| Administrator Guide > Recovery Process Overview > Interest Accrual |

The interest calculation process determines the amount of interest accrued for each active recovery account and repayment plan with a non-zero balance. The Lifecycle Management Suite also provides the ability to recalculate interest on recovery accounts and repayment plans and when variable interest rates have changed.

The following items must be configured in order for the Lifecycle Management Suite to correctly calculate interest:

|

If any of these items are not configured, the interest calculation process fails and errors are logged to the Event log in the Lifecycle Management Suite. |

The accounting rule must be active for the date that interest is calculated.

The interest calculation process can be executed manually within the workspace by a user or automatically through a nightly batch executable.

The Recalculate Interest button allows users with the appropriate permission to initiate real-time interest calculations on recovery accounts and repayment plans.

|

The Recalculate Interest button can be added to the the following panels and screens:

Additionally, this button is only enabled for users and/or security groups who have the Recalculate Accounting Rule Interest Recovery permission set to Change. |

|

This button is only enabled when the Calculation Pending flag is set to true for one or more accounting rules. |

The Calculate All Interest (Akcelerant.AccountServicing.Exe.ComputeRecoveryInterest) nightly batch executable automatically calculates daily interest for all eligible recovery accounts and repayment plans. A recovery account or repayment plan is considered eligible for interest calculation if the Interest Last Calculated field does not contain today's date (i.e. interest has not yet been calculated today). The Interest Last Calculated field is set on recovery accounts and repayment plans each time the Calculate All Interest executable runs and successfully calculates interest for the recovery account or repayment plan.

|

The Interest Last Calculated field is available in the field list for addition to screens, views, reports, and queues in the Lifecycle Management Suite. |

The Lifecycle Management Suite calculates both Annual Interest Rates and Daily Interest Rates for recovery accounts and repayment plans.

To calculate annual interest, the Lifecycle Management Suite locates the active accounting rule (indicated by the Active flag on the Recovery Account and Repayment Plan Interest Rates panels) for the recovery account or repayment plan. The Lifecycle Management Suite then reviews the flags on the accounting rule that indicate which top-level GL forward accounts (Principal, Reimbursable Expense, Non-reimbursable Expense, etc.) are included in interest accrual calculations.

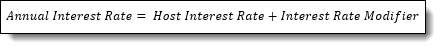

If the Is Variable Rate flag is set to true for the active accounting rule, the Lifecycle Management Suite uses a variable interest rate. The effective interest rate for the Interest Rate Type Id defined for the accounting rule is used to calculate interest. In this scenario, the annual interest rate equals the host interest rate plus the accounting rule interest rate modifier.

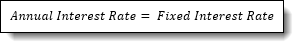

If the Is Variable Rate flag is set to false for the active accounting rule, the Lifecycle Management Suite uses a fixed interest rate. In this scenario, the annual interest rate equals the fixed interest rate defined in the accounting rule.

Once defined, the Lifecycle Management Suite indicates the dates the annual interest rate is valid from and to within the Interest Rates screen.

|

The Lifecycle Management Suite stores dates and times as the local date and time and do not include a time-zone indicator. |

Once the annual interest rate is determined, the Lifecycle Management Suite uses one of the following methods to define the daily interest rate:

|

The daily interest rate calculation method is selected using the Default Calculation Method parameter located within the Recovery page in System Management (System Management > Modules > Recovery). |

| Method | Description | ||

| Actual/Actual |

Calculates the Daily Interest Rate by dividing the Annual Interest Rate by the number of days in a calendar year (365 or 366 for a leap year).

|

||

| Actual/360 |

Calculates the Daily Interest Rate by dividing the Annual Interest Rate by 360, which determines a uniform monthly interest amount.

|

||

| Actual/365 |

Calculates the Daily Interest Rate by dividing the Annual Interest Rate by 365.

|

After daily interest is calculated, the rate is sent to the Transaction Processing Manager for processing and creation of Recovery Ledger entries based on Transaction Codes.

|

For more information on transaction processing, please see the Transaction Processing section of the Recovery Transactions topic in User Guide. |

The following are characteristics of interest calculated within the Lifecycle Management Suite:

For example, 3% interest is stored as 3.00, not 0.03.

While money values are displayed as two decimal places in the Lifecycle Management Suite, four decimal places are stored in the database. Money values greater than four decimal places are rounded to four decimal places using the industry standard "To Even" rounding algorithm, which is the default algorithm used by the Microsoft .NET Math.Round method.

The Lifecycle Management Suite's interest rate change process recalculates interest on recovery accounts, repayment plans, and variable interest rates to ensure the correct amount of interest exists on recovery accounts and repayment plans. The interest rate change process occurs when a user changes an accounting rule on the Recovery Account or Repayment Plan Interest Rates panels and when an administrator modifies an interest rate in Interest Administration.

After a user makes a manual change to an interest rate on a recovery account or repayment plan or if they notice the Calculation Pending flag is set to true, clicking  on the Recovery Account or Repayment Plan Interest Rates panels launches the ad-hoc interest rate change process.

on the Recovery Account or Repayment Plan Interest Rates panels launches the ad-hoc interest rate change process.

|

must be manually added to the Recovery Account Interest Rates panel and the Repayment Plan Interest Rates panel. must be manually added to the Recovery Account Interest Rates panel and the Repayment Plan Interest Rates panel. |

|

If  is not clicked, the interest rate change process occurs automatically during the nightly Compute Recovery Interest processing. is not clicked, the interest rate change process occurs automatically during the nightly Compute Recovery Interest processing. |

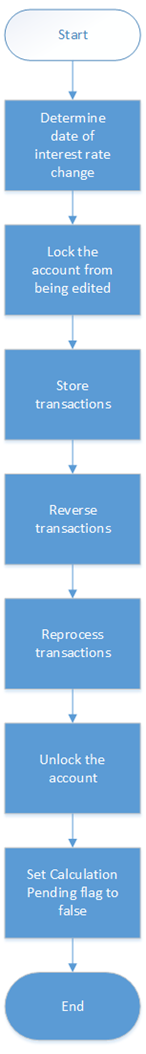

The interest rate change process for recovery accounts and repayment plans is illustrated and described as follows:

The Calculation Pending flag is automatically set when a user manually makes a change to an interest rate on the Recovery Account or Repayment Plan Interest Rates panel.

The current date is used as the posting date for all reversal and reprocessed transactions. The transaction codes and GL accounts that were applied in the initial transactions are used for the reversal and reprocessed transactions.

|

When interest calculation or accrual initiates, the transaction processing engine places a lock on the transaction currently in process. This lock ensures that only one recovery account or repayment plan transaction is processed at a time, mitigating the possibility of corrupt transaction data. If a transaction is currently in process and a user attempts to process another transaction, a "transaction in process" message is displayed indicating that the second transaction cannot be processed until the current transaction has completed processing. |

After an administrator makes a change to an interest rate on the Interest Administration page, the nightly Compute Recovery Interest processing launches the interest rate change process.

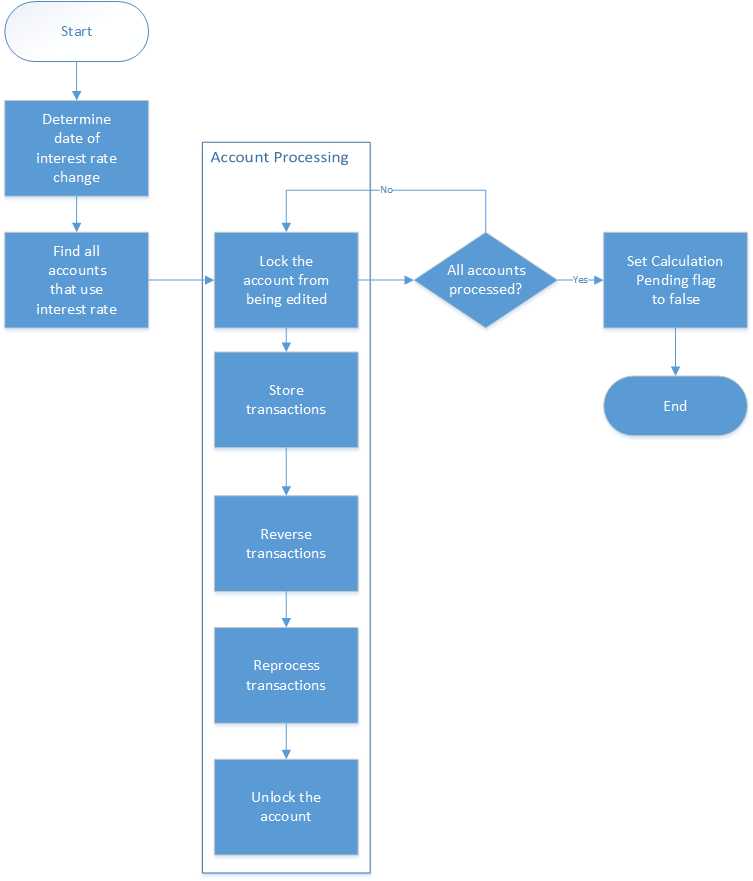

The interest rate change process for variable interest rates is illustrated and described as follows:

The Calculation Pending flag is automatically set when a change is made to an interest rate in Interest Administration.

The current date is used as the posting date for all reversal and reprocessed transactions. The transaction codes and GL accounts that were applied in the initial transactions are used for the reversal and reprocessed transactions.

Reprocessing transactions may cause any payments applied to appear different in the GL account due to more or less interest being accrued.