| End-User Guide > Application Processing > Origination > Loan Terms |

During the application process, users are able to input the terms of the loan. These terms are used to determine the loan calculations and payback information. Users are also able to input information used by the institution such as loan tracking and HMDA information.

Depending on the configuration of screens and workflow models, this process can vary. Institutions may employ multiple application screens to capture loan terms for each loan sub-product. A screen that captures basic loan term information may be assigned to the Workflow, while a more thorough screen may be assigned to the Screens section.

The screen used to capture loan terms is a user-defined Application screen that enables users to collect loan term information. The following list encompasses the panels or logical field groupings that may be configured at an institution:

The fields that pertain to the above loan terms can be collected in various application panels. These panels can be assigned to one or across multiple user-defined screens. Refer to the Screens section of the Administrator Guide for more information on configuring loan terms screens and panels.

|

Based upon the loan terms screen’s configuration, actual screen content and names may vary. The images and processes listed below may not reflect your institution’s loan terms screen. Refer to the following processes for example purposes only. |

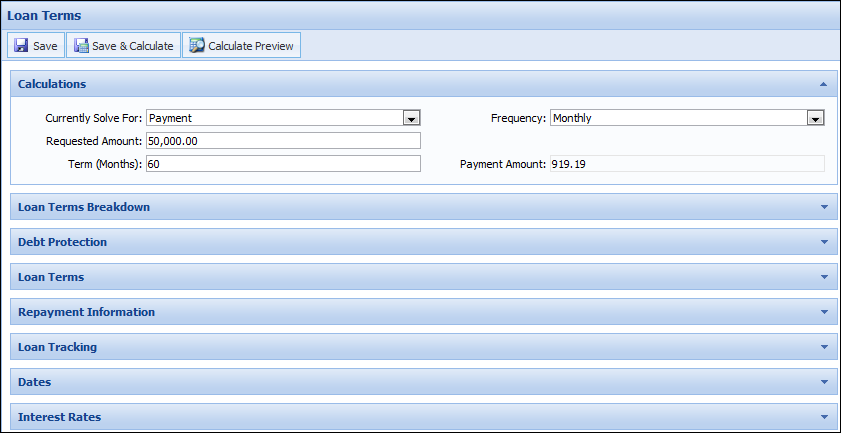

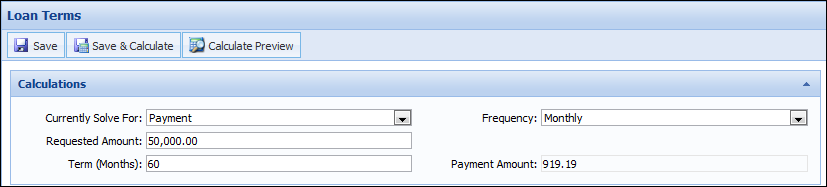

Depending on the configuration of the loan terms screen, a user-defined general calculations panel may be configured to capture the basic loan calculation information.

Basic loan term fields, such as Requested Amount, Term, Payment Frequency, and Payment Amount, allow users to input the applicant’s desired loan terms or build scenarios. To assist users in building loan term scenarios, the Solve For field is configurable to the loan term screen. If configured, the Solve For field enables users to input applicant’s desired loan terms and solve for the Payment, Term, and Requested Amount. This enables users to input known values and solve for desired customer terms.

Also included in basic calculations is the ability to indicate Loan Type and Payment Type. Other configurable loan term fields that may affect loan calculations are Doc Stamp Program, Doc Stamp Rate, and Doc Stamp Amount.

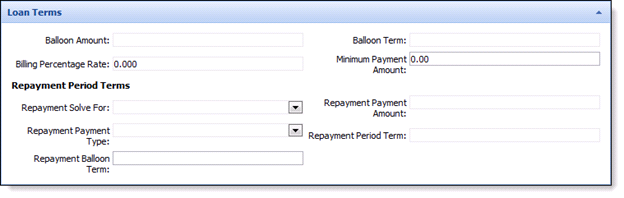

If the Sub-Product has a Payment Type of Balloon, the Balloon Amount, Balloon Term, Billing Percentage Rate, and Minimum Payment Amount fields require a value entered. These fields would need to be configured on the user-defined screen.

When performing Solve For calculations, Payment Types limit Solve For calculations in the following way:

| If Payment Type is: | Can Solve For: |

| Level Pay | Payment, Term, and Requested Amount |

| Interest Only | Payment |

| Principal and Interest | Payment and Term |

| Balloon |

If Open End Loan and Real Estate Type is Home Equity:

Else

Else

|

| Billing Percentage | Payment |

|

Based upon the Solve For selected, certain field are disabled based upon the selection. However, if the Calculate Amortization field is set to false, all fields become available for editing, regardless of the Solve For that was selected. |

When performing Repayment Solve For calculations, Repayment Payment Types limit Solve For calculations in the following way:

| If Repayment Type is: | Can Solve For: |

| Level Pay | Payment |

| Interest Only | Payment |

| Principal & Interest | Payment and Term |

| Balloon | Balloon Amount and Payment & Balloon Amount |

Additionally, the Loan Terms/Application screen is able to be configured with buttons such as:

If configured to the application screen, the Save & Calculate button enables users to update the calculated values within the screen it is assigned to. The Save & Calculate button allows users to quote and re-quote loan figures to applicants without leaving the application workspace. In addition to calculating screen values, clicking the Save & Calculate button performs a save and refreshes the screen.

|

During the Save & Calculate process, the associated refresh causes all minimized panels to expand. |

When the Save & Calculate button is clicked, numerous fields may be set by the calculator; however, not all fields are set each time the calculation is executed. Some fields are only set based upon the attributes of the loan application (IsIntroRate, IsHELOC, and so on).

|

The Save & Calculate label is editable, so the title of the button may vary from institution to institution. |

The following is a list of fields that may be input into or set by the calculator:

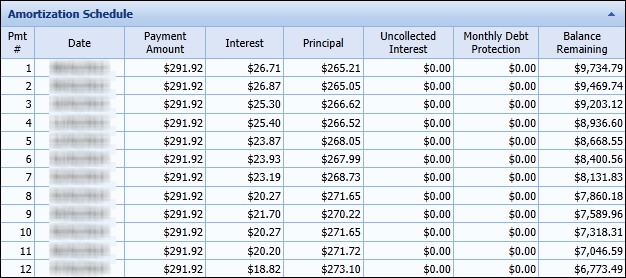

In addition to the aforementioned fields, Aggregates and Ratios as well as the Loan Terms Breakdown and Debt Protection panels update when the application is calculated.

|

When a close-ended loan is calculated, fields such as Amount, Pre-Paid Finance Charge, and Is Military APR are set based on the calculated values of the fees, finance charges, and/or non-loan cross-sell products on the application. Reference the section below for more information on the calculations for close-ended loans:

The table below provides an overview of the Amount to Other calculator fields that are set in an application for a close-ended loan:

Once the above calculations are performed, the value for the Military APR and Military APR Total Fees fields are also updated in the application.

|

When performing calculations, the Lifecycle Management Suite validates the term of the loan entered against the payment frequency. If the term entered for the loan application compared to the payment frequency is not a whole number, the module rounds the term and displays a warning message to the output that the Term was changed. For example, a loan officer enters the Term as 14 and Payment Frequency as annual. With a Payment Frequency of annual, the term should be a full year, which means that the term must be 12, 24, 36 and so on.

|

Failure to assign a Risk Tier may result in a validation error that prevents users from processing a successful calculation. If this error is encountered verify that Risk Rules, Tiers, and Models have been configured properly.

|

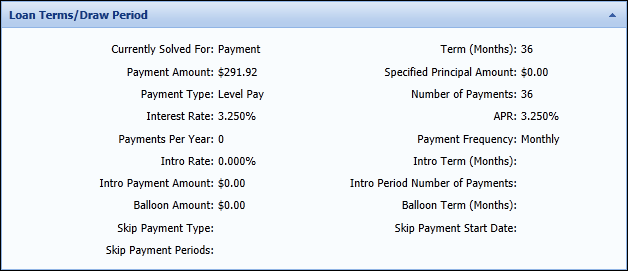

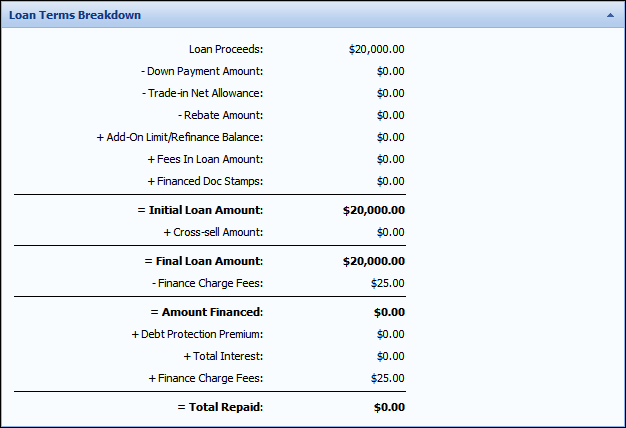

The Calculate Preview button enables users to view the Loan Terms Breakdown, Loan Terms/Draw Period, Details, Repayment Period, Debt Protection Summary, and Amortization Schedule based on the current loan term values.

|

The Calculate Preview label is editable, so the title of the button may vary from institution to institution. |

The Calculate Preview screen contains a toolbar that allows users to perform the following functions:

| Icon | Description | ||

|

Closes the Calculate Preview screen. | ||

|

Allows a user to select the result displayed in the Calculate Preview screen for the loan terms.

|

||

|

Allows a user to print the Calculate Preview to a local or network printer. |

The Loan Terms/Draw Period panel displays a summary of the Loan Terms with information such as Solve For information and APR.

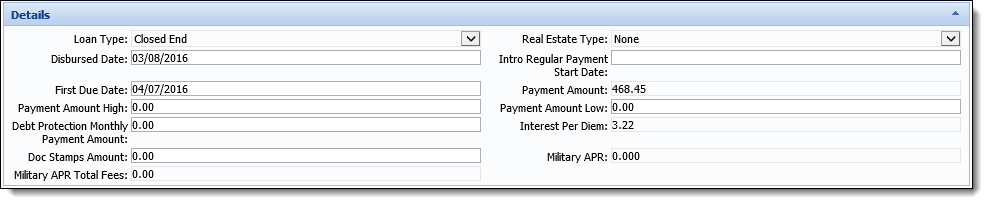

The Details panel displays a summary of loan details, such as Loan Type, Payment Amounts, Dates, and Debt Protection.

|

This panel also displays the Military APR (MAPR) and the total amount of fees included in the MAPR for a close-ended loan. |

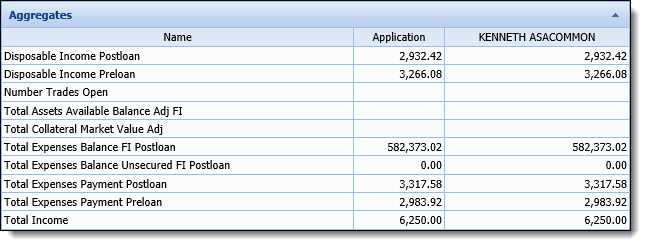

The Aggregates panel displays the calculated aggregate amounts for the application and each applicant.

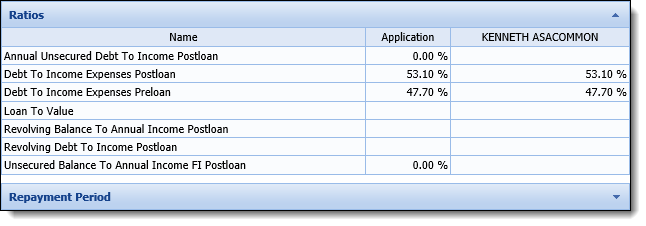

The Ratios panel displays calculated ratio amounts for the application and each applicant.

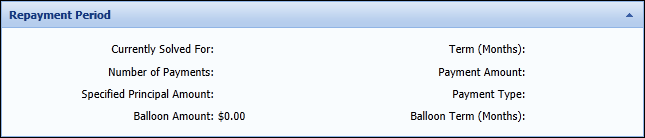

The Repayment Period panel displays a summary of the repayment details, such as Number of Payments, Term, Payment Amount, and Balloon information.

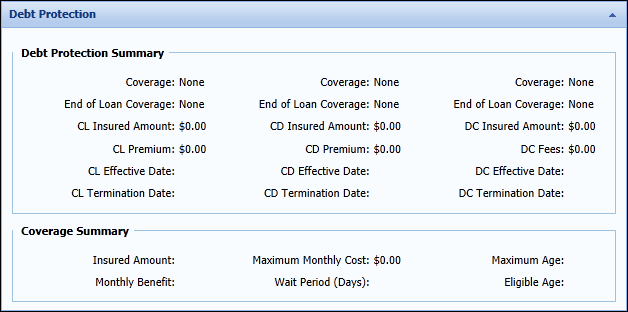

The Debt Protection panel displays a Debt Protection and Coverage summary.

The Amortization Schedule displays an amortization schedule within a grid based upon the loan terms entered. This table displays information such as Payment Number, Payment Date, and Remaining Balance.

|

If the Calculate Amortization field is set to false, an amortization schedule does not generate and the following message appears.

|

|

In some situations, institutions may need to disable all or certain calculations from the application process. For more information on this these processes, see the Calculation Overrides topic. |

Depending on the configuration of the application screen, users may be able to view the loan term breakdown within the application workspace. This panel displays the calculations and values that factor into the loan amounts.

Loan Terms Breakdown is a read-only panel that displays an itemized breakdown of the Total Repaid loan amount that includes the following values:

|

Module Field |

Associated CUDL Field |

Associated DealerTrack Field |

Associated RouteOne Field |

Operator |

Description |

||

| Loan Proceeds | Sales Price | Cash Price | Cash Selling Price |

N/A |

The beginning loan amount, prior to any deductions or additions. | ||

| Down Payment Amount | Cash Down | Cash Down | Cash Down |

- |

The amount that the loan applicant provided towards the purchase price of the item being financed via the loan. | ||

| Trade-in Net Allowance | Trade Allowance | Net difference between: Trade Allowance and Trade Owed |

Net Trade |

- |

This amount represents the amount that the loan applicant received for trading in a vehicle, less any remaining balance owed on the vehicle. | ||

| Rebate Amount | Rebate | Rebate | Rebate |

- |

This amount represents the total incentive provided by the vendors towards the purchase. |

||

| Add-On Limit/Refinance Balance | Not Mapped | Not Mapped | Not Mapped |

+ |

In the case of a refinanced loan, this amount represents the amount of the existing loan that is being refinanced and bundled into the new loan being created. In the case of an Add-On Limit, this amount represents the existing credit limit of the liability selected for increase. | ||

| Fees In Loan Amount | • Credit Disability • GAP • Credit Life • Service Contract • Theft Deterrent • Additional Items • Sales Tax • Environmental Package |

• Taxes • Doc Fees • Title License Reg Fees • GAP • Service Contract • Credit Life • Disability • Other |

• Sales Tax • T&L Estimate • Front-end Fees • Accident/Health Ins • Credit Life Ins • GAP • Warranty • Back-end Fees |

+ |

Fees in Loan Amount represents any costs to the loan applicant that are being included in the financing of the loan and are not being indicated as a finance charge.

|

||

| Doc Stamps | Not Mapped | Not Mapped | Not Mapped |

+ |

In the state of Florida, there is a tax associated with the transfer of real estate or the execution of documents, such as loan notes. This tax can be financed in a loan, if the applicant chooses.

|

||

| Initial Loan Amount | Amount Requested | Financed Amount | Estimated Amount Financed |

= |

This amount represents the initial loan amount, after all down payments, rebates and trade in amounts have been deducted and all fees, taxes, and refinance amounts have been added. | ||

| Cross-sell Amount | Not Mapped | Not Mapped | Not Mapped |

+ |

The total amount of any additional non-loan products that were presented to and accepted by the loan applicant on the Cross-Sells screen. Examples are GAP or MBD Protection.

|

||

| Adjusted Loan Proceeds | Not Mapped | Not Mapped | Not Mapped |

= |

This amount represents the loan amount after all down payments, rebates and total trade-in new allowances have been deducted and all cross-sells with the following properties have been added:

|

||

| Final Loan Amount | Amount Requested | Financed Amount | Estimated Amount Financed |

= |

This amount represents the initial loan amount, along with any cross sell amounts and debt protection premiums. It is the actual amount of the loan that is being borrowed by the loan applicant. | ||

| Finance Charge Fees | Not Mapped | Not Mapped | Not Mapped |

- |

This amount represents any prepaid finance charge fees. | ||

| Amount Financed | Amount Requested | Financed Amount | Estimated Amount Financed |

= |

This number represents the total amount financed by the loan applicant. This amount is the total amount that interest is calculated and charged on. | ||

| Debt Protection Premium | Not Mapped | Not Mapped | Not Mapped |

+ |

This number represents the cost to the loan applicant for insurance that ensures that payments are made for a specific period of time against the loan in the case that an unforeseen circumstance occurs to the applicant and they are unable to make the payments. | ||

| Total Interest | Not Mapped (calculated by module) | Not Mapped (calculated by module) | Not Mapped (calculated by module) |

+ |

This number represents the cost to the loan applicant for insurance that ensures that payments are made for a specific period of time against the loan in the case that an unforeseen circumstance occurs to the applicant and they are unable to make the payments. | ||

| Finance Charge Fees | Not Mapped | Not Mapped | Not Mapped |

+ |

This amount represents any prepaid finance charge fees. | ||

| Total Repaid | Not Mapped (calculated by module) | Not Mapped (calculated by module) | Not Mapped (calculated by module) |

= |

The Total Interest represents the total cost of the loan. |

As changes are made to the loan application, the corresponding values are updated by clicking Calculate or Save & Calculate.

|

The fields that correspond with Loan Terms Breakdown values may be added to a user-defined panel. This enables users to edit indirect loan term values, post decision. |

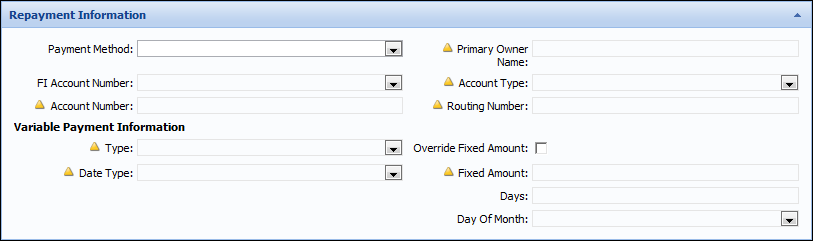

Depending on the configuration of the application screen, users may be able to collect repayment information while processing loan terms.

Collecting repayment information allows users to record Payment Methods and the corresponding fields such as Account Number, Account Type, Routing Number, and Primary Owner Name. If ACH or Automatic Transfer is selected, the Loan Origination module configures these selections in the core.

|

ACH fields are disabled or enabled based on the Payment Method selected for the application. |

|

Skip Payment fields may appear on this screen; however, Skip Payment functionality is not available for all Cores. If these fields are completed, but the functionality is not available for the institution, an error message is received at time of disbursement. |

Additionally, Variable Payment information may be collected. These fields allow users to work with applicants and establish payment preferences for Variable payment loan products.

The variable payment fields have additional editability checks beyond a field editability check. In addition to editability, the following validations occur:

| Field Name | Editability Check |

| Variable Payment Date Type | Can only be edited if the Payment Method is ACH or Auto Transfer. |

| Variable Payment Days | Can only be edited if Variable Payment Date Type is Past Cycle or Prior Due Date. |

| Variable Payment Type | Can only be edited if the Payment Method is ACH or Auto Transfer. |

| Variable Payment Day of Month | Can only be set if Variable Payment Date Type is specific day. |

| Is Override Fixed Amount | Can only be set if Variable Payment Type is Fixed Amount. |

| Variable Payment Fixed Amount | Can only be set if Is Override Fixed Amount is set to true. |

When inputting repayment information, the Loan Origination module is hard-coded with the following field validations that are required for disbursement:

| Payment Method | Validation Check |

| Auto Transfer or ACH | FI Account Number is required. |

| ACH | ACH Routing Number is required. |

| ACH | ACH Account Number is required. |

| ACH | ACH Primary Owner Name is required. |

| ACH | ACH Account Type ID is required. |

| Auto Transfer or ACH | Variable Payment Date Type Id is required. |

| Auto Transfer or ACH and Variable Payment Type Id is FIXED_AMT | Variable Payment Fixed Amount is required. |

| If Payment Method is Auto Transfer or ACH and Variable Payment Type Id is FIXED_AMT | Variable Payment Fixed Amount must be >= Payment Amount. |

| If Payment Method is Auto Transfer or ACH and Variable Payment Type Id is DAYS_PAST_CYCLE or DAYS_PRIOR_DUE_DATE | Variable Payment Days is required. |

| If Payment Method is Auto Transfer or ACH and Variable Payment Type Id is SPECIFIC_DAY | Variable Payment Day Of Month is required. |

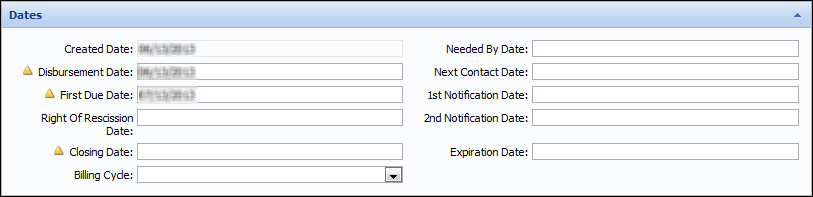

Depending on the configuration of the application screen, users may be able to collect dates associated with the loan application while processing loan terms.

|

The default values for Disbursement Date and First Due Date can be set in Loan Product Definitions for each Sub-Product; however, the field entries may be overridden as editability rights permit.

Other dates such as First Notification Date, Second Notification Date, and Expiration Date can be set via rules. |

Collecting dates allows users to indicate important loan dates such as Disbursed Date, First Due Date, Right of Rescission Date, Closing Date, and Billing Cycle.

Dates such as First Notification Date, Second Notification Date, and Expiration Date are used by the Automatic Withdraw process, which allow the Loan Origination module to withdraw applications which have not been Disbursed or Withdrawn. These fields indicate the dates when the module sends warning emails to the applicants and automatically withdraws applications. For more information on Automatic Withdraw, refer to the Automatic Withdraw topic.

|

If the Disbursement Date is updated, but the First Due Date field is not located on the screen, the First Due Date calculation does not occur. The First Due Date needs to be manually updated. |

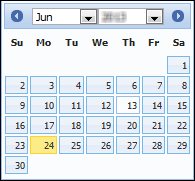

When inputting dates, users are able to click anywhere in the field to prompt a calendar. Use the calendar to select the desired date. Once a date is selected, the calendar closes and the date populates in the field.

In addition to selecting the date from the calendar, users are able to input dates by entering the shortcuts such as:

| Details | Format | Examples |

| Plus or Minus Days Plus Beginning of Month | +/- D + BOM |

+5D+BOM

-7D+BOM |

|

Plus or Minus Months Plus Beginning of Month |

+/-M + BOM |

+1M+BOM

-2M+BOM |

| Plus or Minus Years Plus Beginning of Month | +/-Y + BOM |

+1Y+BOM

-2Y+BOM |

| Details | Format | Examples |

| Plus or Minus Days Plus End of Month | +/- D + EOM |

+5D+EOM

-7D+EOM |

| Plus or Minus Months Plus End of Month | +/-M + EOM |

+1M+EOM

-2M+EOM |

| Plus or Minus Years Plus End of Month | +/-Y + EOM |

+1Y+EOM

-2Y+EOM |

When inputting dates, the Loan Origination module is hard-coded with the following field validations that are required for disbursement:

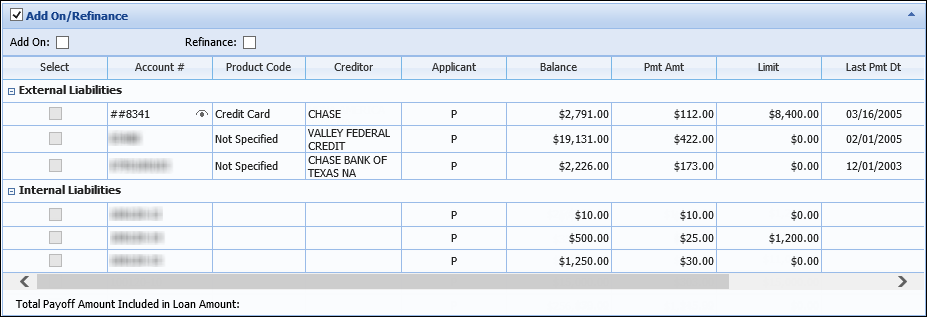

While entering an application's loan terms, users may be able to determine if the application is an Add-On or Refinance loan.

|

The Add-On/Refinance panel and the Liabilities panel contain the same data. If the screen that contains the Add-On/Refinance panel also contains the Liabilities panel, data updated on the most-recent panel added to the screen by a system administrator is saved and overwrites the data updated on the other panel. |

Within the Add-On/Refinance panel, users are presented with a grid of liabilities that are eligible to be added onto or refinanced.

| Loan Type | Description | ||||

| Add-On |

Allows the limit of an existing core liability to be increased. Add-on loans update the existing liability and do not create a new loan record.

|

||||

| Refinance |

Creates a new core liability to pay off an existing liability.

|

The Add-On/Refinance panel displays the liability data within the following columns:

| Column/Field | Description | ||

| Account # |

Indicates a liability's account number.

|

||

| Product Code | Indicates the category of an external liability. | ||

| Creditor |

Indicates the creditor holding an external liability. |

||

| Applicant | Indicates which applicant is the owner of the liability according to the Equal Credit Opportunity Act code indicated on the credit report. | ||

| Balance | Indicates a liability's remaining balance. | ||

| Payment | Indicates a liability's payment amount. | ||

| Limit | Indicates the limit of a liability if open-ended. | ||

| Last Payment Date | Indicates the date the last payment was processed. | ||

| Maturity Date | Indicates the maturity date of a closed-end liability. | ||

| Payoff Amount | Indicates a liability's payoff amount. |

The liabilities that populate within the Add-On/Refinance panel's rows are sorted into two collapsible headings:

To process an add-on or refinance application:

|

Selecting the desired liability updates the Total Payoff Amount Included in the Loan Amount field with the corresponding liability value. |

|

Only one liability may be selected for an Add-On application; however, multiple internal and external liabilities may be selected for refinance applications. |

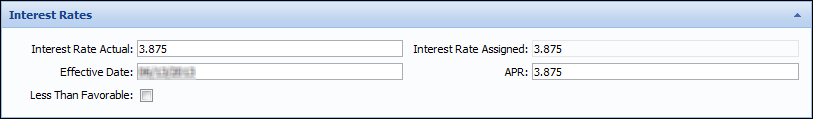

Depending on the configuration of the application screen, users may be able to view rate information, such as the calculated Interest Rate and APR while processing loan terms.

Interest rate fields are populated by Pricing, which runs during the Calculate and Decision processes.

|

Interest Rates are calculated by Risk Models, Pricing Models, and configurations made in Loan Product Definitions for each Sub-Product; however, the field entries may be overridden if granted by editability and permission. Additionally, Rules may be written to apply discounts. |

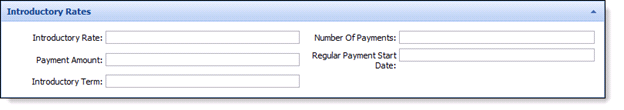

Depending on the configuration of the application screen, users may be able to view or input introductory rate information associated with the loan application while processing loan terms.

|

The default values for Introductory Rates can be set in Loan Product Definitions for each Sub-Product; however, the field entries may be overridden as editability rights permit. |

Introductory rate information allows users to indicate important discounted rate information such as Introductory Rate, Number of Payments for introductory term, Payment Amount during introductory term, Regular Payment Start Date, and Introductory Term.

Depending on the configuration of the application screen, users may be able to view or input variable rate information associated with the loan application while processing loan terms.

|

The default values for Variable Rates can be set in Loan Product Definitions for each Sub-Product; however, the field entries may be overridden as editability rights permit. |

Introductory rate information allows users to indicate important rate change information such as First Rate Change Date, Maximum Increase/Decrease for Loan, Maximum Rate Increase/Decrease per Change, Rate Change Frequency, Rate Margin, and Maximum Payment Amount.

|

Maximum Payment Amount is determined by adding the max rate increase for loan to the current actual interest rate and calculating a payment amount based on the loan terms. The exception to this statement is Billing Percentage, which is used for Open End loans and requires a billing percentage rate and minimum payment amount entered on the loan sub-product. Each payment is the outstanding balance multiplied by a percent or the minimum payment. |

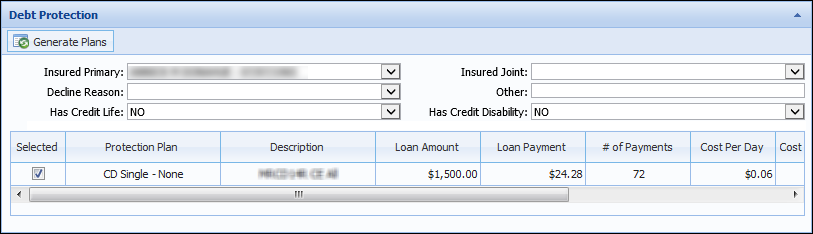

The Debt Protection panel enables users to quote debt protection coverage while processing loan terms.

The Debt Protection panel contains the following fields, which are conditionally required:

| Field | Description | ||

| Insured Primary | Indicates the individual who is primary on the debt protection plan. Use the drop down list to select the primary applicant, in order to generate debt protection plans. | ||

| Insured Joint | Indicates the individual who is joint on the debt protection plan. Use the drop down list to select the joint applicant who is to be added to debt protection plans. | ||

| Decline Reason | Use the drop down list to select the decline reason if debt protection is being declined. | ||

| Other | If "other" is selected as a decline reason, users must enter the reason debt protection is declined | ||

| Has Credit Life |

If an application is an Add-On, users must indicate if the existing liability has Credit Life protection.

|

||

| Has Credit Disability |

If an application is an Add-On, users must indicate if the existing liability has Credit Disability protection.

|

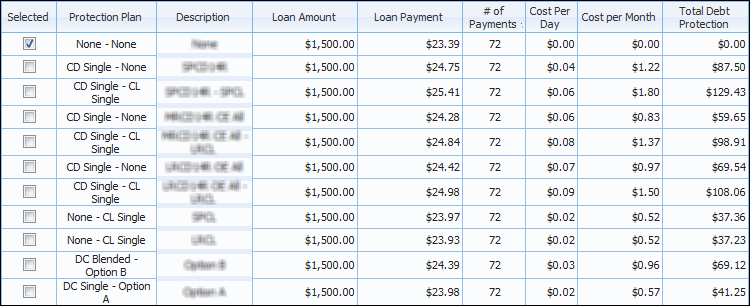

Beneath the aforementioned fields, the protection plan response grid displays a row for each protection plan generated.

|

If an applicant exceeds the age limit for a protection plan, it is not returned to the Protection Plans grid. If an applicant exceeds the age limit for all plans, the Protection Plans grid only displays a "None" option. |

|

The typical age limits are 66 for Credit Disability and 70 for Credit Life plans. For more information on plan age limits, consult your institution's CUNA representative. |

The associated plan costs populate within the columns. If any pertinent plan-related information exists, the Messages column populates with an information icon. Click the icon to display the plan messages. The Message that is displayed is informational and only applies when solving for term or when solving using a billing percentage loan.

|

Regulation Z prohibits debt protection fees and credit insurance premiums from being financed if the application is closed-ended and secured by a dwelling, or open-ended and secured by a principal dwelling. A system defined rule titled CalculateDebtProtectionFinancedFlag always sets the Is Debt Protection Financed field to true during the calculate process, to indicate that the payment protection premium is included in the loan payment. A second system defined rule, titled Set_ChargeInterestOnPremiumFlag, then sets the IsChargeInterestOnPremium flag according to the loan type. The debt protection premium appears above the Final Loan Amount of the Loan Terms Breakdown. |

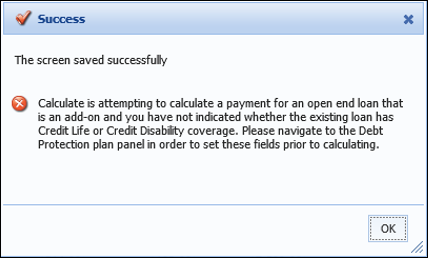

When generating debt protection quotes, the debt protection panel is initially empty.

|

Failure to select a value results in the following calculation error while saving: |

|

If any data changes on the application that impacts the Debt Protection Plans and their associated costs, such as Loan Term or Applicant Date of Birth, clicking the Generate Plans button updates the plans appropriately. |

|

If the Calculate Amortization field is set to false, debt protection plans are not presented to users and the following message appears.

|

If the applicant does not desire debt protection coverage:

If an applicant desires to change their debt protection selection:

If the Fees panel is configured to appear on the Application screen, users may be able to add and remove associated fees while processing loan terms.

|

For more information, please see the Fees Panel topic in this guide. |

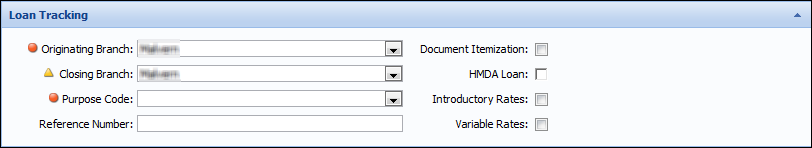

Depending on the configuration of the application screen, users may be able to collect loan tracking information while processing loan terms.

Collecting loan tracking information allows users to record information for tracking purposes in the corresponding fields such as Originating Branch, Closing Branch, and Purpose Code.

|

When inputting loan tracking information, the Loan Origination module is hard-coded to require a Closing Branch for disbursement. |

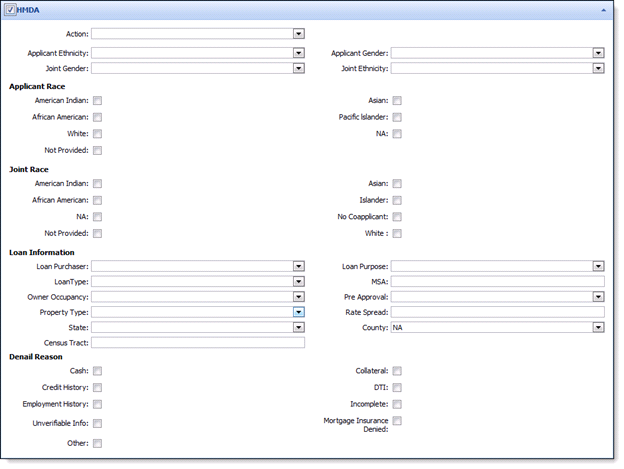

Depending on the configuration of the application screen, users may be able to collect information for Home Mortgages Disclosure Act (HMDA) compliance while processing loan terms.

Collecting loan tracking information allows users to record information for HMDA tracking purposes in the corresponding fields such as Applicant/Joint Ethnicity, Applicant/Joint Gender, Applicant/Joint Race, Loan Purpose, Loan Type, and Denial Reason.

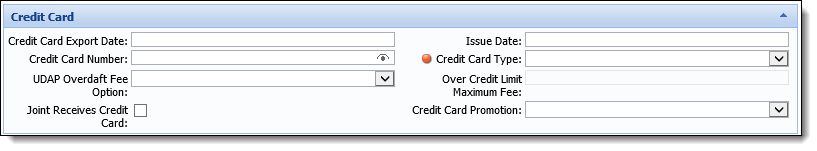

Depending on the configuration of the application screen, users may be able to collect credit card information while processing loan terms.

Credit card information able to be captured includes: Credit Card Number, Issue Date, Type, Overdraft Fee Option, Over Credit Limit Option, and Promotion Type.

When inputting credit card information, certain fields such as Credit Card Number, Export Date, and Issue Date are populated by the credit card processor.

|

To be in compliance with the PCI regulations that require credit card numbers to be masked and not displayed in clear text on a screen, all but the last four digits of the credit card number are masked once a user clicks outside of the Credit Card Number field. While this functionality cannot be disabled, the

|

There are several important fields that are required for credit card applications, such as Credit Card Type and Card Design Type. Click the Credit Card Type field and choose the desired credit card type from the drop-down. Click the Card Design Type field and choose the desired credit card design from the drop-down.

Field values such as UDAP Overdraft Fee, Over Credit Maximum Fee, and Credit Card Promotion Type may also be required. If required, use the corresponding field drop down lists to select the appropriate values.

|

The default values for these fields may be assigned to the selected credit card sub-product; however, users can manually select these values if default values exist. |

By default, only the primary applicant receives a credit card. If joint applicants exist on the application, select the Joint Receives Credit Card check box to indicate that the joint applicants are to receive cards.