Liabilities have been greatly enhanced to increase efficiency and improve productivity during the application process with the introduction of the following functionality:

- Automatic identification of a liability as secured or unsecured when imported from a Core or credit report tradeline, as well as the addition of the ability to manually set a secured/unsecured value for a liability from the Liabilities screen.

- A Liabilities panel that displays the liabilities associated with an application and not only provides the ability to add liabilities, but also modify liability information directly in the grid with its inline editing capability.

- The Add-On/Refinance panel now allows users to refinance external liabilities.

- The creation of a single housing liability from multiple applicants sharing the same address.

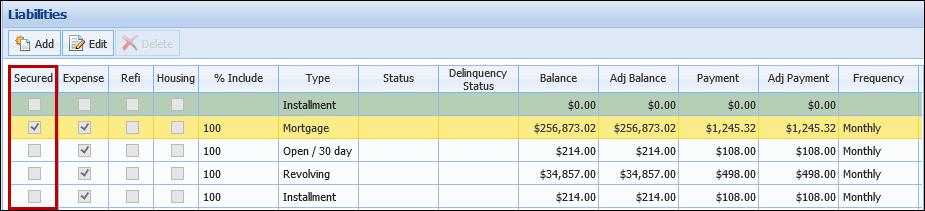

Secured and Unsecured Liabilities

The Liabilities functionality in the Framework has been enhanced to include the ability to identify a liability as secured or unsecured. When liabilities are imported from the core system, they are now automatically marked as unsecured by default. When liabilities are imported from a credit report tradeline, they are identified as secured or unsecured according to new mapping included in the database.

|

After an upgrade to version 15, liabilities included in applications that have not been Disbursed or Withdrawn are automatically marked as secured or unsecured. If a liability has a trade category specified, liabilities are identified as secured or unsecured based on the mapping in the database. Liabilities that do not have a specified trade category are automatically marked as unsecured. |

|

The default secured/unsecured value of a liability can be overwritten through rules using the new IsSecured field available for Rules, Queues, Views and Reports. |

Framework enhancements with this feature include:

- Enhancements to Loan Product Definition that provide the ability to identify a sub-product as secured or unsecured. This allows for concurrent applications created as a liability to be automatically set with the secured/unsecured value of the concurrent application's sub-product.

- Updates to system defined Aggregate and Ratio rules that use trade category to determine liability as secured or unsecured. These rules now use the new IsSecured field to calculate aggregates and ratios.

- The addition of the Application.IsSecured field to Editability, which, by default, only allows editing Pre-decision.

- Enhancements to the Liabilities screen that provide a direct view of which liabilities are secured or unsecured and enable users to manually set the secured/unsecured value of a liability.

For more information, please see the Liabilities topic in the User Guide.

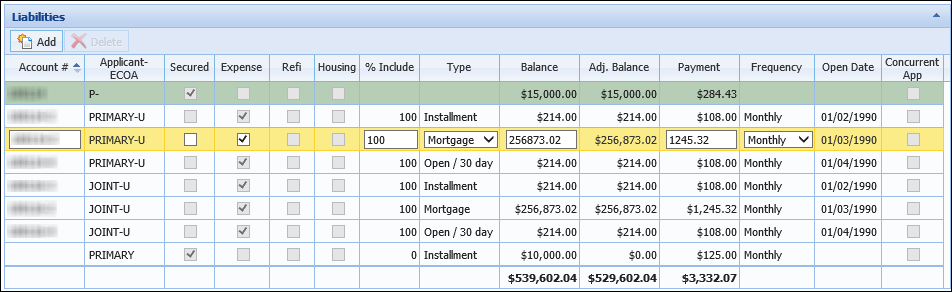

Liabilities Panel

Liabilities are no longer limited to the Liabilities screen!

Liabilities can now be viewed and managed from not only the Liabilities screen, but also the new Liabilities panel available for addition to an Application screen. While this panel is similar to the current Liabilities screen, it provides greater capabilities to both users and administrators with the following functionality:

- The ability to not only determine the data that is captured within the panel by assigning specific columns to appear, but also the ability to configure the field labels that are displayed.

- Inline editing directly within the grid that provides the ability to modify liability information within an editable text box or by selecting a value from a drop-down list of options that populate directly from the application or lookup fields in Field Configurations.

For more information, please see the Liabilities topic in the User Guide.

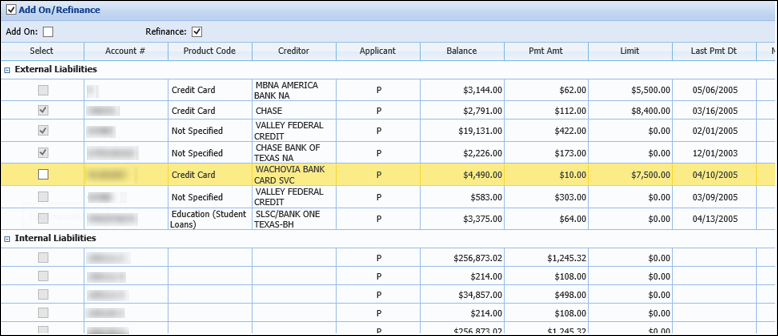

Refinance External Liabilities

Refinance? No Problem!

Framework users are now able to process refinance applications for liabilities imported from the credit report tradelines. From the Add On/Refinance panel, users are able to select a mix of external and internal liabilities to refinance.

To enable this functionality, activate the "Include External Liabilities in Add On Refinance Panel" parameter within Solution.Lending > Origination.

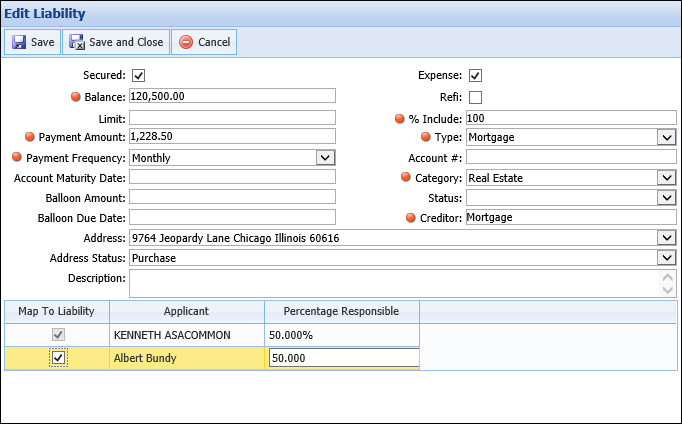

Applicant Housing Expense

Framework users are now able to enter identical housing liabilities for multiple applicants sharing the same address. Users are able to identify if the full housing expense or only the applicant’s share of the housing expense is being provided, when entering the applicant's address. Depending on the answer provided, a liability is created based on the applicant address and percentage responsible. If more than one applicant is responsible for a housing expense, a single liability is created from multiple applicant addresses.

To modify a monthly expense amount, users are able to update the Monthly Expense Amount field for each applicant or update each applicant's Percentage Responsible for the housing liability.

For more information, please see the Applicants topic within the User Guide.