This section provides a list of key functions that were removed or changed in the Framework. By reading this section, institutions are able to understand the functional changes made throughout the Framework for the 15.01 release:

Military Lending Act Support

To comply with the Military Lending Act, the Framework has been enhanced to support Military APR calculations and military status (MLA) searches.

Military APR Calculations

In order to be in compliance with the Military Lending Act, the Loan Origination solution has been enhanced to support calculations for Military APR (MAPR) in close-ended loans. Under this act, institutions are required to identify applicants that are considered a Military Covered Borrower and include a MAPR calculation for all of their non-credit card accounts. The MAPR calculation must include any credit insurance premiums and fees for debt cancellation or debt suspension agreements, as well fees for credit-related ancillary products, such as GAP and MBD.

|

This feature adds the ability to include the MAPR calculation for all closed-ended loans. The system cannot determine if a loan is subject to MAPR, therefore, it is the responsibility of the financial institution to determine if the applicant is a qualified Military Covered Borrower either through Credit Reporting or the Department of Defense Database. |

The following enhancements have been made to the Loan Origination solution in order to support the inclusion of fees and cross-sells in the MAPR calculation as well as capture and display MAPR information during the application process:

|

For a complete overview of the configurations required to capture and display MAPR information during the application process, please see the Military Lending Act Configurations How To document in the Administrator Guide. |

| Functional Area | Description | ||||||||

| Field List for screens, rules, reports and views |

The following Application fields are now available to be configured within rules, reports and views:

The fields listed below have also been added to the Field List for Origination screens to capture and display Military APR information during the application process:

|

||||||||

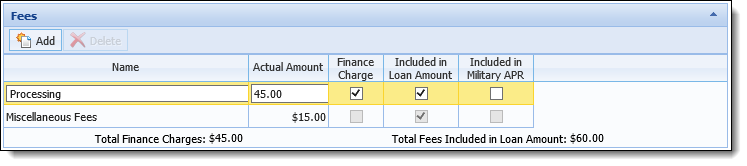

| Fees Panel |

A column for Included in Military APR has been added to the Fees panel in order to identify that a fee should be included in the Military APR calculation.

|

||||||||

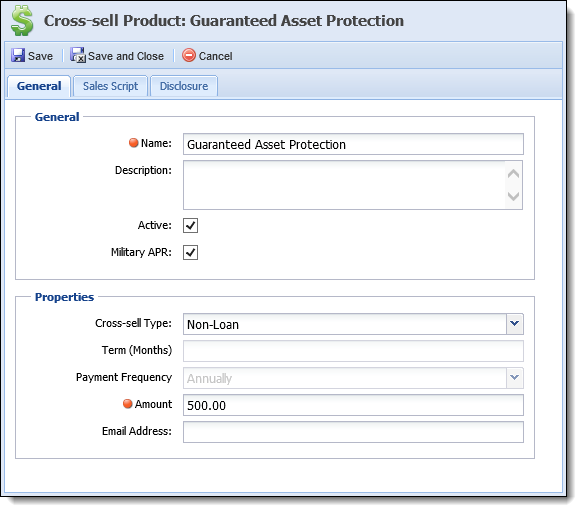

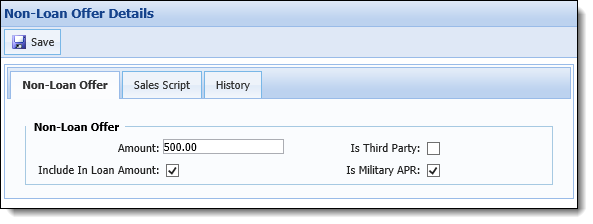

| Cross-sells |

The cross-sell logic for non-loan offers now provides the ability to include non-loan cross-sells in the MAPR calculation. To support this, the following enhancements have been made to the Cross-sell functionality:

|

||||||||

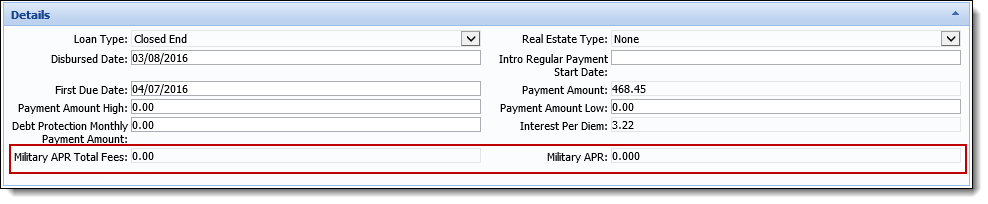

| Calculate Preview Screen |

The Military APR and Military APR Total Fees fields have been added to the Details panel on the Calculate Preview screen. These fields display the MAPR returned from the loan calculator as well as the total amount of fees (interest, fees, payment protection) included in the MAPR.

|

||||||||

| Rules |

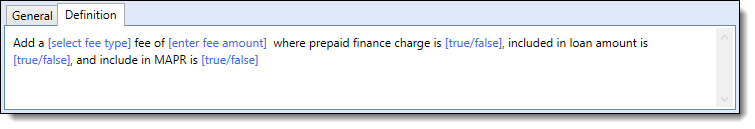

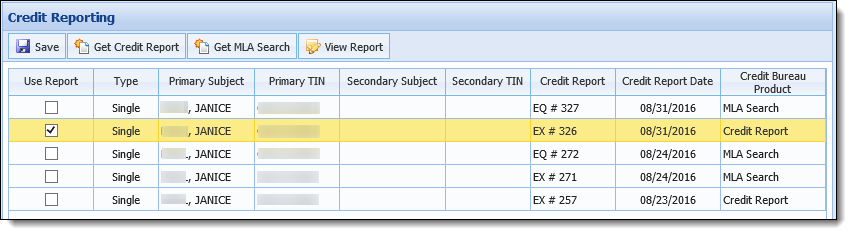

To support the ability to add fees to a loan application that are automatically included in the MAPR calculation, the following two rule templates have been added to Rules Management:

|

||||||||

| Loan Calculator |

The Loan Calculator logic now includes Military APR fees and finance charges in the loan calculations for close-ended loans.

After calculations are made in an application, the value for the Military APR and Military APR Total Fees fields are updated in the application.

|

Additionally, the total amount of cross-sells with the following properties are now incorporated into the Adjusted Loan Proceeds calculation:

- IsMilitaryAPR = False

- Include in Loan Amount = True

- Response = Yes or Yes Referred

MLA Searches

The Military Lending Act states that military status checks must be performed on all applicants to confirm active military or reserve status, or to confirm that the applicant is an immediate relative of an active duty account holder. An applicant's military status can be obtained by performing an MLA Search as part of a credit report or as a stand-alone status request. Rules can then be used to set the Military Covered Borrower field to indicate the applicant's military status.

The following enhancements have been made to the Loan Origination solution in order to support MLA searches as well as capture and display military status information during the application process:

|

For a complete overview of the configurations required to capture and display military status information during the application process, please see the Military Lending Act Configurations How To document in the Administrator Guide. |

| Functional Area | Description |

| Field List for Screens, Rules, Reports, and Views |

The following Application fields are now available to be configured within screens, rules, reports, and views:

The fields listed below have also been added to the field list but are only available for use in rules:

|

| System Management - Equifax, Experian, and TransUnion Connector Pages |

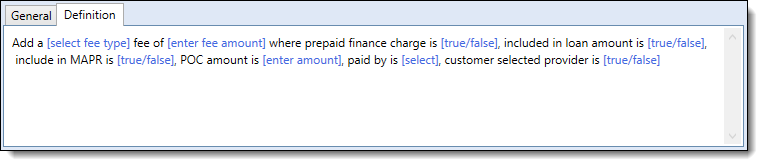

A Military Covered Borrower Check parameter has been added to the Equifax, Experian, and TransUnion connector pages to provide system administrators with the ability to incorporate military status searches in a way that fits the business processes of the financial institution. Options to include MLA searches in credit reports and options to perform stand-alone MLA searches are available.

|

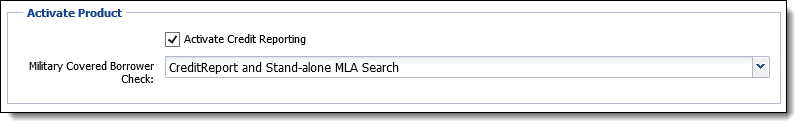

| Credit Reporting Screen |

The Credit Reporting screen has been enhanced to provide users with the ability to perform stand-alone MLA searches and view results of existing MLA searches. A Credit Bureau Product column has also been added to the grid within the Credit Reporting screen to indicate whether a credit report was pulled or an MLA search was performed for a record displayed on the screen.

|

| Event Processing | A Request MLA Search Only action has been added to Event Processing to provide system administrators with the ability to configure military status searches to automatically execute when a certain event is triggered. |

| Editability | Editability has been enhanced to provide system administrators with the ability to determine if the new Get MLA Search action is available to be performed Pre-Decision, Post-Decision, Post-Disbursement, or Post Withdraw. |

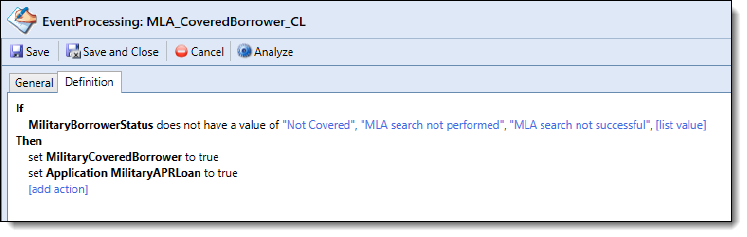

| Rules |

An Event Processing rule can be authored to automatically set the value of the Military Covered Borrower field based on information in the credit report.

|

Additionally, the following core and connector enhancements have been made to support MLA search functionality:

| Core/Connector | Enhancement | ||||

| IMM |

The following field has been added to the IMM interface:

|

||||

| Symitar - Origination |

The MILITARYAPRLOAN, ACTIVEDUTY, and ACTIVEDUTYVERIFICATIONDATE fields have been added to the Symitar interface and can be sent to Symitar using host values using the Set Application Host Value and Set Applicant Host Value rule templates.

|

||||

| TransUnion | The Credit Vision score model has been enhanced to include two additional fields for score information. |

Document Data Available in Event Processing, Rules Management and Web API

The Framework has been enhanced to persist document data to the database when an application is saved.

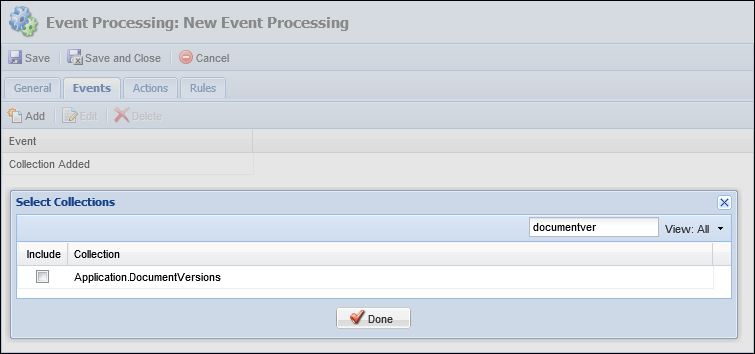

Document Set Version

Document Processing now records the Document Version number within the Application.DocumentVersion DTO collection.

Each time a document set generates, it's version number persists to the collection and may be used to configure Event Processing pairs. Using the Collection Added and Collection Removed event types, institutions are able to trigger an action, when a document set is created or deleted.

In addition to the availability in Event Processing, institutions may access document version collection within Rules Management.

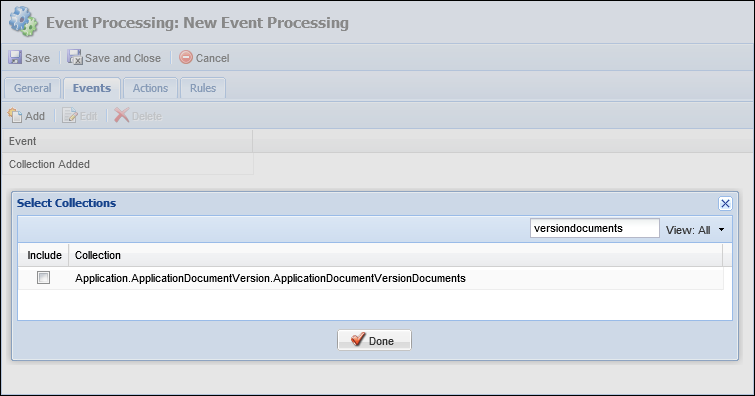

Document Data

Document Processing now records document data within the Application.ApplicationDocumentVersion.ApplicationDocumentVersionDocuments DTO collection.

Each time a document set generates, it's data persists to the collection and may be used to configure Event Processing pairs. Using the Collection Added and Collection Removed event types, institutions are able to trigger an action, when a document set is created or deleted.

In addition to the availability in Event Processing, institutions may access document version collection within Rules Management and the Web API.

Other Functional Changes

| Function | Action | Reason/Description |

| Max Generated Document Versions Solution Parameter | Removed | The “Max Generated Document Versions” parameter located on the Solution.Origination > Approval tab have been removed. The enhancement that made document data available in Event Processing, Rules Management and the Web API rendered this functionality unnecessary. |

| Cross-sell Functionality Available in Web API | Changed | The Framework's cross-sell functionality now creates child applications when the parent application is saved, if New Loan, Replacement or Consolidated opportunities were accepted. Through this enhancement, institutions are able to leverage the Framework's cross-sell functionality in API applications. |