| End-User Guide > Application Processing > Post-Decision > Approval > Disburse |

The disbursement function allows users to disburse an approved loan application to core and/or third party integration. The disbursement process may be a live process or a nightly batch disbursement process.

This topic includes the following information:

|

While an application's disbursement is processing, an application is locked and users are prevented from making changes until the disbursement completes.

Refresh or re-open the workspace after the application has been disbursed to enable editing of the application. |

Applications may be disbursed manually by Loan or Account Origination module end users or automatically by administrative configurations made with Event Processing.

Loan or Account Origination module users with the appropriate permissions are able to able to disburse an application, once an application is approved. Users are able to manually disburse an application from the:

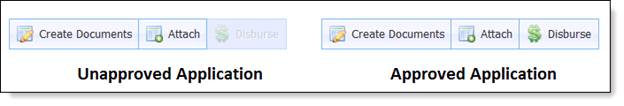

Once an application is in a disbursable state, users may select the Disburse button within the application toolbar.

When the Disburse button is clicked, the Disbursement process initiates.

When a user navigates to the final screen assigned to a Workflow’s Approval category, the Disburse button appears in the screen’s toolbar.

When the Disburse button is clicked, the Disbursement process initiates.

Applications may also be automatically disbursed by Event Processing, based on the following application conditions:

|

The IsAccountReadyForDisbursement flag is automatically set to true by the system when the following conditions are met in the application:

|

Application Type IsAccountReadyForDisbursement IsLoanReadyForDisbursement Disburse? Account and Loan True True Account and Loan Account and Loan True False Account Account and Loan False True None

Users must disburse accounts before loan. Loan N/A True Loan Loan N/A False None Account True N/A Account Account False N/A None

|

If the application is locked by a system user:

|

|

In the event of validation errors, To-dos or other system errors, the automated disbursement does not complete. The application remains in an Auto Approved or Loan Officer Approved status. Additionally if a user bypasses warnings on the approval, the warnings are also bypassed during the automatic disbursement. |

During the disbursement process, a notification stating "application is being automatically disbursed by the module" is added to the application. Once the application disburses, this notification is removed and queuing rules execute.

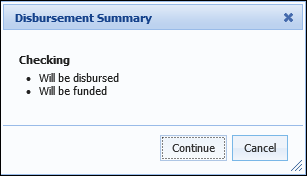

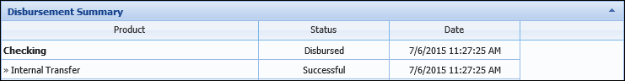

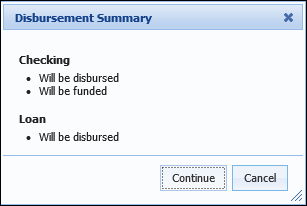

Once an application is ready to be disbursed, click  . The Disbursement Summary pop-up window appears, indicating the disbursement actions that are to occur.

. The Disbursement Summary pop-up window appears, indicating the disbursement actions that are to occur.

|

Account applications must include at least one account product for disbursement; therefore, if an account application does not include any account products, a Validation error is received upon clicking  to inform that at least one account product must be added to disburse the application. to inform that at least one account product must be added to disburse the application. |

Click Continue to proceed with the disbursement. Click Cancel to return to the application without disbursing.

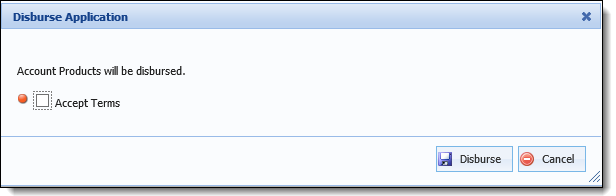

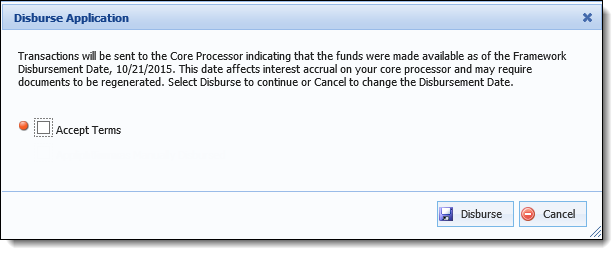

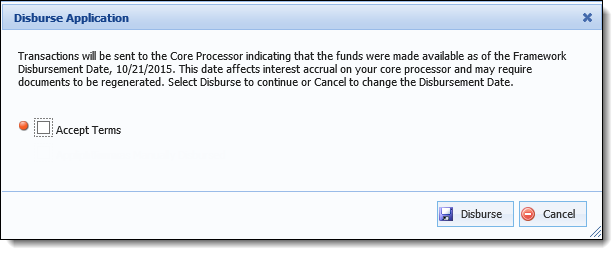

After clicking Continue, the Disburse Application pop-up window appears. Select the Accept Terms check box and click Disburse. To return to the application without disbursing, click Cancel.

Upon clicking Disburse, the disbursement process begins. During the disbursement process, the following occurs:

|

If the application does not pass the account Validations or Validation Rules, the disbursement process stops and errors generate. Once the validations are cleared, click  . . |

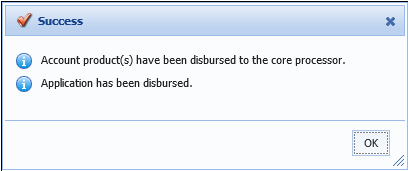

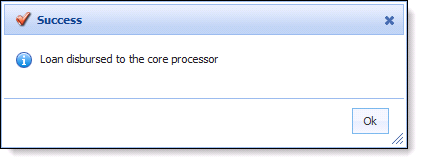

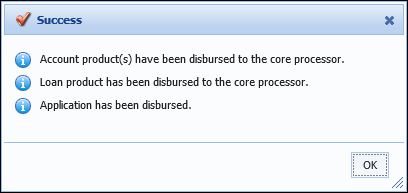

After the disbursement process completes, a Success message appears:

|

The success message may indicate the application has been partially disbursed if an account product's funding is not successful.

|

Once an application has been disbursed, the system processes the account product funding records.

|

If multiple account products are being processed, the system disburses and funds the Base Share Account first. Once the base share is processed, the system disburses and funds any remaining account products.

|

Funding records are sent to the core in the order that they appear in the Event/Action pair(s) configured to execute by the system administrator in System Management > Origination > Event Processing. When an account product is disbursed, the configured action executes to create the funding record in the core and/or transmit the funding information to the applicable third party connector.

|

If all funding actions are configured in one Event/Action pair, the funding records are processed in the order that they appear in the configured action. If more than one Event/Action pair is configured, the funding records are processed in the order that the Event/Action pairs were created. Cash and Check funding records are not disbursed to the core since they are processed immediately once the cash and/or check is received at the institution. |

|

If account disbursement or funding is not successful, clicking  again initiates the disbursement process for the unsuccessful records. All successful records are skipped and the disbursement process picks up with the first record that is not successful. again initiates the disbursement process for the unsuccessful records. All successful records are skipped and the disbursement process picks up with the first record that is not successful. |

Upon successful account disbursement and funding, the following fields are set in the screen for each account product:

Once all account products on the application have been successfully disbursed and funded, Is Account Disbursed is set to true for the application. When this field is set to true, the overall application is able to disburse and the following fields are set for the application:

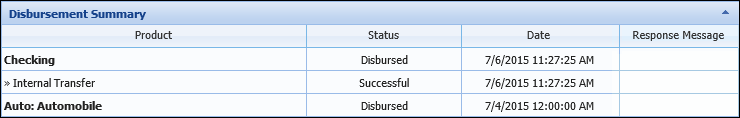

When configured to appear in an application, the Disbursement Summary panel provides a table that lists each account product as well as their corresponding funding record(s).

The grid within this panel indicates the following information for both account products and funding records:

| Column | Description | ||

| Status |

|

||

| Date |

|

Once an application is ready to be disbursed, click  . Once clicked, the Disburse Application pop-up window appears. Select the Accept Terms check box and click Disburse. To return to the application without disbursing, click Cancel.

. Once clicked, the Disburse Application pop-up window appears. Select the Accept Terms check box and click Disburse. To return to the application without disbursing, click Cancel.

Upon clicking Disburse, the disbursement process begins. During the disbursement process, the following occurs:

|

If the application does not pass the loan Validations or Validation Rules, the disbursement process stops and errors generate. Once the validations are cleared, click  . . |

After the disbursement process completes, a Success message appears.

|

If the Actual Interest Rate is set manually, the value entered may potentially be updated when Pricing Rules run at Disbursement. This may cause the Actual Interest Rate on the documents to differ from the Actual Interest Rate disbursed to the core. To avoid this potential issue, a Pricing Rule can be authored using the "Do Not Update Actual Rate" template which prevents the Actual Interest Rate from updating if set manually. Once authored, this rule must be assigned to each Pricing Model. |

Upon a successful loan disbursement, the following fields are set in an Application screen for the loan:

Once Is Loan is Disbursed is set to true, the overall application is able to disburse and the following fields are set for the application:

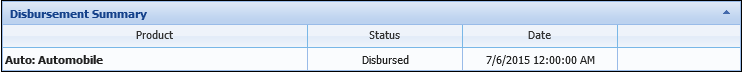

When configured to appear in an Application screen, the Disbursement Summary panel contains a table that lists the disbursement status of the loan product as well as the date the loan was disbursed.

The grid within this panel indicates the following information for the loan product application:

| Column | Description |

| Status |

Indicates the disbursement status of the loan product. The value that populates in this column is derived from the APPLICATION_STATUS field look up and include values such as: In Progress, Decisioned, and Disbursed. |

| Date |

The date column indicates the date and time the loan product was disbursed. |

|

For information on Batch Disbursement, refer to the Batch Disbursement topic within the Administrator Guide. |

Once an application is ready to be disbursed, click  . The Disbursement Summary pop-up window appears, indicating the disbursement actions that are to occur.

. The Disbursement Summary pop-up window appears, indicating the disbursement actions that are to occur.

Click Continue to proceed with the disbursement.

After clicking Continue, the Disburse Application pop-up window appears. Select the Accept Terms check box and click Disburse.

Upon clicking Disburse, the disbursement process begins. During the disbursement process, the following occurs:

|

If the application does not pass the loan or account Validations or Validation Rules, the disbursement process stops and errors generate. Once the validations are cleared, click  . . |

When a Base Share exists on the application, the account product identified as a Base Share is disbursed and funded prior to the loan or any subsequent account products. Once the Base Share is successfully disbursed and funded, the system proceeds with disbursing the loan.

|

If the application does not include a Base Share, the system moves right to loan disbursement. |

After the loan disburses, any additional account products on the application are disbursed and funded.

|

If an account is already disbursed, the system skips disbursement and moves onto funding. If the account was already funded, the system skips funding and moves onto the disbursement and funding of subsequent account products. |

Account Product Funding records are sent to the core in the order that they appear in the Event/Action pair(s) configured to execute by the system administrator in System Management > Origination > Event Processing. When an account product is disbursed, the configured action executes to create the funding record in the core and/or transmit the funding information to the applicable third party connector.

|

If all funding actions are configured in one Event/Action pair, the funding records are processed in the order that they appear in the configured action. If more than one Event/Action pair is configured, the funding records are processed in the order that the Event/Action pairs were created. Cash and Check funding records are not disbursed to the core since they are processed immediately once the cash and/or check is received at the institution. |

|

If account disbursement or funding is not successful, clicking  re-initiates the disbursement process for the unsuccessful records. All successful records are skipped and the disbursement process picks up with the first record that is not successful. re-initiates the disbursement process for the unsuccessful records. All successful records are skipped and the disbursement process picks up with the first record that is not successful. |

Upon the successful disbursement and funding of each account product, the following fields are set in the screen for each account product:

Once all account products on the application have been successfully disbursed and funded, Is Account Disbursed is set to true for the application.

|

Is Account Disbursed is only set to true after all account products on the application have been successfully disbursed and funded. |

Upon a successful loan disbursement, the following fields are set in the Application screen for the loan:

Once both Is Account Disbursed and Is Loan Disbursed are set to true, the application is able to disburse and the following fields are set in the application:

|

If a loan application includes one or more account products, then both Is Account Disbursed and Is Loan Disbursed must be set to true in order to fully disburse the application. When either account disbursement and/or loan disbursement is not successful, the application is only partially disbursed; Is Disbursed is not set to true and the value of Application Disbursed Date is also not set until all loan and account products are successfully disbursed. When a loan application does not include any account products, Is Disbursed and Application Disbursed Date are set once the loan is successfully disbursed. |

When the disbursement process completes, a Success message appears:

|

The success message indicates the application has been partially disbursed if an account product's funding is not in a successful state.

|

When configured to appear in an Application screen, the Disbursement Summary panel provides a table that lists each account product along with their corresponding funding record(s), as well as the loan product.

The grid within this panel indicates the following information for both account and loan products as well as account funding records:

| Column | Description | ||

| Status |

|

||

| Date |

|

||

| Response Message |

Displays a response message, such as a confirmation code returned by a connector.

|

For an application to be disbursed, it must be in a disbursable state. The following system-defined validations may prevent an application from being disbursed:

|

Validations do not make the Disburse button unavailable in the toolbar. |

| Validations | ||

| Loan Account Number is required if Core doesn't support generating loan account numbers. | ||

| If an account number for a loan or account product is required and not present, disbursement cannot continue. | ||

| If the Eligibility Required field is set to "Yes" within the Origination page in System Management, and the Primary applicant value for IsEligible is false, then disbursement cannot continue and an error message stating the following is received: "The primary applicant is not eligible." | ||

| Stipulations required for disbursement must be met or waived. | ||

| Final loan amount must be within sub-product limits. | ||

| DisbursementDate is required. | ||

| If pledge collateral, pledged asset must be on the Core. | ||

| If pledge collateral, AvailableBalance of pledged asset must be >= PledgeAmount. | ||

| Vendor, if set, must be active. | ||

| Vendor Channel, if set, must be active. | ||

| Vendor, if set, must have a VendorCode. | ||

| If AutoTransfer/ACH, FIAccountNumber is required. | ||

| If ACH, ACHRoutingNumber is required. | ||

| If ACH, ACHAccountNumber is required. | ||

| If ACH, ACHPrimaryOwnerName is required. | ||

| If ACH, ACHAccountTypeId is required. | ||

| If AutoTransfer/ACH, VariablePaymentDateTypeId is required. | ||

| If AutoTransfer/ACH, VariablePaymentTypeId is required. | ||

| If AutoTransfer/ACH and VariablePaymentTypeId is FIXED_AMT, VariablePaymentFixedAmount is required. | ||

| If AutoTransfer/ACH and VariablePaymentTypeId is FIXED_AMT, VariablePaymentFixedAmount must be >= PaymentAmount. | ||

| If AutoTransfer/ACH and VariablePaymentTypeId is DAYS_PAST_CYCLE or DAYS_PRIOR_DUE_DATE, VariablePaymentDays is required. | ||

| If AutoTransfer/ACH and VariablePaymentTypeId is SPECIFIC_DAY, VariablePaymentDayOfMonth is required. | ||

| If disbursement provider is batch, must pass its validation. | ||

| Ensures funding is within limits. | ||

|

All funds must be allocated.

|

||

| OFAC is active and Payees have not passed OFAC check. | ||

| OFAC is active and has not been run on a primary applicant. | ||

| Precise ID is active and applicants have not passed the Precise ID check. | ||

| The application cannot have already been disbursed. | ||

| The application must be approved. | ||

| The application cannot be withdrawn. | ||

| The application cannot have a disbursement pending. | ||

|

If the Minimum and/or Maximum Term set for an Open End loan is exceeded.

|

In addition to the system-defined validations, institutions are able to create their own validations and To Dos that have the ability to prevent an application from disbursing.