The Origination page enables institutions to manage parameter settings for the Loan Origination and Account Origination modules.

To access the Origination page, navigate to System Management > Modules > Origination.

Each tab contains a variety of parameters that optimize Temenos functionality. Parameters with an asterisk (*) require an Internet Information Services (IIS) reset on all Temenos Infinity servers in order for any configuration changes to take effect.

|

It is advised that the IIS reset occurs after business hours as it causes a disruption in the production environment. |

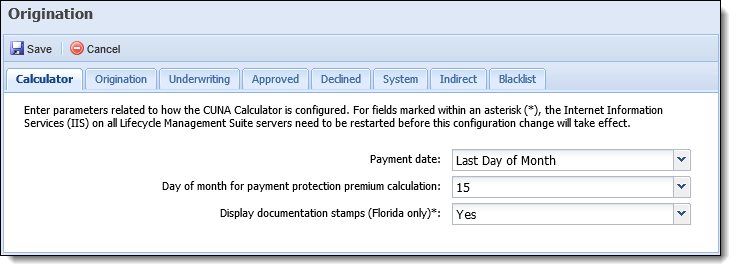

The Calculator tab contains the following fields that allow institutions to configure the CUNA calculator:

| Field Name | Solution Parameter | Description | Valid Values |

| Payment date | CALCULATOR_LAST_PAYDAY | Determines whether the calculator calculates based on the last pay day of the month or based on the due date, even if it is the last day of the month. |

Drop-down: Last Payday of Month or Last day of Month |

| Day of month for payment protection premium calculation | CALCULATOR_APPLICATION_PREMIUM_DAY | Determines the day of the month the premium is calculated. |

Drop-down: 1 to 31 |

| Display documentation stamps (Florida only) | DISPLAY_DOC_STAMPS | Determines whether or not Doc Stamps are visible. |

Drop-down: Yes or No |

The Origination tab contains parameters that allow institutions to configure functions related to the origination stage:

| Field Name | Solution Parameter | Description | Valid Values | ||||

| Application age for Select Application search (days) | APPLICATION_AGE_IN_DAYS | Determines the number of days old an application must be in order to display in the Select Application pop-up window during a search. |

Textbox: Integer > 0 |

||||

|

Eligibility Required

|

ELIGIBILITY_REQUIRED |

Determines whether non-member applicant information is input on the Applicant screen of the sub-product (No) or on the Non-Member Information screen and Non-Member Eligibility screen (Yes). |

Drop-down: Yes or No

|

||||

| Eligibility Segmentation ID | ELIGIBILITY_SEGMENTATIONID | Determines whether or not a value from Lending_Segmentation_Code is applied to the application. | Drop-down list: Application > Applicants > Segmentation > Description | ||||

| Enable Good Faith Estimate (GFE) date validation errors | VALIDATE_GFE_DATES | Determines whether or not GFE date validation errors are displayed. |

Drop-down: Yes or No |

||||

| Include External Liabilities in Add On Refinance Panel | INCLUDE_EXTERNAL_LIABILITIES | Determines whether or not external liabilities are displayed on the Add On Refinance panel. |

Drop-down: Yes or No |

||||

| Load demographics and income from prior application for applicant with Invalid TIN | INVALID_TIN_DEMOGRAPHICS | Determines whether applicant demographics and income information are pulled from previous applications when an applicant has been flagged as having an invalid TIN. |

Drop-down: Yes or No

|

||||

|

Default Virtual Capture Instance

|

DEFAULT_VIRTUAL_CAPTURE_INSTANCE | Determines the default instance of Virtual Capture where applicants, or vendors, are navigated to if they access Virtual Capture, or Merchant Lending, with a URL that does not include an instance code. |

Drop-down: All active instances configured in System Management > Origination > Virtual Capture > Virtual Capture Settings. The options available in this list are formatted as <Instance Type> - <Instance Name>.

|

||||

| Create Cross-sell Offers in Pending Review | CREATE_CROSS_SELL_IN_REVIEW | Determines whether a cross-sell with a status of Pending Review is presented to applicants. |

Drop-down: Yes or No

|

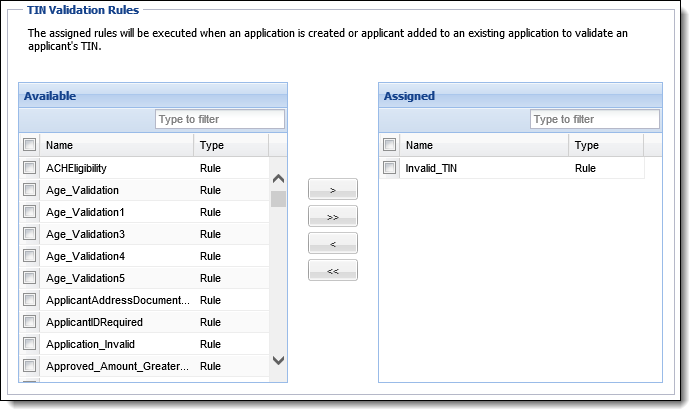

The TIN Validation Rules multi-grid allows institutions to assign one or more Validation Rules to execute when an application is created or an applicant is added to an existing application. If the criteria within the rule fails validation when an application is created or an applicant is added, the Is Invalid TIN field is set to true.

|

It is imperative that only TIN validation rules are set here, as it may result in errantly flagging an applicant's TIN as invalid. |

|

Only validations written at the Applicant level populate in this grid. |

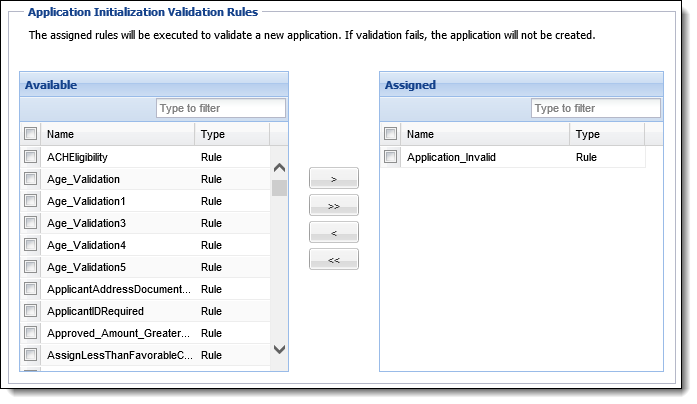

Application Initialization Validation Rules

Application Initialization Validation Rules

The Application Initialization Validation Rules multi-grid allows institution to assign one or more Validation Rules to execute when the application is created. If the criteria within the rule fails validation, the application is not created.

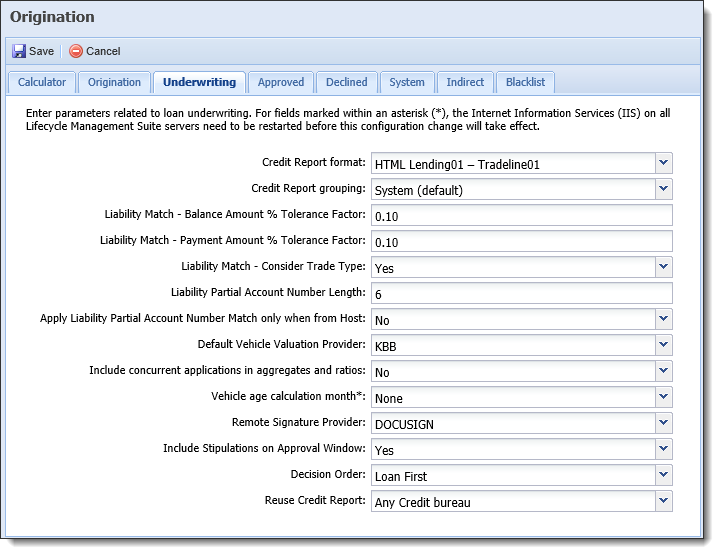

The Underwriting tab contains fields that allow institutions to configure functions related to application underwriting:

| Field Name | Solution Parameter | Description | Valid Values | ||||

| Credit Report Format | CREDIT_REPORT_FORMAT | Determines the custom format for credit reports. If left blank, the LUXCOMMON SUMMARY profile is used. |

Drop-down:

|

||||

| Credit Report Grouping | CREDIT_REPORT_GROUPING | Determines the criteria by which credit report data, or tradeline information, is grouped when the report is generated, such as Account Type, or Open/Closed Accounts. |

Drop-down:

|

||||

| Liability Match - Balance Amount % Tolerance Factor | DEDUPE_BALANCE_TOLERANCE_FACTOR |

Determines the balance amount tolerance factor used when searching for a liability to map to an address.

For example, if the Balance Amount % Tolerance Factor is set to 0.05 (5%) and the liability balance amount in the core is within 5% of the liability balance amount in the credit report, the liability is considered a duplicate.

|

Textbox: Decimal > 0 |

||||

| Liability Match - Payment Amount % Tolerance Factor | DEDUPE_PAYMENT_TOLERANCE_FACTOR |

Determines the payment amount tolerance factor used when searching for a liability to map to an address.

For example, if the Payment Amount % Tolerance Factor is set to 0.05 (5%) and the liability payment amount in the core is within 5% of the liability payment amount in the credit report, the liability is considered a duplicate.

|

Textbox: Decimal > 0 |

||||

| Liability Match - Consider Trade Type | DEDUPE_COMPARE_BY_TRADETYPE | Determines whether or not the trade type is considered when searching for a liability to map to an address. |

Drop-down: Yes or No |

||||

| Liability Partial Account Number Length | LIABILITY_ACCOUNT_MATCH_LENGTH |

Determines the amount of Credit Report Account Number digits that are compared during the applicant credit reporting de-duplication process.

For example, if the Liability Partial Account Number Length is set to 6, the first six digits of the Credit Report Account Number on the application are compared to the first six digits of the Credit Report Account Number on the credit report. If the first six digits match, the credit reports are de-duplicated. If the first six digits do not match, the last six digits of the Credit Report Account Numbers are compared. |

Textbox: Numerical value between 0 and 999

|

||||

| Apply Liability Partial Account Number Match only when from Host | LIABILITY_ACCOUNT_MATCH_FROM_HOST |

Determines how liabilities are de-duped between applicants when there is a partial account number match for credit report tradelines. |

Drop-down: Yes or No

|

||||

| Default Vehicle Valuation Provider | DEFAULT_VEHICLE_VALUATION_PROVIDER | Determines the valuation provider used by the financial institution. |

Drop-down: NADA or KBB |

||||

| Include concurrent applications in aggregates and ratios | INCLUDE_CONCURRENT_APPS | Determines whether or not concurrent applications are used in the Loan Origination and Account Origination modules |

Drop-down: Yes or No |

||||

| Vehicle age calculation month | Vehicle_Age_Month | Determines the month that is used to begin calculating a new model year for a vehicle. |

Drop-down: January – December, None

|

||||

| Remote Signature Provider | REMOTE_SIGNATURE_PROVIDER | Determines the remote signature provider used by the financial institution. |

Drop-down: IMM, DocuSign, or Silanis

Setting this parameter determines whether DropSpot functionality is used for the following connectors:

|

||||

| Include Stipulations on Approval Window | INCLUDE_STIPULATIONS_ON_APPROVAL_WINDOW | Determines whether or not the Stipulations grid is displayed on the Manual Approve Loan screen. | Drop-down: Yes, No (default) | ||||

| Decision Order | DECISION_ORDER | Determines whether the loan or account decision is rendered first during the automated decision process for an application that requires both decisions. |

Drop-down: Account First, Loan First

|

||||

| Reuse Credit Report | REUSE_CREDIT_REPORT | Determines if the system reuses the most recent credit report from any credit bureau, or the most recent report based on the credit bureau sequence logic for an application type. |

Drop-down:

|

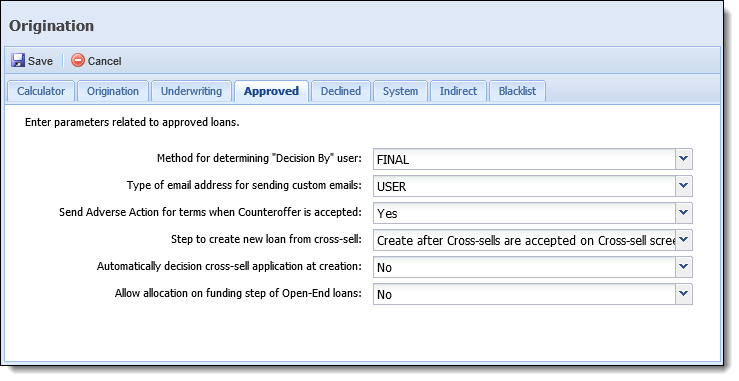

The Approved tab contains fields that allow institutions to configure functions related to approved applications:

| Field Name | Solution Parameter | Description | Valid Values |

| Method for determining “Decision By” user | DECISIONED_BY_METHOD | Determines the value used to set the Decisioned By user. |

Drop-down: FINAL or SUGGEST |

| Type of email address for sending custom emails | FROM_EMAIL_ADDRESS_TYPE | Determines the email address used when sending custom emails from within Temenos Infinity. |

Drop-down: SYSTEM or USER |

| Send Adverse Action for terms when Counter Offer is accepted | SEND_APPLICATION_COUNTEROFFER_ADVERSE_ACTION | Determines whether or not an adverse action notice for application terms is sent when a counteroffer is accepted. |

Drop-down: Yes or No |

| Step to create new loan from cross-sell | CREATE_FROM_CROSSSELL | Determines on which step of the application process a new loan is created from a cross-sell. |

Drop-down: Create after Cross-sells are accepted on Cross-sell screen or Create after application is disbursed. |

| Automatically decision cross-sell application at creation | AUTO_DECISION_APP_FROM_CROSSSELL | Determines whether or not a child application is automatically decisioned after creation. |

Drop-down: Yes or No |

| Allow allocation on funding step of Open-End loans | ENABLE_OPEN_END_FUNDING_ALLOCATIONS | Determines whether or not allocations can be added on the Funding step for open-end loans. |

Drop-down:

Yes or No |

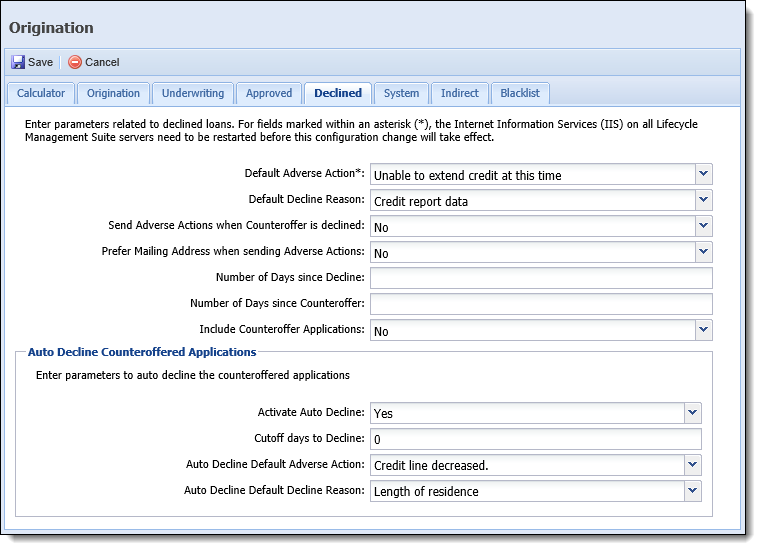

The Declined tab contains fields that allow institutions to configure functions related to declined applications, including the ability to automate the decline process for applications with counteroffers that have not been accepted.

| Field Name | Solution Parameter | Description | Valid Values | ||

| Default Adverse Action | DEFAULT_ADVERSE_ACTION | Determines the default Adverse Action ID used for the ADVERSE_ACTION lookup type. | Drop-down: Select lookup based on “ADVERSE_ACTION” lookup type | ||

| Default Decline Reason | DEFAULT_REJECT_REASON | Determines the default Reject Reason ID used for the REJECT_REASON lookup type when an application is auto declined. | Drop-down: Select lookup based on “REJECT_REASON” lookup type | ||

| Send Adverse Actions when Counteroffer is declined | SEND_COUNTEROFFER_ADVERSE_ACTION | Determines if adverse actions should be included when a counteroffer is declined. |

Drop-down:

Yes or No |

||

| Prefer Mailing Address when sending Adverse Actions | PREFER_MAILING_ADDRESS | Determines the address that is used in the Adverse Action Export. If the Prefer Mailing Address option is set to Yes, the Mailing Address for an Applicant is used instead of the current address. |

Drop-down:

Yes or No |

||

| Number of Days since Decline | DAYS_SINCE_DECLINE | Determines the time frame in which declined applications are to be included in an Adverse Action Export. For example, inputting "5" includes all declined applications within the last five days prior to the export process. |

Textbox: Integer |

||

| Number of Days since Counteroffer | Determines the time frame in which countered applications are to be included in an Adverse Action Export. For example, inputting "5" includes all countered applications within the last five days prior to the export process. |

Textbox: Integer |

|||

| Include Counteroffer Applications | INCLUDE_COUNTEROFFER_APPLICATIONS | Determines if countered applications are included in the Adverse Action Export. |

Drop-down:

Yes or No |

||

| Auto Decline Counteroffered Applications | |||||

|

Activate Auto Decline

|

ACTIVATE_AUTO_DECLINE | Determines if the Auto Decline Process for Counteroffered Applications is active. |

Drop-down:

Yes or No

|

||

| Cutoff days to Decline | CutOffDays | Determines the amount of time that must lapse to automatically decline an application with counteroffers that has not been accepted. |

Textbox: Integer |

||

| Auto Decline Default Adverse Action | AUTO_DECLINE_DEFAULT_ADVERSE_ACTION | Determines the default Adverse Action that appears on the Adverse Action notification transmitted to the applicant. | Drop-down: Select lookup based on “ADVERSE_ACTION” lookup type | ||

| Auto Decline Default Decline Reason | AUTO_DECLINE_DEFAULT_DECLINE_REASON | Determines the default Decline Reason that appears on the Adverse Action notification transmitted to the applicant. | Drop-down: Select lookup based on “REJECT_REASON” lookup type | ||

The System tab contains fields that allow institutions to configure Temenos Infinity or host configuration policies:

| Field Name | Parameter | Description | Valid Values | ||||

| Number of application tabs allowed per session | MAXLENDINGWORKSPACE | Determines the maximum number of application tabs that can be open during a user's session in Temenos Infinity. |

Textbox: Integer > 0 |

||||

| Host supports account number auto-generation | HOST_AUTOGEN_LOANNUMBER | Determines whether the host supports auto-generation of loan account numbers (Yes) or if account numbers must be entered by the user (No). |

Drop-down: Yes or No |

||||

| Host supports person account number auto-generation | HOST_AUTOGEN_PERSONNUMBER | Determines whether the host supports auto-generation of person account numbers (Yes) or if account numbers must be entered by the user (No). |

Drop-down: Yes or No |

||||

| Loan Number (suffix) is editable and required | SUFFIX_ISREQUIRED | Determines whether or not the loan number suffix is required and can be edited. |

Drop-down:

Yes or No |

||||

| Account Product Number (suffix) is editable and required | ACCOUNT_PRODUCT_SUFFIX_IS_REQUIRED | Determines whether or not the account product number suffix is required and can be edited. |

Drop-down: Yes or No |

||||

| Credit Union routing number | ROUTING_NUMBER | Determines the default routing number used for internal transfers. |

Textbox: Number, 9 digits |

||||

| GL Code (OSI only) | HOST_CHECK_CODE | Determines the GL Code used for DNA (OSI). | Textbox: Optional | ||||

| Update Demographics for Account Search | CHANGEACCOUNT_INCLUDE_DEMOGRAPHICS | Determines whether or not demographics are updated when the Change Loan/Account Number pop-up window is saved in the application workspace. |

Drop-down:

Yes or No |

||||

| Include Addresses when updating Demographics | CHANGEACCOUNT_INCLUDE_ADDRESS | Determines whether or not addresses are included in demographic updates when the Change Loan/Account Number pop-up window is saved in the application workspace. |

Drop-down: Yes or No |

||||

| Update Core Messages for Account Search | CHANGEACCOUNT_INCLUDE_COREMESSAGES | Determines whether or not Core Messages are updated when the Change Loan/Account Number pop-up window is saved in the application workspace. |

Drop-down: Yes or No |

||||

| Vendor Split | DEALER_SPLIT | Determines the percentage given to the dealer for an application, if the vendor fee type is split. |

Textbox |

||||

| Flat Rate | FLAT_RATE | Determines the flat rate given to the dealer for an application, if the vendor fee type is a flat rate. |

Textbox |

||||

| Indirect Application Counteroffer Decision Notification | INDIRECT_APP_COUNTEROFFER_DECISION_NOTIF | Determines how Temenos Infinity communicates counteroffers to the indirect provider. |

Drop-down:

|

||||

| Automated Counteroffer Maximum Iterations | AUTOMATED_COUNTEROFFER_MAX_ITERATIONS | Determines the maximum number of automated counteroffer iterations. |

Textbox: Integer > 0 |

||||

| Direct Total Monthly Expense Default | DIRECT_IS_TOTAL_MONTHLY_EXPENSE_DEFAULT | Determines whether or not the Total Monthly Expense flag is automatically set on addresses for all applicants when an application is created. |

Drop-down: Yes or No |

||||

| Indirect Total Monthly Expense Default | INDIRECT_IS_TOTAL_MONTHLY_EXPENSE_DEFAULT | Determines whether or not the Total Monthly Expense flag is automatically set on addresses for all applicants when an application is created from an indirect provider. |

Drop-down: Yes or No |

||||

| Account Decision for Existing Account Holder | ACCOUNT_DECISION_FOR_EXISTING_ACCOUNT_HOLDER | Determines whether account applications for existing account holders are automatically approved or require a decision. |

Drop-down:

|

||||

| Virtual Capture Configuration Refresh Frequency (Minutes) | CONFIG_REFRESH_MINUTES |

Determines the number of minutes to pass before an automatic refresh of the virtual application occurs. After the set amount of time passes, Virtual Capture automatically refreshes to apply the updated configurations made in Temenos Infinity to the virtual application.

|

Textbox: Integer > 0

|

||||

| Document Virus Scan in Virtual Capture and API | VIRTUAL_CAPTURE_SCAN_TYPE | Determines whether documents uploaded in Virtual Capture are sent through a virus scan at the financial institution. |

Drop-down: None or Virus Scan

|

||||

| Document Import File Location | QUARANTINE_PATH |

Identifies the file path location on the institution's network where documents are to be placed to await a virus scan when attached to a Virtual Capture application.

|

Textbox

|

||||

| Document Export File Location | DESTINATION_PATH |

Identifies the file path location on the institution's network where documents are to be placed by the institution once they successfully complete a virus scan.

|

Textbox

|

||||

| Host supports Organization | HOST_SUPPORTS_ORGS |

Identifies whether the core system supports the Organization functionality, and enables the ability to create applications for Organizations. |

Drop-down: Yes or No

|

||||

| Host supports Real Time Payoff | HOST_SUPPORTS_REAL_TIME_PAYOFF | Identifies whether the core system supports real-time payoff requests as part of Applicant Import and Disbursement. |

Drop-down: Yes or No

|

||||

| Host supports Member Account Number | HOST_SUPPORTS_MEMBER_ACCOUNT_NUMBER | Identifies whether the core system supports the creation of member accounts in their interface. |

Drop-down: Yes or No

|

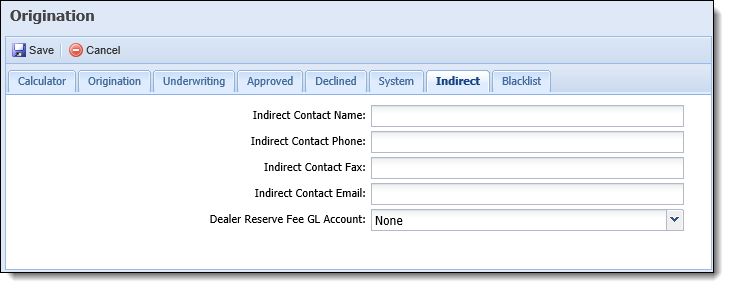

The Indirect tab contains the following parameters allowing allow institutions to define the contact information for their indirect lending department.

|

The Indirect Contact information is transmitted to the Dealertrack and RouteOne connectors during counteroffer processing or when an automated decision has been rendered. |

| Field Name | Solution Parameter | Description | Valid Values | ||

| Indirect Contact Name | INDIRECT_CONTACT_NAME | Determines the general contact name for the Indirect Lending department. | Textbox |

||

| Indirect Contact Phone | INDIRECT_CONTACT_PHONE | Determines the general contact phone number for the Indirect Lending department. | Textbox |

||

| Indirect Contact Fax | INDIRECT_CONTACT_FAX | Determines the general contact fax number for the Indirect Lending department. | Textbox |

||

| Indirect Contact Email | INDIRECT_CONTACT_EMAIL | Determines the general contact email address for the Indirect Lending department. | Textbox |

||

| Dealer Reserve Fee GL Account | DEALER_RESERVE_FEE_GENERAL_LEDGER_ACCOUNT |

Determines the GL Account to be used for debit GL transactions sent to the core for dealer reserve fees.

|

Drop-down that defaults to None, and includes a list of all GL Vouchers configured for the institution in the database. |

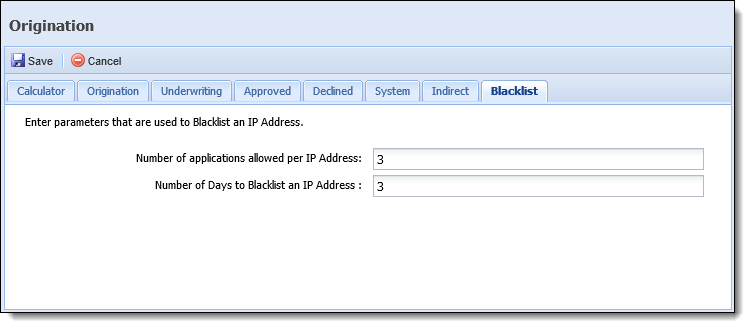

The Blacklist tab provides administrators with the ability to define the parameters that are used to prohibit certain IP addresses from accessing Temenos Infinity's Virtual Capture solution to submit account and loanapplications.

The Blacklist tab contains the following fields:

| Field | Description | ||||

| Number of applications allowed per IP Address | Enter the number of Virtual Capture applications that can be submitted from each unique IP address within the time-frame specified in the below parameter for Number of Days to Blacklist an IP Address. When an IP address has reached the maximum number of applications within the specified number of consecutive days, the applicant is redirected to an error page in Virtual Capture. | ||||

| Number of Days to Blacklist an IP Address |

Enter the number of consecutive days that must pass before an IP address can be blacklisted if the number of applications allowed for the IP Address is reached within the specified timeframe. Applications cannot be submitted from a blacklisted IP address.

|

|

In the above image, both parameters are set to a value of three. Using that example, if three applications are submitted from the same IP Address in three consecutive days, the IP Address is added to the blacklist. If one application is submitted from the IP Address on Monday, one on Tuesday, and then another on Friday, the IP Address is not blacklisted as the applications were not submitted consecutively; however, if two more applications are submitted from the IP Address on Saturday and Sunday, the IP Address will then be blacklisted. |