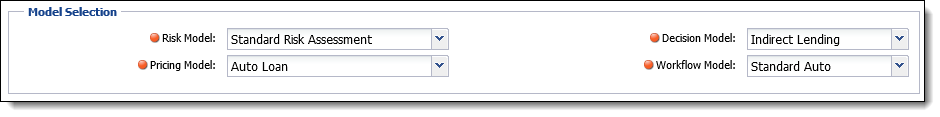

Models allow institutions to apply institutional policies. Models are assigned to each sub-product, in order to allow institutions to automate and standardize application processing.

| Model | Description | ||

| Risk |

Risk Models use business rules and matrices based on institutional lending policies and tolerances to assign applicant risk and determine creditworthiness.

|

||

| Pricing |

Pricing Models use base rate totals, thresholds and rules to determine application interest rates.

|

||

| Decision |

Decision Models use business rules and matrices based on institutional lending policies and tolerances to automatically render loan application decisions.

|

||

| Workflow |

Workflow Models provide institutions the ability to increase the efficiency of the application process by ensuring only relevant screens appear within the workspace. In addition to assigning screens to the workspace, workflow models enables administrators to create a roadmap for completing applications using screens.

|

Once the aforementioned models are defined, they are assigned at the sub-product level.

For more information on assigning models, see the Sub-Product topic.