On the Elements tab, select the System Management button on the toolbar. Under the Elements group on the menu, select Collection, then select Transaction codes from the Recovery Settings on the Configure tab. Access to this form is controlled by your Security Profile.

The Collection Element users eleven Internal Transaction Types. For every transaction type that you want to use, you will need to create one ore more Transaction Type Codes. You can create more than one Transaction Type Code for the same internal transaction type. For example, you might create various codes to indicate how funds were received for a payment (e.g. cash, certified funds, from account). Alternatively, you may want to indicate different codes for a category, such as New Cost, for each type of cost (e.g. legal fees, courier charges, etc.).

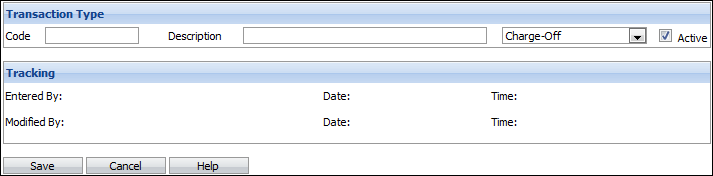

On this page you can create, edit or delete a Transaction Type Code.

Create a Transaction Type

- Click New.

Field Description Code Enter a unique code. Any alphanumeric string with a maximum of ten alphanumeric characters can be used. Description Enter a description of the Transaction Type code. Transaction Type dropdown Select the appropriate internal transaction type from the dropdown list. Active Leave the Active field checked. - Click Save.

Edit a Transaction Type

- Click the Transaction Type Code you want to edit.

- Change any of the values except the Transaction Type Code.

- Click Save.

Delete a Transaction Type

- Click the Delete checkbox(es) next to the Transaction Type Code(s) you want to delete.

- Click Delete.

Transaction Type Codes that are used in existing transactions will not be deleted - they will be made inactive. Inactive Transaction Type Codes cannot be selected for any new transactions.

From Transactions topic (deleted):

The Collection Element uses eleven internal transaction types.

| Internal Transaction Types | Description |

| Charge-off | This is the first transaction for a charged-off loan. This transaction transfers "ownership" of the loan from "host" to "local." This transaction sets all current loan balances (interest, principal and cost) based on the current loan information and sets the interest date (interest last charged to) to the transaction date. |

| Charge-off Reversal | For loans that were originally host-maintained, a charge-off reversal will reset the ownership to Host. All transactions back to, and including, the original charge-off will be reversed. The "interest date" is cleared. |

| Close | Interest is charged to the effective transaction date. All balances are reduced to zero and the status of the loan is changed to "Closed." |

| Cost Adjustment | Interest is not calculated. Adjusts the cost balance. A negative amount decreases the cost balance. A positive amount increases the cost balance. |

| Cost Payment | Interest is not calculated. Funds are applied to the cost balance only. |

| Interest Adjustment | Interest is not calculated. Adjusts the interest balance. A negative amount decreases the interest balance. A positive amount increases the interest balance. |

| Interest Payment | Interest is charged to the effective transaction date. The payment amount is applied to outstanding interest first, then to the principal balance. |

| New Cost | Interest is not calculated. Increases the cost balance. The transaction amount is always positive. |

| Principle Payment | Interest is charged to the effective transaction date. The payment amount is applied to the principal balance first then to outstanding interest. |

| Principle Adjustment | Interest is not calculated. Adjusts the principal balance. A negative amount decreases the principal balance. A positive amount increases the principal balance. |

| Reversal | Reverses the previous transaction. A reversal resets all the balances to the values they would have been had the transaction being reversed not occurred. Any interest charged by the original transaction will be reversed. |