| End-User Guide > Application Processing > Underwriting > Decision Processing > Counteroffer |

If an application has undesirable loan terms or if a decision cannot be reached using the current terms, a user with appropriate permissions is able to create one or more counteroffers that contain alternative loan terms that are more desirable to the institution.

Counteroffers provide an interface for loan officers with security permissions to add, edit, or delete one or more counteroffers that can be reviewed and selected by the borrower. The processing can then proceed automatically, if indicated, without resubmitting to the decision engine. Counteroffers also allow support of expirations and reminders of counteroffers using email.

Counteroffers may also generate automatically using Event Processing rules. Counteroffers generated by rules may be automatically approved or flagged for underwriter review. At the conclusion of automated counteroffer processing, users are alerted to the successful and failed processing with General Notifications. Each counteroffer generated may contain comments and stipulations which are also assigned automatically by rules. From the counteroffers panel, users may view all manual and automatic counteroffers.

|

If the Automatic Decline Process for Counteroffered Applications is enabled by a system administrator, applications including counteroffers that have not been accepted are automatically declined after a specified amount of days. For more information on this process, please see the Counteroffer Configurations topic in the Administrator Guide. |

The Counteroffer topic includes an overview of the following counteroffer information:

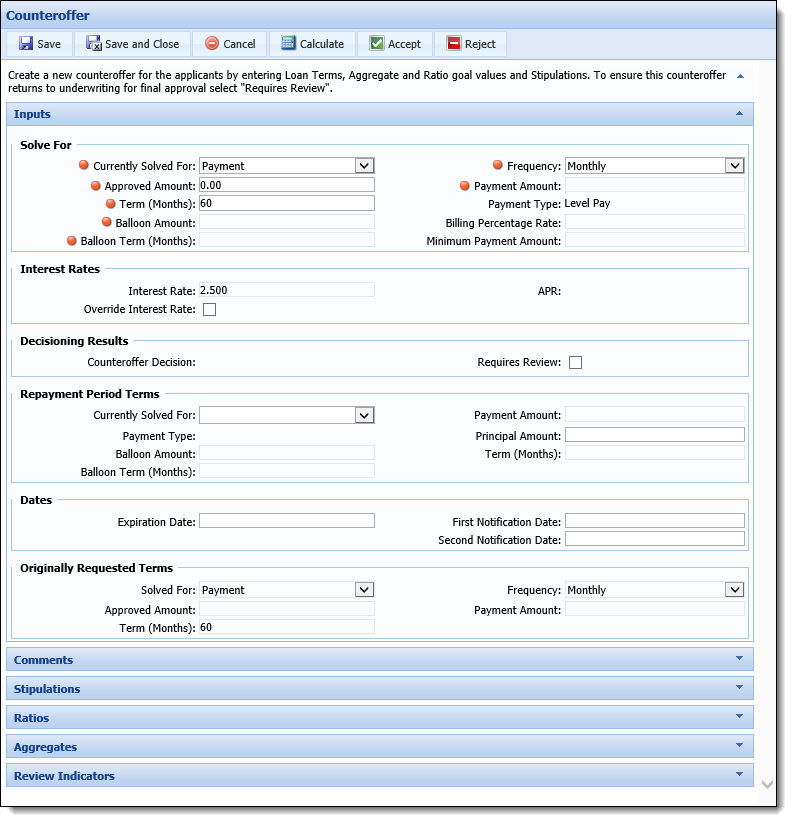

The Counteroffer screen consists of a toolbar and a series of panels, which contain the counteroffer's details.

At the top of the Counteroffer screen, a toolbar allows users to perform the following actions:

| Icon | Description | ||

|

Allows a user to save the Counteroffer to the application without closing the Counteroffer screen. | ||

|

Allows a user to save the Counteroffer to the application and close the Counteroffer screen. | ||

|

Allows a user to exit the Counteroffer screen without saving a Counteroffer. | ||

|

Allows a user to perform calculations, run pricing and amortization on the provided Counteroffer terms. | ||

|

Allows a user to accept a counteroffer and assign the terms to the loan application. Clicking Accept also performs a Save.

|

||

|

Allows a user to reject a counteroffer. |

|

Counteroffers may be issued for applications originated by third party connectors. Once a counteroffer is created and saved, the countered terms transmit to the originating party. |

A counteroffers consist of the following details, which are broken into separate panels:

The input panel is broken into six sections, which contain the countered terms:

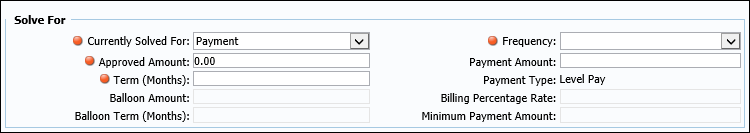

The Solve For section allows a user to enter the Counteroffer’s loan calculations and interest rate information.

|

Certain fields in this section are enabled/disabled based upon the value selected for the Currently Solved For field. |

The Solve For section contains the following fields:

| Field Name | Description | ||

| Currently Solved For |

Use the drop-down list to select the value the calculator is to “solve for.”

|

||

| Frequency |

Use the drop-down list to select the payment frequency.

|

||

| Requested Amount |

Enter the amount of the loan.

|

||

| Payment Amount |

Enter the Payment Amount.

|

||

| Term |

Enter the Loan Term.

|

||

| Payment Type |

Displays payment type selected within the application. |

||

| Balloon Amount | Enter the remaining balance at the end of the Balloon Term. | ||

| Billing Percentage Rate | Enter the percentage of the loan balance that is used to calculate the payment amount. | ||

| Balloon Term (Months) | Enter the number of months that must pass before the Balloon Amount comes due. | ||

| Minimum Payment Amount |

Enter the minimum payment amount that the borrower must pay, regardless of the payment amount calculated by Billing Percentage Rate. |

When performing Solve For calculations, Payment Types limit Solve For calculations in the following way:

| If Payment Type is: | Can Solve For: |

| Level Pay | Payment, Term and Requested Amount |

| Interest Only | Payment |

| Principal and Interest | Payment and Term |

| Balloon |

If Open End Loan and Real Estate Type is Home Equity, or if Real Estate Type is None and Convert to Closed End is Yes:

Else

Else

|

| Billing Percentage | Payment |

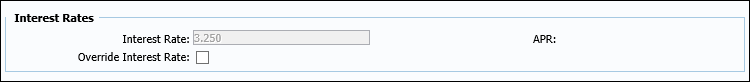

The Interest Rates section provides users the ability to view and edit the interest rate.

The Interest Rates section contains the following fields:

| Field Name | Description | ||

| Interest Rate |

Enter the Interest Rate assigned to the Counteroffer.

|

||

| APR | Displays the calculated APR. | ||

| Override Interest Rate |

Select the Override Interest Rate check box to edit the Interest Rate field.

|

||

| Requires Review |

Select the Requires Review check box to submit the countered loan terms to underwriting for final loan approval.

|

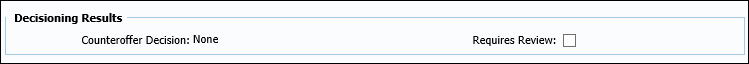

The Decisioning Results section allows users to view the counteroffer's decision and indicate if it requires underwriting review.

The Decisioning Results section contains the following fields

| Field Name | Description | ||

| Counteroffer Decision | Displays the counteroffers current decision. | ||

| Requires Review |

Select the Requires Review check box to submit the countered loan terms to underwriting for final loan approval.

|

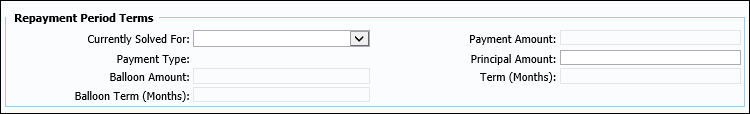

The Repayment Period Terms section allows users to view the counteroffer's repayment terms.

When performing Repayment Solve For calculations, Repayment Payment Types limit Solve For calculations in the following way:

| If Repayment Type is: | Can Solve For: |

| Level Pay | Payment |

| Interest Only | Payment |

| Principal & Interest | Payment and Term |

| Balloon | Balloon Amount and Payment & Balloon Amount |

| Billing Percentage | None (empty drop-down) |

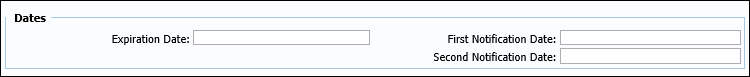

The Dates section allows users to define dates which trigger applicant notifications or automatically withdraw abandoned countered applications.

The Dates section contains the following field:

| Field Name | Description |

| Expiration Date | The date in which the Counteroffer expires. |

| First Notification Date | The date when the first notification is sent. |

| SecondExpiration Date | The date when the second notification is sent. |

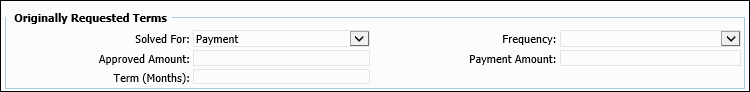

This section allows users to view the application's original terms.

The Comments panel enables users to enter an informative comment that supports the issuance of a Counteroffer, as well as modify existing comments for the Counteroffer.

|

The maximum number of characters for a Counteroffer Comment is 250. |

When a comment is added, it populates within the Comments grid, along with the username of the user who added the comment, an indicator to identify if comment is internal, the date the comment was submitted, and the comment classification.

|

If a counteroffer is deleted, any comments associated with the counteroffer are removed from the Comment History. |

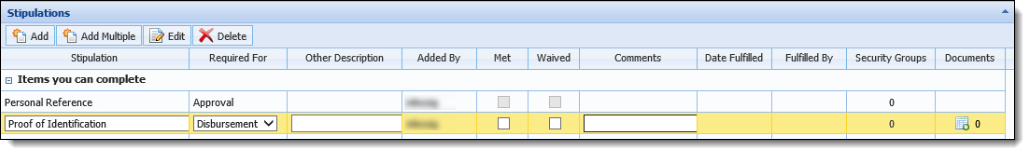

The Stipulations panel enables users to enter new stipulations that must be met prior to approval or disbursement. Any stipulation currently on the existing application automatically copies to all counteroffers created.

|

Stipulations on an accepted counteroffer automatically migrate to the application. The original stipulations on the application are removed and the stipulations on the counteroffer become the official stipulations on the countered application. |

|

If a rule-driven stipulation is deleted in a counteroffer, it returns to the application as only user-defined stipulations can be deleted. Rule-driven stipulations can only be Met or Waived. |

For more information on Stipulations, please refer to the Stipulations topic under Decision Processing.

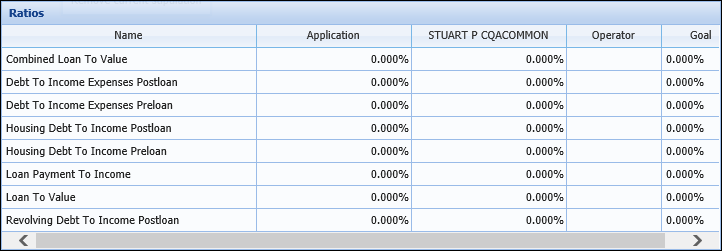

The Ratios panel displays the ratios for each applicant within a Grid. When a Counteroffer is added and calculated, the ratios update based on the results of the Counteroffer calculations.

The Ratios for both the Application and Applicant appear on the Counteroffer screen. This provides the underwriter the ability to set a goal value and calculate loan terms until the goal ratios have been attained.

|

When a counteroffer is calculated, saved, or accepted, Ratios update. Once an application is accepted, the counteroffer's Ratios populate on the application. The original values on the application are saved to the database. Users are able to access these values within Origination reports. |

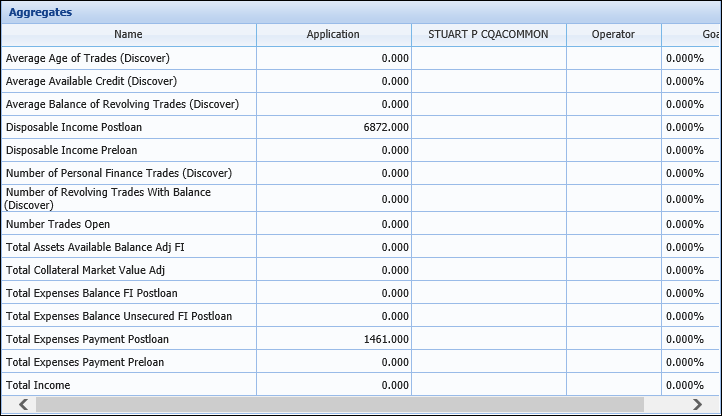

The Aggregates panel displays the aggregates for each applicant within a Grid. When a Counteroffer is added and calculated, the aggregates update based on the results of the Counteroffer calculations.

The Aggregates for both the Application and Applicant appear on the Counteroffer screen. This provides underwriters the ability to set a goal value and calculate loan terms until the goal aggregates have been attained.

|

When a counteroffer is calculated, saved, or accepted, Aggregates update. Once an application is accepted, the counteroffer's Aggregates populate on the application. The original values on the application are saved to the database. Users are able to access these values within Origination reports. |

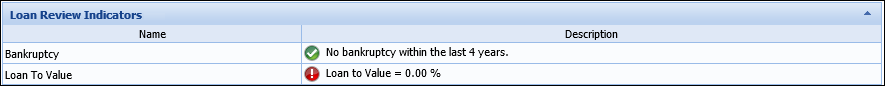

The Loan Review Indicators panel displays various indicators to highlight the status of particular decision criteria and allow institutions to review any indicators that do not align with their lending guidelines prior to rendering a decision.

|

Only review indicators that apply to a Loan decision are displayed within the Counteroffers screen. |

Within the Loan Review Indicators panel, all of the review indicators related to an application's Loan decision are displayed in alpha-numeric order by name.

|

When a counteroffer is calculated, saved, or accepted, review indicators are updated. Once an application is accepted, the counteroffer's review indicators populate on the application. The original values on the application are saved to the database. Users are able to access these values within Origination reports. |

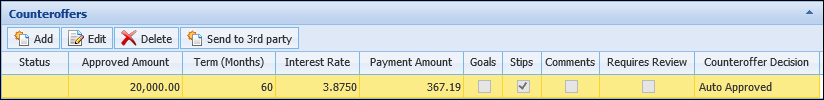

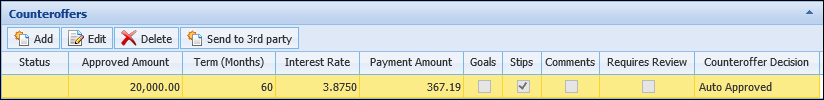

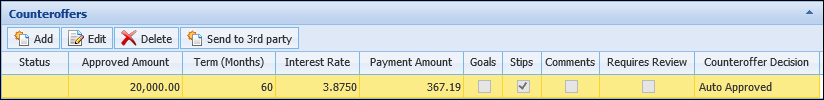

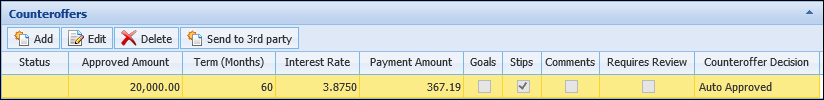

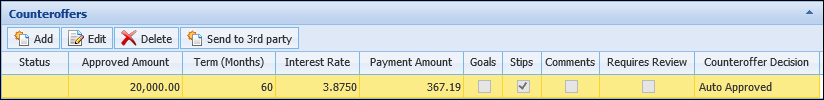

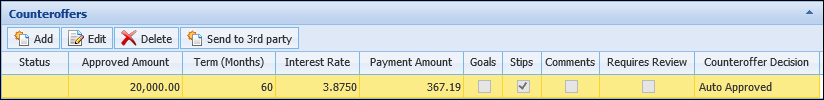

The Counteroffer panel enables users to create one or more counteroffers that contain alternative loan terms that are more desirable to the institution.

This panel contains a toolbar that allows users to perform the following functions:

| Icon | Title | Description | ||||||

|

|

Add |

Allows a user to create a counteroffer to the application. When counteroffer is added to the application. |

||||||

|

|

Edit |

Allows a user to edit a counteroffer currently on the application.

|

||||||

|

|

Delete |

Allows a user to remove a counteroffer from the application. When a counteroffer is deleted, a row is removed from the counteroffer grid.

|

||||||

|

|

Send to Third Party |

Allows a user to send the selected counteroffer to the indirect connector that submitted the application.

|

Each counteroffer populates as a separate row within a grid containing the following columns:

| Column Name | Description |

| Status |

Indicates whether the counteroffer was accepted or rejected. |

| Approved Amount | Indicates the countered loan amount. |

| Term | Indicates the countered loan term (months). |

| Interest Rate | Indicates the countered interest rate. |

| Payment | Indicates the countered payment amount. |

| Goals | A check box that indicates if the counteroffer has goal aggregates and/or ratios. |

| Stipulations | A check box that indicates if the counteroffer has stipulations. |

| Comments | A check box that indicates if the counteroffer has comments. |

| Requires Review | A check box that indicates if the counteroffer requires underwriting review. |

| Counteroffer Decision | Indicates the counteroffer decision. |

|

The Counteroffer panel may be assigned to any user-defined application screen. It may also be assigned to its own exclusive screen. |

Counteroffer actions include the ability to create, edit, or delete counteroffers. Users are also able to review and accept counteroffers.

Counteroffers may be issued in the following methods:

Click the Add button, the Counteroffer screen opens within the workspace.

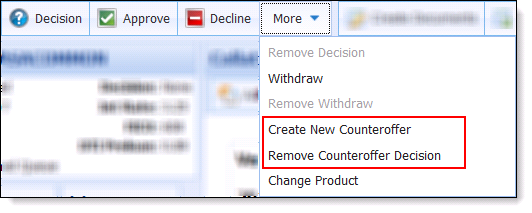

From the last screen assigned to a workflow's Underwriting stage, users with the appropriate permissions are able to create counteroffers

Select Create New Counteroffer to issue a loan counteroffer. The Counteroffer screen opens within the workspace.

Within the Application Toolbar, users with appropriate permissions are able to create counteroffers.

To create a counteroffer, select the More drop down from the Application Toolbar to populate the additional decision processing drop down. Select Create New Counteroffer to issue a loan counteroffer. The Counteroffer screen opens within the workspace.

|

If at least one counteroffer is created on an application, the Is Countered field is set to True. This field is available within queues, views, reports, application screens and rules. |

Based on configurations made in System Management, the Loan Origination module may automatically process counteroffers. At the conclusion of automated counteroffer processing, users are alerted to the successful processing with a General Notification stating the following: "Counteroffer processing completed and generated <insert number> counteroffers."

|

If automatic counteroffer processing fails due to an error, the following notification displays: "Counteroffer processing encountered an error. Please contact a System Administrator." |

|

A system administrator can configure rules to set a default decline reason on automatic counteroffers. |

Counteroffers generated by rules may be automatically approved or flagged for underwriter review. Users are able to view each counteroffer from the counteroffers panel.

Editing counteroffers provides users the opportunity to revisit a counteroffer that has been previously added to the application. When users choose to edit a counteroffer, they are able to update the terms included in the counteroffer. Additionally, users are able to approve a counteroffer and assign its loan terms to the application.

|

Existing counteroffers are only editable from the Counteroffer panel grid. |

Deleting counteroffers provides users the opportunity to remove a counteroffer that has been previously added to the application.

|

Existing counteroffers can only be deleted from the Counteroffer panel grid. |

Existing counteroffers can only be viewed from the counteroffer panel grid.

|

If a countered loan application requires an account decision, the Account Decision Model does not run until the counteroffer is accepted. |

If Requires Review is If Approve Application on Counteroffer Acceptance is If Counteroffer Decision is Application Status is Changed to Decision Status is changed to Counteroffer Terms are Applied to Application Comments Yes No Auto or LO Approved Countered None No If the Loan Officer clicks the Accept button, the result is one of the following rows.

Yes Yes Auto Approved Decisioned Auto Approved Yes Yes Yes LO Approved Decisioned LO Approved Yes The approval process runs as the lending system user and LOA rules are bypassed. No N/A Auto Approved Decisioned Auto Approved Yes No N/A LO Approved Decisioned LO Approved Yes The approval process runs as the lending system user and LOA rules are bypassed.

Users without Approve Application and Counteroffer - Add, Edit, Delete permissions are unable to Save or Accept a counteroffer if Met Stipulations do not have Comments entered.

|

If a counteroffer is saved and later accepted without prior modifications, a full calculation is not triggered. The application updates base upon the terms of the counteroffer. |

Once the user accepts a counteroffer and approves the application, the Loan Origination module automatically rejects the original application and any other counteroffers. If no action is taken, the automatic withdrawal process updates the application with the correct status and final decision.