| End-User Guide > Recovery Process > Repayment Plans > Repayment Plan Scheduled Payments |

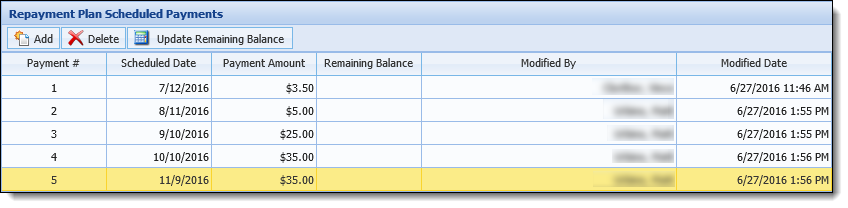

The Repayment Plan Scheduled Payments panel displays the amortization and calculated payment schedule for a traditional repayment plan. This panel also allows users to manually generate the payment schedule for a non-traditional repayment plan. Additionally, users are able to view scheduled payments associated with a repayment plan.

|

In order for this panel to display within the workspace, it must be included in the Repayment Plan Screen configured in System Management > Modules > Recovery. |

|

A traditional repayment plan is created using the Recovery module's calculate repayment functionality. Upon clicking A non-traditional repayment plan is manually created by adding payments to the Repayment Plan Scheduled Payments panel. These types of plans allow recovery agents to set up irregular payments that do not follow a traditional amortization schedule.

|

This topic includes an overview of the panel, as well as instructions for editing, adding, recalculating, and deleting the scheduled payments for a repayment plan.

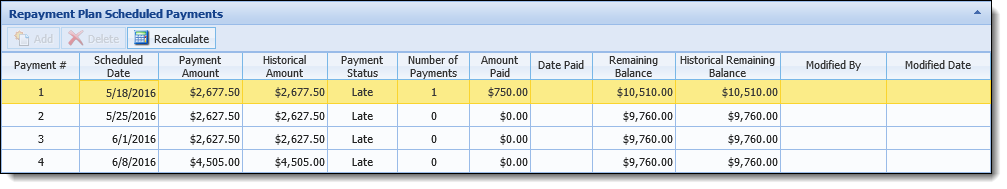

The Repayment Plan Scheduled Payments panel consists of a grid that displays all scheduled payments associated with a repayment plan and a series of action buttons that allow users to manage scheduled payments.

|

The content and functionality available within the Repayment Plan Scheduled Payments panel depends on a repayment plan's status.

Additionally, the availability of certain action buttons is determined by repayment plan status. For more information on the available buttons, see the Action Buttons section within this topic. For more information on the available columns, see the Repayment Plan Scheduled Payments Grid section within this topic. |

At the top of the Repayment Plan Scheduled Payments panel, the following buttons are available:

| Button | Description | ||||

|

Click this button to add a new scheduled payment (row) beneath the highlighted row. If a payment is not selected, a row is added to the bottom of the grid.

|

||||

|

Click this button to delete a scheduled payment (highlighted row).

|

||||

|

Click this button to initiate the process that calculates the remaining balance on each payment for the repayment plan.

|

||||

|

Click this button to allow users with the Modify Active Repayment Plan Payments permission to recalculate a repayment plan's interest, payments, and balances based on plan modifications.

Upon clicking this button, the Recalculate Repayment Plan pop-up window opens. For more information on the recalculation process, please see the Recalculate Repayment Plan section within this topic. |

The grid within the Repayment Plan Scheduled Payments panel displays the following columns of information for each payment :

| Column | Description | ||||||||||||||||

| Payment # |

Displays the order in which a scheduled payment is to be repaid. The values displayed in this column automatically generate when a payment is added. |

||||||||||||||||

| Scheduled Date |

Provides the ability to view and edit the date that a payment is scheduled. Upon adding a payment, the scheduled date defaults to:

To edit the scheduled date, click within the cell and manually enter the date or select the desired date from the calendar tool.

When entering dates, the following shortcuts are available to users:

The following validation occurs when a date is entered to ensure the scheduled date is valid:

|

||||||||||||||||

| Payment Amount |

Provides the ability to view and edit the payment amount. Upon adding a payment, this value defaults to the previous payment amount.

The following validations occur when entering a scheduled payment amount:

|

||||||||||||||||

| Historical Amount |

Displays the scheduled amount that existed when the repayment plan was created. This field allows the user to identify the original amount the repayment plan was created with.

|

||||||||||||||||

| Payment Status |

Identifies whether a scheduled payment is Scheduled, Paid, Paid Late, or Late.

|

||||||||||||||||

| Number of Payments |

Displays the number of payment type transactions for a scheduled payment. This value is calculated based on the number of payment transactions associated with the payment.

|

||||||||||||||||

| Amount Paid |

Displays the sum of all payment transactions paid to fulfill the scheduled payment.

|

||||||||||||||||

| Date Paid |

Displays the date that the payment was satisfied in full. If multiple payments were made to reach the full payment amount, this field displays the date when the entire payment was paid in full.

|

||||||||||||||||

| Remaining Balance | Displays a running total of the payment plan's balance, after interest has been accrued and the scheduled payment has been applied. | ||||||||||||||||

| Historical Remaining Balance |

Displays the remaining balance that existed when the repayment plan was created. This field allows users to understand ther remaining balance the repayment plan was created with. It also allows users to identify how the repayment plan was affected by the timing of the transactions.

|

||||||||||||||||

| Modified By |

Displays the name of the user who last edited the scheduled payment.

|

||||||||||||||||

| Modified Date |

Displays the date and time when the scheduled payment was last edited.

|

|

The  button is disabled within the Repayment Plan Scheduled Payments panel when the payment plan is active. button is disabled within the Repayment Plan Scheduled Payments panel when the payment plan is active. |

To manually schedule a payment for a repayment plan:

.

. |

Prior to a repayment plan being activated, users are able to navigate to different cells within the grid by using the up and down arrows. Additionally when entering dates, the following shortcuts are available to users:

|

|

If an invalid date has been entered, the date displays in red font. |

to schedule additional payments.

to schedule additional payments. to update the remaining balance for each payment based on the date and payment amounts.

to update the remaining balance for each payment based on the date and payment amounts. |

If  is clicked, the non-traditional payment plan entered by the user is removed and replaced with the schedule created from the calculation process. is clicked, the non-traditional payment plan entered by the user is removed and replaced with the schedule created from the calculation process. |

to retain the scheduled payments.

to retain the scheduled payments. to initiate the terms of the repayment plan.

to initiate the terms of the repayment plan. |

Users are unable to edit scheduled payments for active payment plans. |

To edit a payment:

to update the remaining balance for each payment based on the date and payment amounts.

to update the remaining balance for each payment based on the date and payment amounts. to retain the scheduled payments.

to retain the scheduled payments.Users with the Modify Active Repayment Plan Payments permission are able to recalculate a repayment plan's interest, payments, and balances based on plan modifications.

|

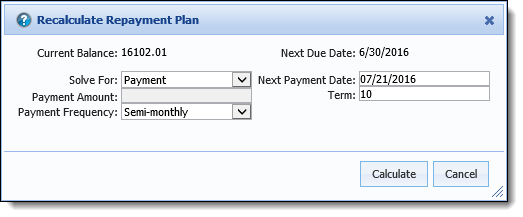

Recalculating payment plans allow institutions to ensure the interest is properly calculated based on the payment amount and timing.

|

To recalculate a repayment plan, click  . The Recalculate Repayment Plan pop-up window opens.

. The Recalculate Repayment Plan pop-up window opens.

Within this window, the following fields are available:

| Field | Description | ||||||||||||

| Current Balance |

Displays the repayment plan's outstanding balance.

|

||||||||||||

| Solve For |

Select an option from the drop-down list to indicate whether the calculator solves for the repayment plan's Payment or Term.

|

||||||||||||

| Payment Amount |

Enter the amount the debtor is to pay at each scheduled payment.

|

||||||||||||

| Payment Frequency |

Select one of the following options from the drop-down list to indicate how often the debtor must make payments towards the repayment plan.

|

||||||||||||

| Next Due Date |

Displays the date when a repayment plan's next payment is due.

|

||||||||||||

| Next Payment Date |

If a debtor is unable to pay the next scheduled payment on the next due date, but wants to keep the repayment plan, this field allows users to modify the repayment plan's payment schedule. Within this field, enter the modified next due date for the repayment plan payment.

|

||||||||||||

| Term |

Enter the number of payments for a repayment plan based on the Payment Frequency Type.

|

Once the desired fields are changed, click  . The Recalculate Repayment Plan pop-up window closes and the following occurs:

. The Recalculate Repayment Plan pop-up window closes and the following occurs:

The existing paid payments remain on the original repayment plan.

The Audit - Account screen reflects any changes made to repayment plan fields as a result of recalculations.

Click  to close the Recalculate Repayment Plan pop-up window without recalculating the repayment plan.

to close the Recalculate Repayment Plan pop-up window without recalculating the repayment plan.

|

The  button is disabled when a repayment plans has been activated. button is disabled when a repayment plans has been activated. |

To remove a scheduled payment from a repayment plan in an Initialized status:

.

. to update the remaining balance for each payment based on the date and payment amounts.

to update the remaining balance for each payment based on the date and payment amounts. to retain the scheduled payments.

to retain the scheduled payments.