The user experience in 15.02 is now more efficient, organized, and secure than ever before! The following enhancements have been made to the Lifecycle Management Suite to take the application experience in the Origination modules to the next level:

- Classification of review indicators to easily identify the decision to which they apply.

- Masking of credit card numbers to be in compliance with PCI regulations.

- New fields added to the Field List that capture additional information for the disbursement process, such as the product disbursed as well as the disbursed date for the overall application.

- Enhancements to cross-sells which include the ability to manually add non-loan cross-sells to applicationsthe creation of the Cross-sells panel.

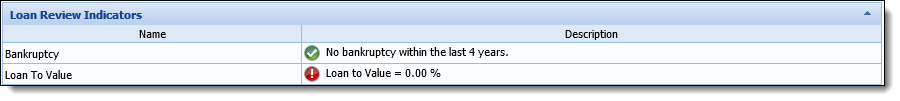

Classification of Review Indicators

Review indicators are now automatically classified as loan during the decision process to easily distinguish the decision to which they apply. Each time an application is decisioned, the review indicators assigned to the application type's decision models isare executed and a list of the indicators populates in the panel related to the type of decision rendered.

The existing Review Indicators panel has been renamed to Loan Review Indicators and now displays all of the review indicators related to an application's Loan decision.

|

Please see the Important Notes Regarding the Upgrade topic for information on how existing review indicators are classified during an upgrade to 15.02. |

Masking of Credit Card Numbers

Credit Card numbers are now more secure than ever!

PCI regulations require credit card numbers to be masked and not displayed in clear text on a screen in order to protect the credit card information that is displayed. To support this regulation, values displayed within the following Origination screens/panels are now masked up to the last four digits an  icon now appears to enable the ability to temporarily unmask the value of the credit card number by hovering over the icon. Navigating away from the icon once again masks the credit card number.

icon now appears to enable the ability to temporarily unmask the value of the credit card number by hovering over the icon. Navigating away from the icon once again masks the credit card number.

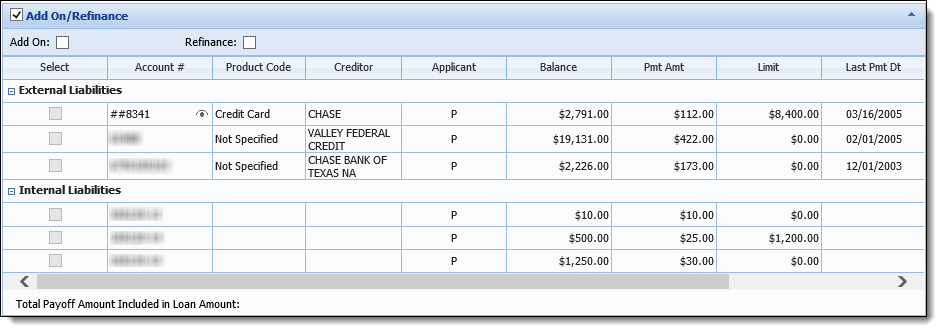

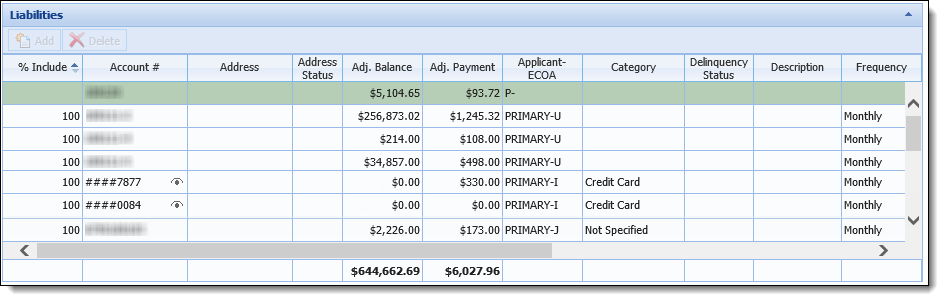

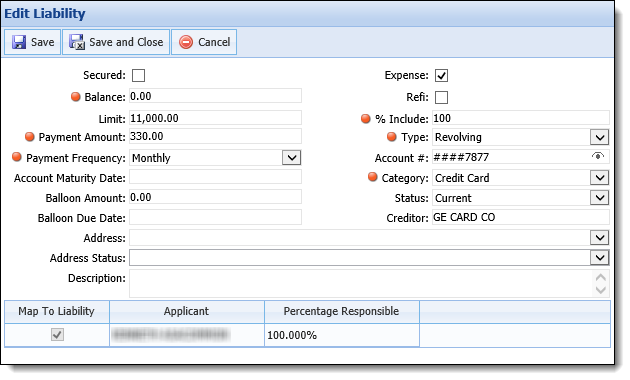

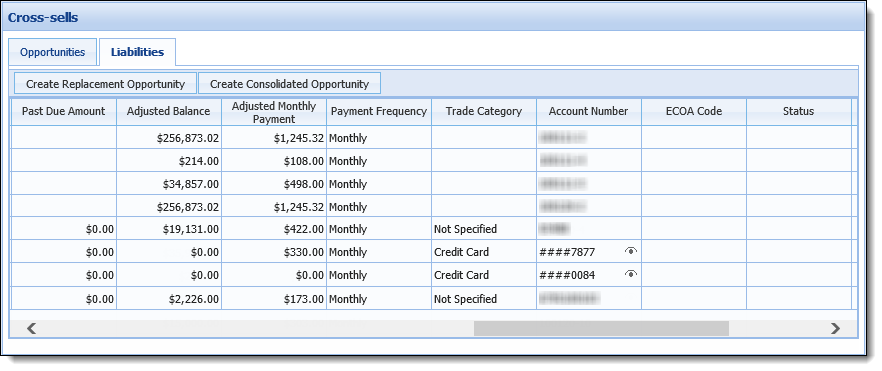

| Origination Screen/Panel | Masked Value |

| Add/On Refinance Panel |

Value for Account # when the Trade Category = Credit Card or Department Store

|

| Liabilities screen and Liabilities panel |

Value for Account # when the Trade Category = Credit Card or Department Store

|

| Edit Liabilities screen |

Value for Account # when the Trade Category = Credit Card or Department Store

|

| Liabilities tab in the Cross-sells screen |

Value for Account Number when the Trade Category = Credit Card or Department Store

|

Additionally, when the following two fields are configured to appear in an Application panel, or in the panel assigned to the Workspace Summary for an application type, the  icon is displayed and all but the last four digits of the number appear masked in the panel:

icon is displayed and all but the last four digits of the number appear masked in the panel:

- Application > Account Number

The Account Number field only displays a masked value when the following are true:

- Is Add On = True for the application

- Account Number is greater than 12 characters

- Application > Credit Card Number

Enhancements to the Disbursement Process

The Disbursement Process now automatically identifies that the loan and overall application have been disbursed as well as captures the disbursement date for the overall application.

To support this functionality, the following fields have been added to the Field List for screens, views, reports, and rules to identify that the loan was disbursed and the date that the application was disbursed:

- Is Loan Disbursed

- Application Disbursed Date

|

For a complete overview of the disbursement process, please see the Disburse topic in the User Guide. |

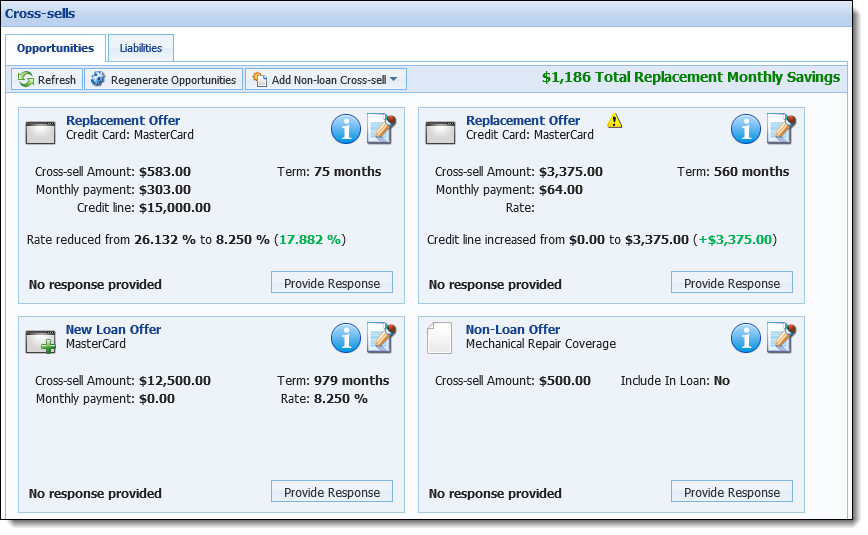

Cross-sell Enhancements

Manually Adding Non-Loan Cross-Sells

Lifecycle Management Suite users now have the ability to manually add non-loan cross-sells to applications!

Clicking  within the Cross-sell screen enables the ability to select which non-loan cross-sell to add to an application and displays the corresponding non-loan offer details and sales script. Within a few simple steps, non-loan cross-sells, such as GAP or MBD, can be added to an application after its initial creation.

within the Cross-sell screen enables the ability to select which non-loan cross-sell to add to an application and displays the corresponding non-loan offer details and sales script. Within a few simple steps, non-loan cross-sells, such as GAP or MBD, can be added to an application after its initial creation.

For more information on this exciting new functionality, please see the Cross-sells topic of the Lifecycle Management Suite User Guide.

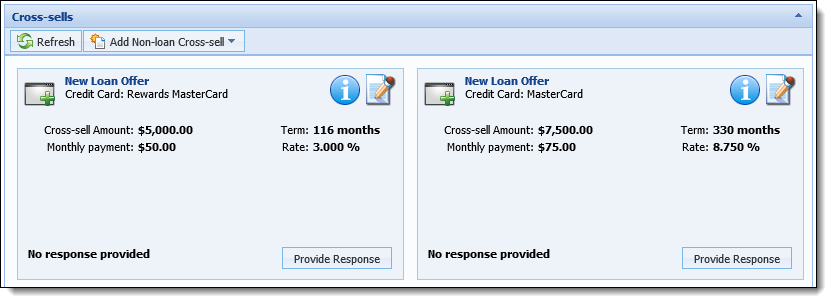

Cross-sell Panel

The Cross-sell panel is now available within the Lifecycle Management Suite!

When added to an application screen, such as Underwriting Review, the Cross-sell panel allows users to easily review existing cross-sells and add new non-loan cross-sells at any time during the application's lifecycle.

For more information on the Cross-sells panel, please see the Underwriting Review topic of the Lifecycle Management Suite User Guide.