| Administrator Guide > Counteroffer Configurations |

Counteroffers provide users with the ability to counter the loan terms requested by the applicant with alternate terms. Rather than outright declining an application with unfavorable terms, users are able construct one or more counteroffers with terms more agreeable to the institution. This functionality provides institutions the opportunity to increase their loan portfolios, while minimizing their declinations.

Counteroffers may be constructed manually by Temenos users, or automatically by rules. Once a counteroffer is created, it is stored within the system where it can be reviewed with applicants.

|

If an application was originated by Dealertrack or RouteOne, Temenos Infinity communicates Counteroffers created within the system back to the connector. For more information on Counteroffers and their behavior within Dealertrack or RouteOne, refer to their Connector Guides. |

The processing can then proceed automatically, if indicated, without resubmitting to the decision engine. Counteroffers supports expirations and reminders of counteroffers using email.

|

The loan terms originally requested are available in the Audit History once a counteroffer is created. The following information is stored: Loan Terms, Aggregates, Ratios, and Review Indicators. |

This topic provides administrators details on the System Management configurations required to implement Counteroffers within the Loan Origination module. These configurations include:

Counteroffers are created, maintained, and viewed within the Counteroffer panel. This panel can be added to an Application screen in System Management > Origination > Screens.

Once configured, the screen must then be assigned to the applicable Loan Workflow Models in System Management > Origination > Loan > Loan Workflow Models.

|

It is recommended that this panel is assigned to an Application screen used during Underwriting Review. |

Counteroffer processing requires permissions to be granted in order to Add, Edit, Delete, Accept, and Reject Counteroffers. These permissions can be granted at both the User and Security Group levels within the Permissions tab in System Management Users, and System Management > Groups > Security Groups.

| Function | Description |

| Counteroffer - Accept and Reject | This permission allows a user in a security group to accept or reject a counteroffer. |

| Counteroffer - Add, Edit and Delete | This permission allows a user in a security group to add, edit, and delete a counteroffer they have made or another user has made. |

Each function contains two permission options:

| Permission | Description |

| None | The security group does not have any access to this permission. |

| Change | The security group has full access to view, create, edit, and copy this permission. |

|

When changing permissions for a security group, it affects every user under the security group. For example, a user has his/her permission for "Counteroffer - Accept and Reject" set to "None." This user is also part of the Lending Security Group. If the Security Group has permission for "Counteroffer- Accept and Reject" as "Change," then the user has full access to this permission, even though individually the permission is set to "None." |

Any application that requires Underwriting Review (Application Status = Pending Review) should be "queued" to an Underwriter. For any Application that has a Counteroffer, the application should be “queued” back and forth between the Underwriter and the user processing the Application. It is recommended that a queue be configured per department or per user. Underwriter (LO) and Member Service Representative (MSR) fields are now configurable.

The following new fields allow the administrator to design queuing rules around the following roles:

| Field | Description |

| Application.Underwriter |

|

| Application.ServiceRepresentative |

|

Using dates set within each application, institutions are able to configure the system to automatically withdraw abandoned applications and countered applications. Three date fields drive this functionality:

|

Based upon editability and user/group permissions, these fields can be manually set on both application and counteroffer screens. |

If the First Notification Date, Second Notification Date or Expiration Date is today and the Application Status is not Disbursed, Withdrawn or Auto Withdrawn, the Automatic Withdraw Process executes.

To configure the automatic withdraw process, institutions must complete the following steps:

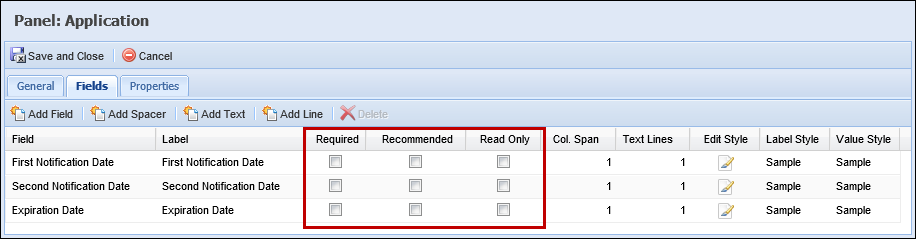

By default, the Counteroffer screen contains the Expiration Date, First Notification and Second Notification Date fields. However, these fields must be assigned to the application screen where loan terms and loan tracking information is collected.

Within the Counteroffers screen, the Expiration Date, First Notification and Second Notification Date fields are not required. However when these fields are added to the Application screen, the administrator is able to determine whether the fields are Required, Recommended or Read Only.

For more information on configuring application screens, refer to the Screens topic.

|

These field can either be set manually by the user or set automatically by rules. Refer to the Rules section within this topic for more information on rules. |

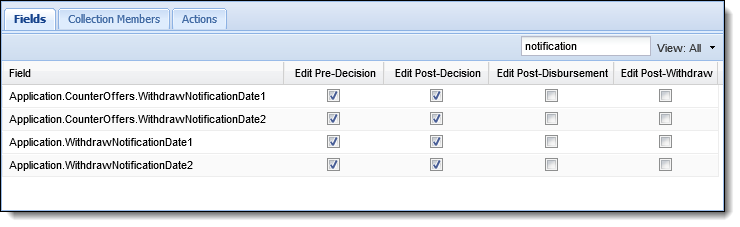

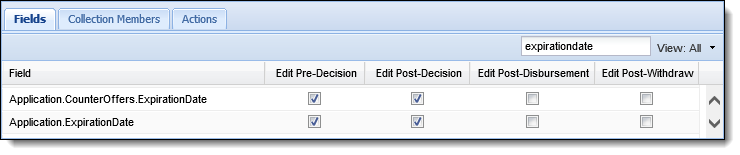

In addition to configuring whether the Expiration Date, First Notification Date and Second Notification Date fields are Required, Recommended or Read Only, institutions are able to configure the field editability.

The following application fields are available for editability configuration:

The following counteroffer fields are available for editability configuration:

For more information on configuring field editability, refer to the Editability topic.

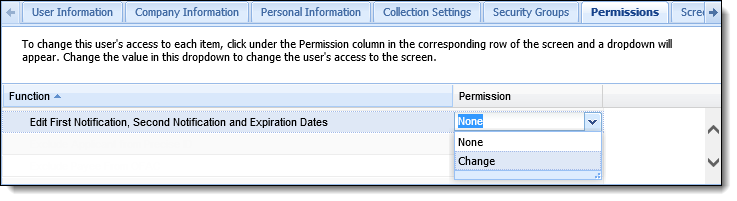

In addition to field editability, the ability to update the Expiration Date, First Notification Date and Second Notification Date fields are controlled by the following User or Security Group permission:

By default, this permission is set to None. To grant the permission to edit these fields, update this permission to Change.

By authoring rules, institutions are able to set the values of the Expiration Date, First Notification Date and Second Notification Date fields. Rule authors are able to write these rules at both the Application and Application.Counteroffer entity levels.

|

When authoring rules at the application level, it is advised that two rules are created or a single rule is written in such a way that the Expiration Date, First Notification Date and Second Notification Date fields are set initially by Created Date and reset by the Decision Date. |

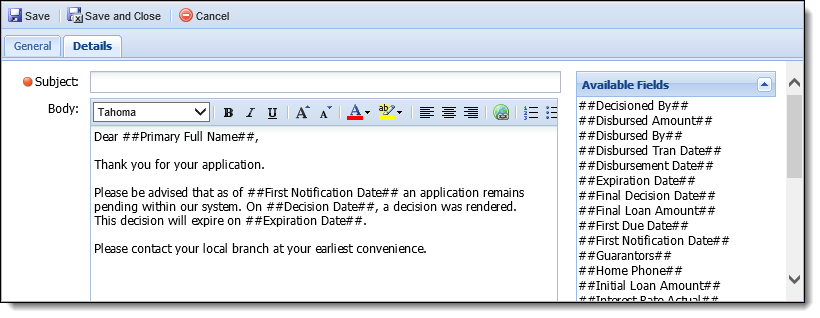

The automatic withdraw process uses emails to inform applicants when the First Notification, Second Notification and Expiration Dates have been reached. To use this feature, institutions must create individual email templates for both applications and counteroffers using the following email fields:

|

Once all email templates have been created, institutions should have six warning email templates (three templates for the automatic withdraw of an application and three templates for the automatic withdraw of a counteroffer). |

For more information on creating email templates, refer to the Email Template topic.

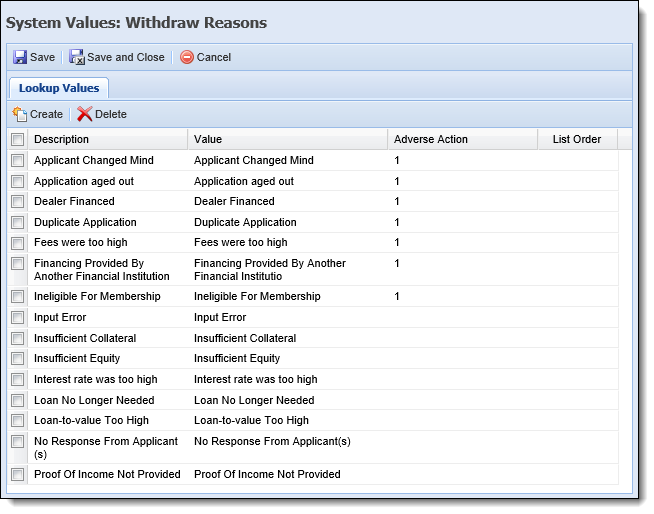

In order to employ automatic withdraw, institutions must identify a default Withdraw Reason that is associated with the application or counteroffer when withdrawn. From Field Configurations, create a new or locate an existing Withdraw Reason.

For more information on Field Configurations, refer to the Field Configurations topic.

With the assistance of a Temenos Customer Care Representative, activate the following process within the database:

| Process Name | Process ID |

| AUTOWITHDRAWPROCESS | 100 |

Once the Auto Withdraw process is activated, the following parameters must be activated within the database:

| Parameter ID | Process ID | Parameter Code (Name) | Description |

| 414 | 100 | Withdraw Notification Template 1 | Within the Parameter Value field, enter the ID that corresponds with the email template sent to applicants when the application reaches the First Notification Date. |

| 415 | 100 | Withdraw Notification Template 2 | Within the Parameter Value field, enter the ID that corresponds with the email template sent to applicants when the application reaches the Second Notification Date. |

| 416 | 100 | Withdraw Expiration Template | Within the Parameter Value field, enter the ID that corresponds with the email template sent to applicants when the application reaches the Expiration Date. |

| 417 | 100 | Default Withdraw Reason ID | Within the Parameter Value field, enter the ID that corresponds with the Withdraw Reason assigned to each application withdrawn via the auto withdraw process. |

| 418 | 100 | Counteroffer Withdraw Notification Template 1 | Within the Parameter Value field, enter the ID that corresponds with the email template sent to applicants when the counteroffer reaches the First Notification Date. |

| 419 | 100 | Counteroffer Withdraw Notification Template 2 | Within the Parameter Value field, enter the ID that corresponds with the email template sent to applicants when the counteroffer reaches the Second Notification Date. |

| 420 | 100 | Counteroffer Withdraw Expiration Template | Within the Parameter Value field, enter the ID that corresponds with the email template sent to applicants when the counteroffer reaches the Expiration Date. |

| 421 | 100 | Counteroffer Default Withdraw Reason ID | Within the Parameter Value field, enter the ID that corresponds with the Withdraw Reason assigned to each counteroffer withdrawn via the auto withdraw process. |

|

An automatic withdraw cannot be removed or changed manually. A withdraw can be removed by using rules or field change event processing. |

By default, counteroffers are constructed manually; however, institutions are able to automate the counteroffer process by completing the following configurations:

Within Rules Management, institutions are able to author rules which determine the countered terms and behavior. Within the Event Processing category, rule authors are able to define the behavior of automatic counteroffers using the following action templates:

| Template | Description | ||

| Create a counteroffer | This template enables institutions to define the interval in which countered loan terms and amounts should increase or decrease. | ||

| Create a counteroffer for manual review | This template enables institutions to define the loan terms and amount of the counteroffer. Upon generation, each counteroffer is flagged for underwriting review. | ||

| Set counteroffer priority |

This template enables institutions to define which loan term should be prioritized when creating counteroffers.

|

||

| Add a comment to a counteroffer | This template enables institutions to add comments to a counteroffer. | ||

| Add a stipulation to a counteroffer | This template enables institutions to add stipulations to a counteroffer. |

|

A rule can also be authored to set a default decline reason on automatic counteroffers. |

For more information on authoring rules using these action templates, see the Rules Management topic.

|

Institutions may opt to adjust Decisioning rules in order to counter more and decline less applications. |

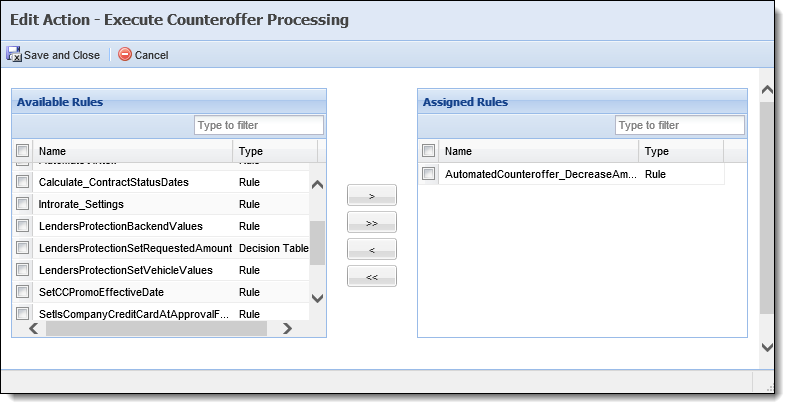

Once rules have been authored, create Event Action pairings to tie the automatic counteroffer rules to triggering events.

Within the Events tab, select an event that triggers the automatic counteroffer rules to process, such as: Field Changed > Application Status.

|

The Field Changed > Application Status event triggers the automatic counteroffer rules at any application status change. If configured, it is recommended that rule authors define which Application Statuses and/or Application Decisions trigger automatic counteroffer processing. |

Within the Actions tab, select the Execute Counteroffer Processing action and, using the multi-grid, assign the desired automatic counteroffer processing rules.

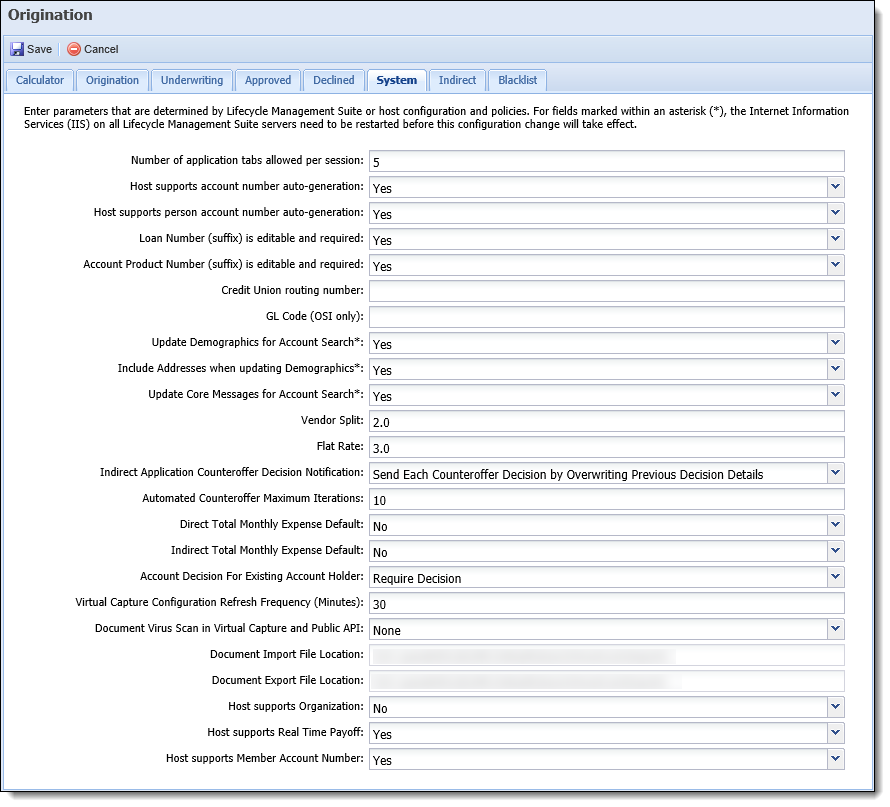

Once rules and event action pairs have been defined, navigate to System Management > Modules > Origination, and select the System tab.

Update the following parameters to define the behavior of automatic counteroffer processing:

| Parameter | Description | ||

| Indirect Application Counteroffer Decision Notification |

Allows institutions to indicate how the system communicates counteroffers to indirect connectors. Within this parameter, the following options are available:

|

||

| Automated Counteroffer Maximum Iterations |

Allows institutions to indicate the maximum number of iterations that each automated counteroffer action type should attempt.

|

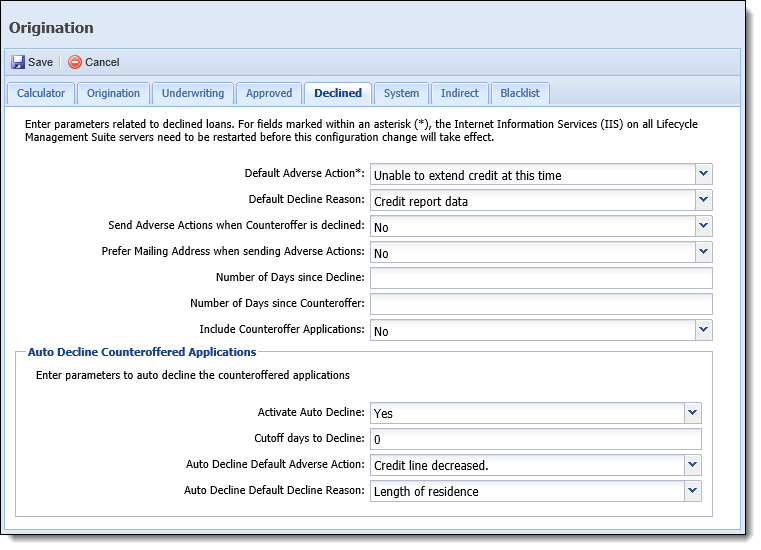

The Automatic Decline Process for Countered Applications provides institutions with the ability to automatically decline or withdraw applications including unaccepted counteroffers after a pre-determined amount of time lapses from when the counteroffer was created.

|

This process only auto-declines applications that have been countered, and surpass the value configured for the Cutoff Number of Days parameter in the Origination page. |

To activate and configure the Automatic Decline Process for Countered Applications:

|

The Auto Decline Default Adverse Action drop-down list contains the values configured for the ADVERSE_ACTION lookup type in System Management > Origination > Field Configurations. |

|

The Auto Decline Default Decline Reason drop-down list contains the values configured for the REJECT_REASON lookup type in System Management > Origination > Field Configurations. |

at the top of the Origination page to retain the settings.

at the top of the Origination page to retain the settings.Once activated, the Automatic Decline Process for Countered Applications runs each night at 10pm.

During this process, applications with a status of "Countered" are identified and automatically declined if they exceed the time frame configured for the Cutoff days to Decline parameter. When a countered application is automatically declined, the following values are set within the application:

| Field | Application Value | ||

| Application Status | Set to Decisioned. | ||

| Loan Decision |

Set to one of the following:

|

||

| Decisioned By |

Set to the name of the user who initiated the counteroffer.

|

||

| Adverse Action | Set to the value configured for the Auto Decline Default Adverse Action parameter in the Origination page. | ||

| Assigned Decline Reason |

Set to the value configured for the Auto Decline Default Decline Reason parameter in Origination page.

|