type is a value other than Fixed, the Interest Rate field is blank and read-only. The Interest Rate is then determined by the configurations made within System Management > Recovery > Interest Rate. |

||

| Adjustment | If a variable Interest Rate Type is selected, this field is enabled to allow the Interest Rate to be adjusted. Enter the rate at which interest is to be adjusted beyond the interest rate type. For example, if the variable rate of interest to be accrued is Prime + 1%, after Prime is selected for the Interest Rate Type, a value of 1.00 is entered for Adjustment. | ||

| Collectability Status Code |

From the drop-down, assign a collectability status to the account being charged off. The Collectability Status is available for queuing logic enabling a financial institution to build Recovery queues based on the likelihood of a debt being collected.

|

||

| Reasons for Charge Off | Displays the reason for the charge-off defined during the Recommend for Charge Off and Recommendation Approval steps. This field is editable. |

Once the charge-off fields have been reviewed, clicking  is the final opportunity to reject the charge-off. Clicking

is the final opportunity to reject the charge-off. Clicking  confirms the account is being charged off and initializes the charge-off process. If configured, the Post Charge Off Event is automatically triggered when the charge off process completes and the account in context is moved from the Collection module to the Recovery module. When this event occurs, Recovery account fields are set in order to support Metro 2 Credit Reporting. For example, rules can be authored that execute when the Post Charge Off Event is triggered to set an Account field on the Recovery account, such as Credit Reporting Identification Number, Credit Reporting Account Type, Payment History Profile, or Date of First Delinquency, to populate with information required for Metro 2 credit reporting.

confirms the account is being charged off and initializes the charge-off process. If configured, the Post Charge Off Event is automatically triggered when the charge off process completes and the account in context is moved from the Collection module to the Recovery module. When this event occurs, Recovery account fields are set in order to support Metro 2 Credit Reporting. For example, rules can be authored that execute when the Post Charge Off Event is triggered to set an Account field on the Recovery account, such as Credit Reporting Identification Number, Credit Reporting Account Type, Payment History Profile, or Date of First Delinquency, to populate with information required for Metro 2 credit reporting.

|

System administrators can configure the Post Charge Off event in System Management > Collection > Event Processing. For more information, please see the Charge Off Events topic of the Lifecycle Management Suite Administrator Guide. |

|

Upon clicking  , the transaction processing engine places a lock on the transaction currently in process. This lock ensures that only one charge off approval is processed at a time, mitigating the possibility of corrupt transaction data. If a transaction is currently in process and a user attempts to process another transaction, a "transaction in process" message is displayed indicating that the second transaction cannot be processed until the current transaction has completed processing. , the transaction processing engine places a lock on the transaction currently in process. This lock ensures that only one charge off approval is processed at a time, mitigating the possibility of corrupt transaction data. If a transaction is currently in process and a user attempts to process another transaction, a "transaction in process" message is displayed indicating that the second transaction cannot be processed until the current transaction has completed processing. |

|

Once the charge-off process initializes, the Lifecycle Management Suite becomes the official system of record for the charged-off account. |

The charge-off process is initialized through completion of the Charge Off Account workflow step or through the System Management > Recovery > Recovery Approval page. When an account is approved for charge-off, the existing account data captured through the Charge Off workflow transfers to the Recovery solution and is available for screens, queues, views, reports, and repayment plans. The charge-off process consists of the below steps:

When an account is charged off, a record is created in the database with the initial recovery account information. The following fields are updated when a new record is created:

|

Accounts being charged off may have previously had a partial charge-off that resulted in the creation of a charge-off record for the account. If this is true, the existing data in the fields below is updated with the new charge-off information. |

| Recovery Field | Description | ||||||||||||||||||||||||||||||||||

| Is Fully Charged Off | A flag field that is set if the account is fully charged off. If the account is partially charged off, this flag is not set. | ||||||||||||||||||||||||||||||||||

| Initial Balance | The initial balance is the amount that has been charged off. This amount reflects the sum of the initial Principal, Interest, Reimbursable Expense, Non Reimbursable Expense and Non Reimbursable Other amounts. | ||||||||||||||||||||||||||||||||||

| Initial Principal | The amount allocated to Principal GL Accounts in the Set Balances workflow step. | ||||||||||||||||||||||||||||||||||

| Initial Interest | The amount allocated to Interest GL Accounts in the Set Balances workflow step. | ||||||||||||||||||||||||||||||||||

| Initial Reimbursable Expense | The amount allocated to Reimbursable Expense GL Accounts in the Set Balances workflow step. | ||||||||||||||||||||||||||||||||||

| Initial Reimbursable Other | The amount allocated to Reimbursable Other GL Accounts in the Set Balances workflow step. | ||||||||||||||||||||||||||||||||||

| Initial Non Reimbursable Expense | The amount allocated to Non Reimbursable Expense GL Accounts in the Set Balances workflow step. | ||||||||||||||||||||||||||||||||||

| Initial Non Reimbursable Other | The amount allocated to Non Reimbursable Other GL Accounts in the Set Balances workflow step. | ||||||||||||||||||||||||||||||||||

| Collectability Status Id | The Id of the Collectability Status that has been assigned during the pre-charge-off process. | ||||||||||||||||||||||||||||||||||

| Created By Id | The User Id of the person that created the recovery account. | ||||||||||||||||||||||||||||||||||

| Modified Date | The date of the most recent modification to the recovery account. | ||||||||||||||||||||||||||||||||||

| Modified By Id | The User Id of the person that last modified the recovery account. | ||||||||||||||||||||||||||||||||||

| Charge Off Date | The Charge Off Date identified during the pre-charge-off process. | ||||||||||||||||||||||||||||||||||

| Payment History Profile |

The value that indicates the payment history for an account in Recovery. This value changes each month to reflect the most up-to-date payment history for an account. This field does not exceed 24 characters. The values in this field reflect the following:

When a Metro 2 export runs, the Lifecycle Management Suite determines the last time that the data on a Recovery account was updated. If a month has passed based on the LAST_CREDIT_REPORT_EXPORT_DATE parameter within the database, the right-most character is removed from the Payment History Profile value and a new left-most character is added. |

Accounting rules are used to determine the daily amount of interest accrued based on the interest rate assigned to the account during the pre-charge-off process. Please see the Interest Accrual topic of the Administrator Guide for more information on interest accrual. Please see the Recovery Account and Repayment Plan Interest Rates Panels topic of the User Guide for more information on interest accrual.

Initial transaction processing sets the initial balances allocated during the Set GL Amounts workflow step. Once the charge-off process completes, the transaction is logged in the recovery account's ledger and can be viewed through the System Management > Recovery > GL Balances and Journal Entries screen or the Transaction panel that may be assigned to an account screen.

|

The category of the initial transaction is Initial Balance. For more information about transaction categories, please see the Transaction Categories section of the Transaction Codes topic in the Administrator Guide. For more information about transaction processing, please see the Transaction Processing section of the Recovery Transactions topic in the User Guide. |

After an account is charged off, the next step in the recovery process is to create a repayment plan. A repayment plan is an agreement made between the debtor and the financial institution in which the debtor agrees to repay the funds that have been charged off.

Please see the Repayment Plans topic of the User Guide for details on all components and processes included in the Recovery solution's repayment plan functionality.

|

The debts owed on charged off accounts may be repaid without being included in a Repayment Plan. For more information on charged off accounts, please see the Recovery Accounts topic. |

Throughout the lifecycle of recovery accounts and repayment plans, transactions from debtors can be applied and recorded in the system. The Recovery module provides a powerful yet easy-to-use transaction processing interface that can be accessed at any time for recovery accounts and repayment plans.

For more information on a recovery account's initial charge-off transaction, please reference the Charging Off an Account section of this topic.

For information on standard recovery account and repayment plan transactions, please see the Recovery Transactions topic of the User Guide.

For information on how transactions are processed via batch, please see the Batch Transaction Import topic of the Administrator Guide.

The recovery process is completed when an account is paid in full and it has been finalized by a user with the appropriate permissions.

.

. .

.Once clicked, validations are performed. If the recovery account or repayment plan passes the validations, the recovery account or repayment is finalized.

|

For more information on finalizing a recovery account, please see the Finalizing Recovery Account section within this guide.

For more information on finalizing a repayment plan, please see the Finalizing Repayment Plans section within this guide. |

|

The Metro II Account Status field is set to 64 during the Account finalization process. |