| End-User Guide > Application Processing > Post-Decision > Approval > Contract Updates |

After an indirect application has been approved, situations may arise where loan terms require adjustments once the contract arrives from the dealership. Since dealer contract is legally binding, the Loan Origination module must match the values enclosed.

This topic consists of the following sections:

|

The process outlined in this topic assumes the following configurations have been made by the administrator:

|

|

To update loan terms post-decision, editability rights must be granted. |

The following section provides a business example that illustrates the updates that can be performed, based on contract and module application differences.

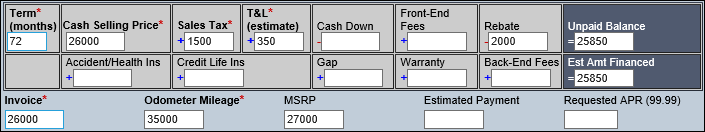

Using an indirect interface, a dealership creates an application based on the following breakdown:

| Dealertrack Fields | RouteOne Fields | CUDL Fields | Amount |

| Cash Selling Price | Cash Price | Sales Price / Total Sales Price | $26,000.00 |

| T&L Estimate | Tile/Lic/Other Fees | License | $1,500.00 |

| Sales Tax | Taxes | Tax | $350.00 |

| Rebate | Rebate | Rebate | $2,000.00 |

| Unpaid Balance | Financed Amount | Amount Requested | $25,850.00 |

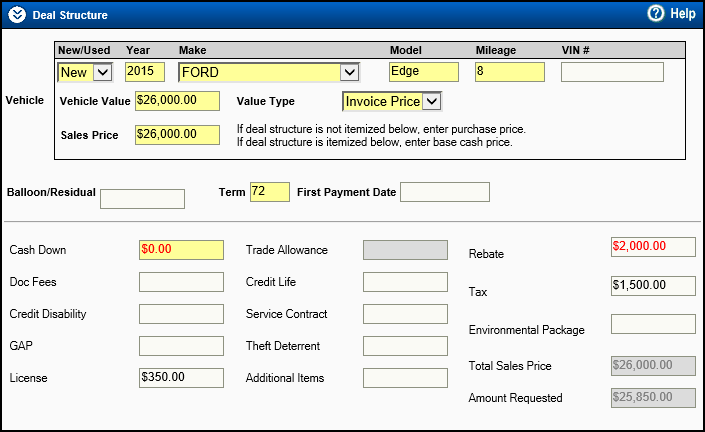

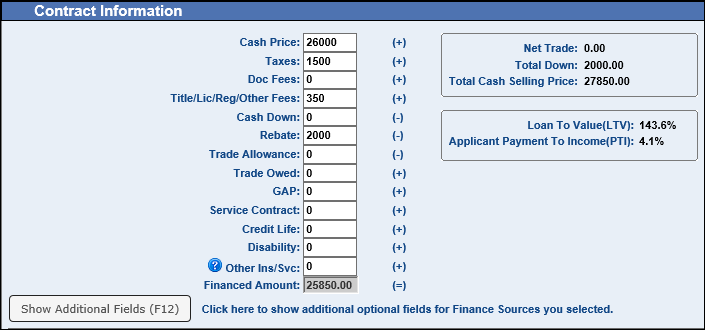

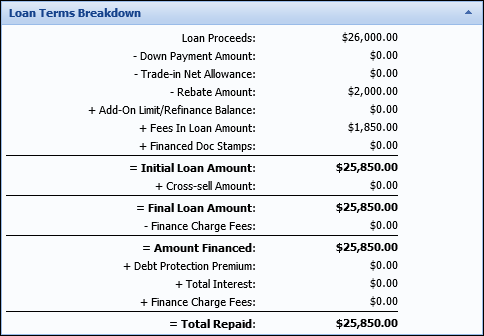

The indirect application imports to Temenos Infinity based on the following breakdown:

| Module Loan Breakdown Fields | Amount |

| Loan Proceeds | $26,000.00 |

| Rebate Amount | $2,000.00 |

| Fees in Loan Amount (Title & License + Tax) | $1,850.00 ($350.00 + $1,500.00) |

|

$25,850.00 |

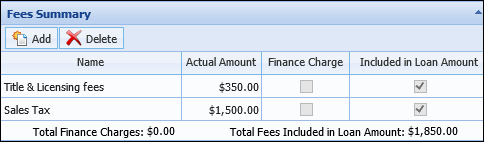

Additionally, the Fees in Loan Amount are also broken down in the Fees panel.

Based on the loan terms, the application is approved, priced and transmitted back to the dealership by the institution.

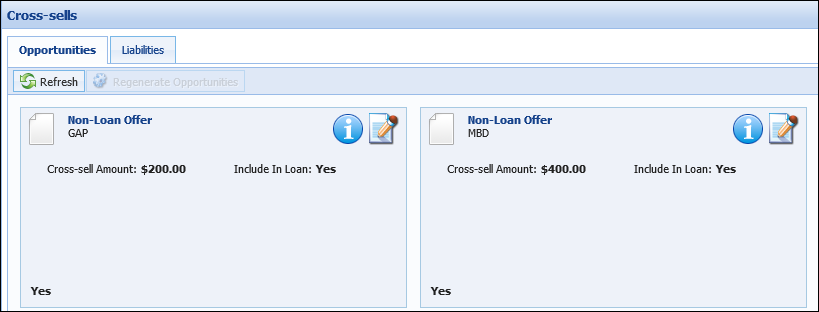

Upon receiving the approval, the dealership discusses the decision, rate and loan terms with the applicants. During the discussion, the applicants negotiate to lower the monthly payment amount. During this negotiation, the applicants successfully reduce the loan amount by negotiating a $500 price reduction and by adding a $1,050.00 down payment. The applicants also add a $2,500.00 Mechanical Breakdown plan and a $560.00 Guaranteed Asset Protection plan. In addition to the aforementioned loan modifications, all applications approved by the financial institution are subject to a $125.00 Loan Application Fee as well as a $5.00 New Account Voucher for non-account holder applications. Finally, the dealer marks up the customer's interest rate from 3.35% to 4.125%, which results in the Total Interest amount increasing from $2,604.65 to $3,636.81.

These modifications are added to the loan contract, signed, and submitted to the financial institution.

Upon receiving the dealer contract, the loan file clerk notices the differences between the approved loan terms within Temenos Infinity and the contract signed by the applicant. The loan file clerk accesses the application within the module and navigates to the Contract Updates screen.

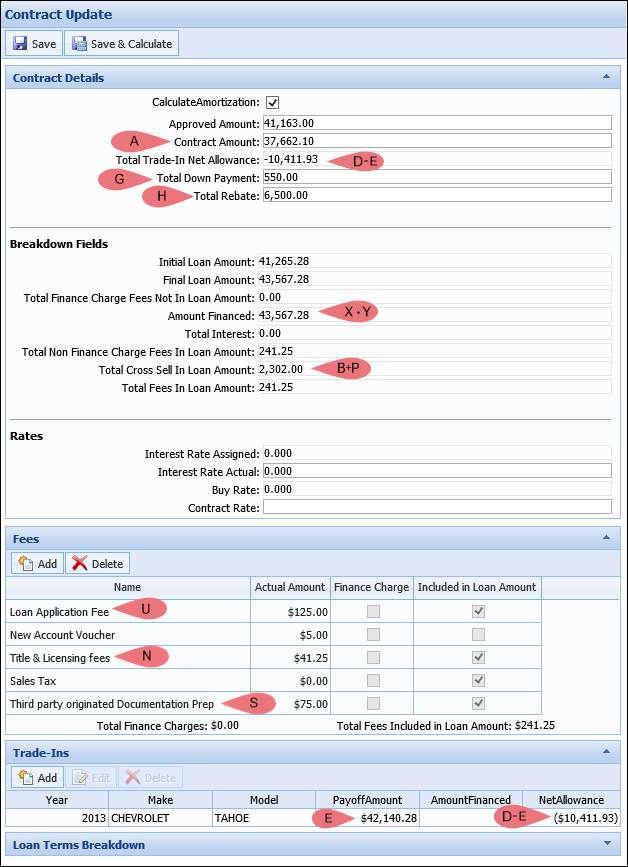

Once on the Contract Updates screen, the clerk clears the Calculate Amortization check box and completes the following updates:

| Contract Update Screen Fields | Dealertrack Fields | RouteOne Fields | CUDL Fields | Amount | ||

| Contract Amount (Base Loan Amount) |

Cash Selling Price | Cash Price | Sales Price / Total Sales Price | $25,500.00 | ||

| Total Down Payment | Cash Down | Cash Down | Cash Down | $1,050.00 | ||

| Total Rebate | Rebate | Rebate | Rebate | No change | ||

| Total Cross Sell in Loan Amount | GAP + Warranty | GAP + Service Contract | GAP + Service Contract |

Updates automatically once GAP and MBD plans are added.

|

||

| Total Interest | Value derived from Contract | Value derived from Contract | Value derived from Contract |

$3,636.81 |

||

| Contract Rate | Customer Rate | Customer Rate | N/A | 4.125% | ||

| Interest Rate Actual | N/A | N/A | N/A | 4.125% |

|

Refer to the following rate matrix for more information on the rates affected by a dealer rate mark-up:

|

In addition to the aforementioned fields, the following fee updates are made:

| Contract Update Screen Fees | Dealertrack Fields | RouteOne Fields | CUDL Fields | Amount | ||

| Title and Licensing Fees | T&L Estimate | Tile/Lic/Other Fees | License | No change | ||

| Sales Tax | Sales Tax | Taxes | Tax | $1,470.00 | ||

|

Third Party Originated GAP

|

GAP | GAP | GAP | $560.00 | ||

|

Third Party Originated MBD

|

Warranty | Service Contract | Service Contract | $2,500.00 | ||

| Loan Application Fee New Account Voucher |

Back End Fees | Additional Items | Other Ins/Svc | $125.00 $ 5.00 |

|

The Total Finance Charge Fees Not in Loan Amount, Total Finance Charge Fees in Loan Amount, and Total Fees in Loan Amount fields update after all fees are added and the screen is saved. |

To update GAP and MBD amounts on RouteOne and Dealertrack applications:

|

The Total Cross Sell in Loan Amount field updates to reflect the $3,060.00 combined value of the GAP and MBD plans. |

Once all the updates have been completed, the file clerk saves the screen and proceeds with Funding and Disbursement.

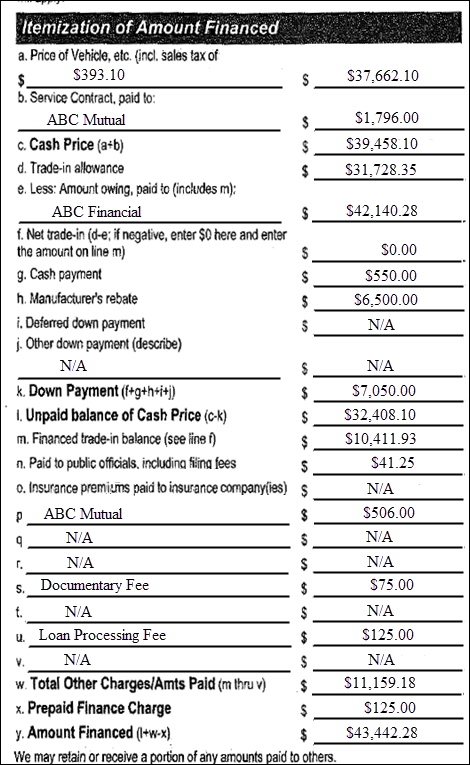

The following section provides a sample dealer contract as well as a list of the contract's corresponding Temenos fields and fees.

|

The Temenos fields that correspond with the dealer contract are indicated in the image on the right. |

| Line | Line Item Label | Amount | Temenos Field |

| A | Price of Vehicle (including sales tax) | $37,662.10 | Contract Amount (Base Loan Amount) |

| B | Service Contract, paid to | Abc Mutual | N/A |

| Service Contract, amount | $1,796.00 | Third Party Originated MBD Fee or MBD Cross-sell | |

| C | Cash Price | $39,458.10 | N/A |

| D | Trade Allowance | $31,728.35 | Trade In Value |

| E | Less: Amount owing, paid to | Abc Financial | N/A |

| Less Amount owing, amount | $42,140.28 | Trade In Payoff Amount | |

| F | Net Trade In | $0.00 | N/A |

| G | Cash Payment | $550.00 | Total Down Payment |

| H | Manufacturer's Rebate | $6,500.00 | Total Rebate |

| I | Deferred Down Payment | N/A | N/A |

| J | Other Down Payment | N/A | N/A |

| K | Down Payment | $7,050.00 | N/A |

| L | Unpaid Balance of Cash Price | $32,408.10 | N/A |

| M | Financed Trade-in Balance | $10,411.93 | Total Trade In Net Allowance |

| N | Paid to Public Officials, including filing fees | $41.25 | Title and Licensing Fees |

| O | Insurance Premiums Paid to Insurance Companies | N/A | N/A |

| P | ABC Mutual | $506.00 | Third Party Originated GAP Fee or GAP Cross-sell |

| Q | N/A | N/A | N/A |

| R | N/A | N/A | N/A |

| S | Documentary Fee | $75.00 | Third Party Documentation Prep |

| T | N/A | N/A | N/A |

| U | Loan Processing Fee | $125.00 | Loan Origination Fee |

| V | N/A | N/A | N/A |

| W | Total Charges Amt Paid | $11,159.18 | N/A |

| X | Prepaid Finance Charges | $125.00 | Loan Origination Fee |

| Y | Amount Financed | $43,442.28 | Amount Financed |