Calculation Enhancements

Assumed Interest Rate Calculation for Closed-End Liabilities

The Assumed Interest Rate calculation for closed end loans has been enhanced for Replacement Cross-sells. Prior to this enhancement, the Assumed Interest Rate was calculated using the values for Assumed Balance and Assumed Remaining Term. Now, the system uses the following logic to calculate the Assumed Interest Rate for closed-end liabilities:

| Old Field Used for Calculation | New Field Used for Calculation | Comments |

| Liability > Assumed Balance |

Liability > Original Loan Amount or Liability > High Credit Amount |

The value of the Origination Loan Amount is used to calculate the Assumed Interest Rate, unless the Original Loan Amount is NULL/Empty. If Original Loan Amount is NULL/Empty, the High Credit Amount field is used in the Assumed Interest Rate calculation. |

| Liability > Assumed Remaining Term | Liability > Term | If the value of Term is NULL/Empty, the existing calculation for Assumed Interest Rate is performed using the values for Assumed Balance and Assumed Remaining Term. |

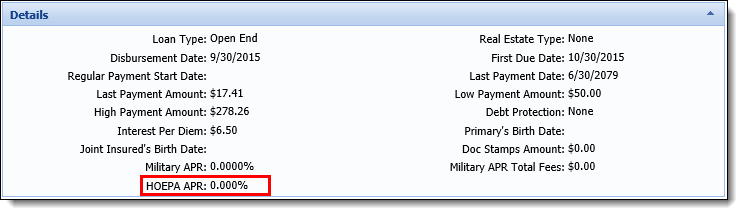

Calculation of HOEPA APR

The CUNA Calculator now supports the 2013 Home Ownership and Equity Protection Act (HOEPA) which calculates the APR used to determine if a transaction is a high-cost mortgage differently than the APR that is used on TILA disclosures. To be in compliance with the HOEPA Act, the calculation logic for Home Equity applications has been updated to calculate the APR for Home Equity loans according to HOEPA guidelines.

Now, when a Home Equity loan application is calculated, the amortization process uses updated logic to calculate the HOEPA APR, and populate the value in the new HOEPA APR field that has been added to the Details panel of the Calculation Preview in the Loan Terms screen, as well as the Field List for Application type screens, rules, views, and reports.

|

The value of the HOEPA APR is populated by the Loan calculator; therefore, the HOEPA APR field displays as read-only within the Calculation Preview and Application screens. |

To allow the HOEPA APR to be calculated for an open-end Home Equity application, the system now creates a clone of the application and converts it closed-end during the amortization process; a second call is then sent to the CUNA calculator to calculate the HOEPA APR using the updated logic for a closed-end loan.

|

For an overview of the calculation logic used to determine the HOEPA APR, please see the Loan Terms topic in the End User Guide. |

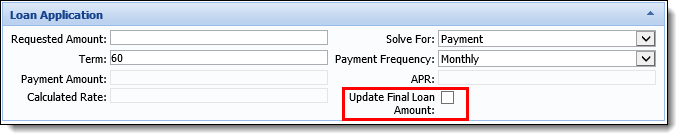

Update Final Loan Amount - Reverse Calculation of Loan Terms

The Loan Origination module now allows institutions to automatically perform a reverse calculation of fees, cross sell offers, down payments, etc. to determine the base loan amount, or requested loan amount, when the final loan amount is updated in an application.

Prior to release 16.05, if the final loan amount was modified in a loan application, institutions had to manually perform calculations to determine the loan proceeds. Now, a new field titled Update Final Loan Amount can be configured to appear in an Application panel on the Loan Terms screen to allow the system to automatically perform reverse calculations of the loan terms when the value of the Final Loan Amount is updated by a dealer. When the Update Final Loan Amount field is set to true, and the Final Loan Amount is modified, the system automatically re-calculates the loan terms in reverse order to set the Base Loan Amount in a decisioned application, or the Requested Amount in an application that has not been decisioned.

|

The Update Final Loan Amount field has been added to the Field List for screens, views, rules, and reports. |

The behavior of the Requested Loan Amount, Final Loan Amount, and Base Loan Amount fields has also been modified to conditionally enable the fields based on the value of the Update Final Loan Amount field. Additionally, the Application.Final Loan Amount field has been added to the Fields tab in System Management > Origination > Editability to allow system administrators to control the editability of the Final Loan Amount field at their institution.

|

For more information and an overview of the behavior for the Requested Loan Amount, Final Loan Amount, and Base Loan Amount fields, please see the Update Final Loan Amount section of the Loan Terms topic in the End User Guide. |

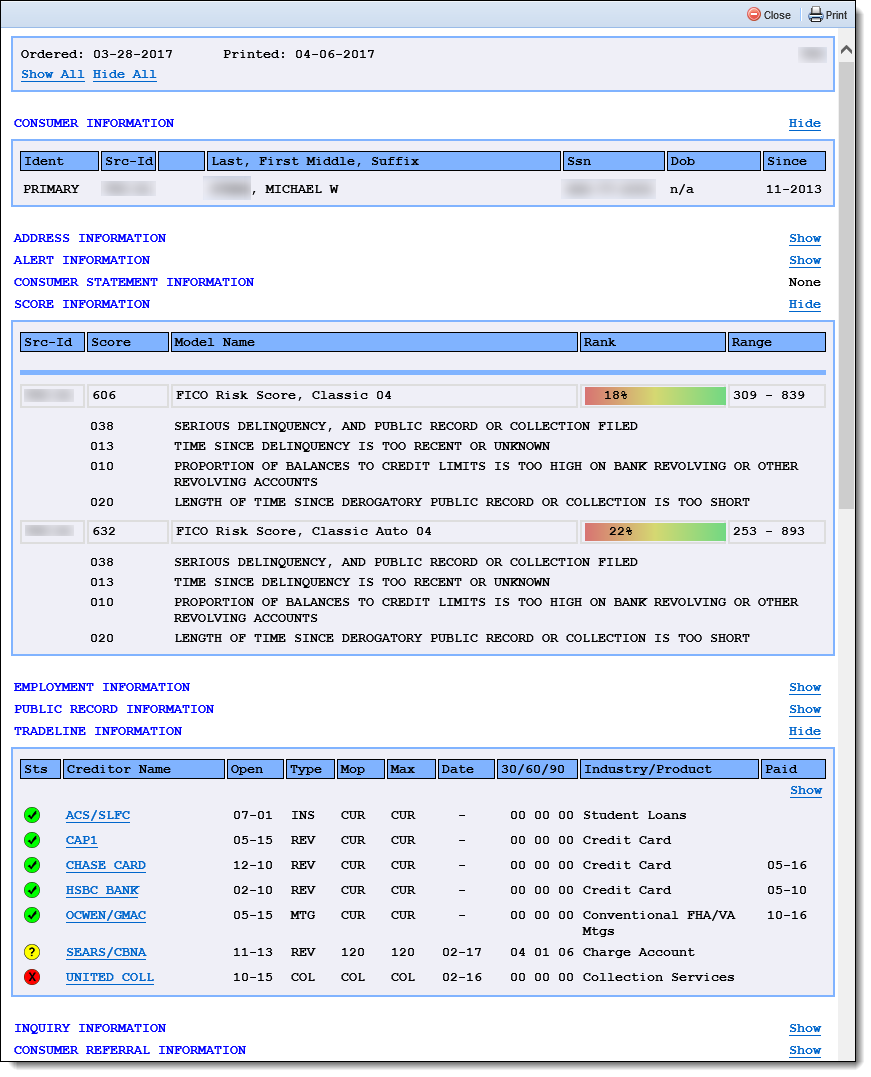

HTML Credit Report Formats

In addition to the LUXCOMMON credit report format available with the Credit ++ Toolkit, institutions can now display credit reports in a detailed and interactive HTML format using Luxor's CreditSharp tool.

|

In order to display credit reports in a HTML format, institutions must have both the Credit ++ Toolkit and CreditSharp installed at their institution. The file for CreditSharp is automatically installed during the upgrade to 16.05, or when the Credit ++ Toolkit is installed during a new implementation of the Lifecycle Management Suite. For more information on installing the Credit ++ Toolkit, please see the connector guide for the applicable credit bureau connector. |

The following 10 credit report formats are now available to assign as the credit report format to display when credit is pulled in the Lifecycle Management Suite:

|

The formats below are available to assign within the Credit Report Format parameter in the Underwriting tab of the Origination page in System Management (System Management > Modules > Origination). |

- HTML Common01 – Tradeline01

- HTML Common01 – Tradeline02

- HTML Common01 – Tradeline03

- HTML Common01 – Tradeline04

- HTML Common01 – Tradeline05

- HTML Lending01 – Tradeline01

- HTML Lending01 – Tradeline02

- HTML Lending01 – Tradeline03

- HTML Lending01 – Tradeline04

- HTML Lending01 – Tradeline05

Using one of the above HTML formats, institutions are provided with a more collaborative and organized credit report experience, including color-coded indicators for both credit score and major/minor derogatory indicators on tradelines, as well as an expandable/collapsible view of the data that appears in the report.

Below is an example of a credit report displayed in the HTML Common01 – Tradeline01:

|

For an overview and example of each HTML format, please see the HTML Credit Report Formats topic in the User Guide. |

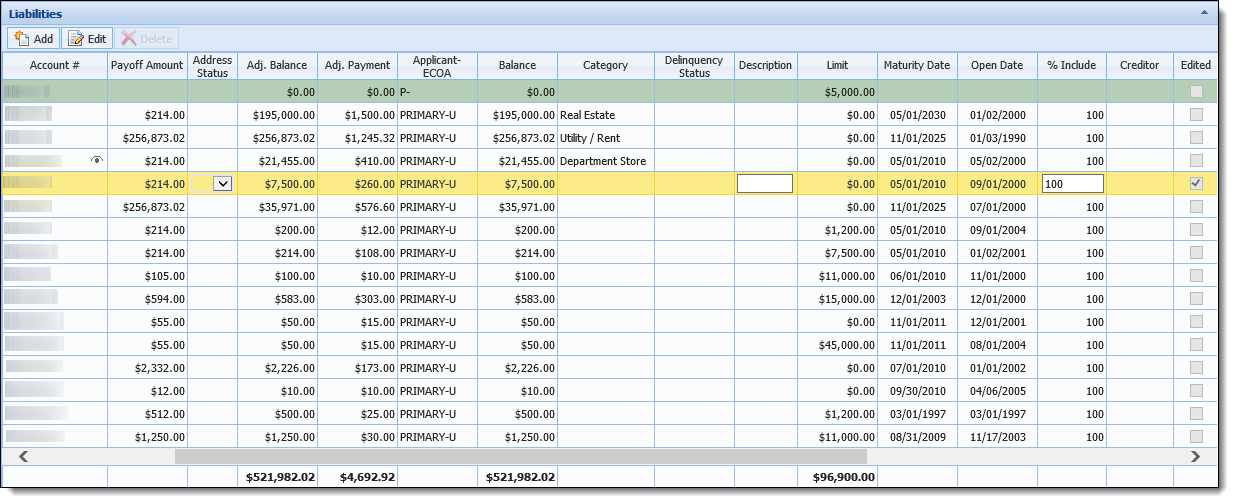

Inline Editing within the Liabilities Panel

The Liabilities panel has been enhanced to restrict the fields which are editable for liabilities that populate from a core or credit report. With this enhancement, users are no-longer able to edit fields such as Account Number, Type, Balance, and Payment Amount for liabilities populated by the core or a credit report directly within the Liabilities panel, in order to order to safeguard the liabilities from errant modifications.

In addition to restricting the editable fields within the Liabilities panel, users are now able to double-click on a liability within the Liabilities panel to open the Edit Liability screen. Prior to this enhancement, users were required to highlight the desired liability within the grid and click  in order to open the Edit Liability screen.

in order to open the Edit Liability screen.

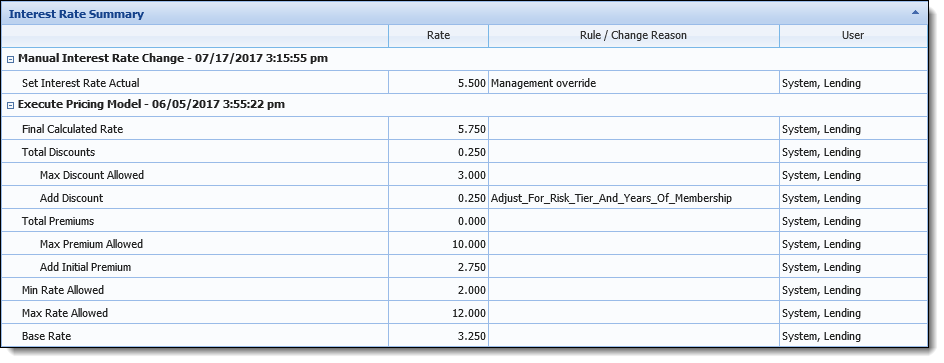

Interest Rate Summary Panel

The Lifecycle Management Suite has been enhanced with a new system-defined Application panel titled Interest Rate Summary that allows users to view all rate changes that have occurred on a loan application.

This panel contains a grid that captures changes which were manually processed by an end user, or automatically set by the Pricing Model.