Transactions are linked to the client and the highlighted loan. These links cannot be broken.

The Trans Tab serves two functions:

- For core-maintained loans - displays transactions for the individual loan. Loan transactions are imported on request through the real-time interface and cannot be modified in the Collection Element. The default starting date for transactions is the current date minus the default number of days specified in the User Preferences form. You can modify this date if you wish.

- For locally-maintained loans - displays all transactions for the loan posted in the Collection Element. Transactions can be posted, reversed and deleted for all locally-maintained loans.

Core-Maintained Loans

To view transactions on core-maintained loans:

- Select the loan in the Loan Grid.

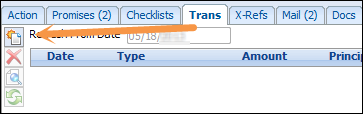

- Click the Trans tab.

- The default Starting Date is displayed on the tab. You can change this date if you wish for this particular loan. Alternatively, you can modify the default number of days in the User Preferences form.

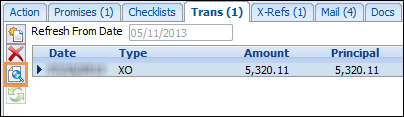

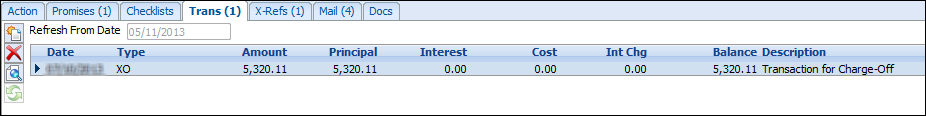

- Click the Refresh Transactions button to load transactions from the core system. All transactions that have been posted since the specified date for this loan will be displayed in reverse chronological order. The total number of transactions for the loan is displayed in brackets on the Trans tab.

- To view the details of a specific transaction, highlight the transaction and click the View Transaction button.

Locally-Maintained Loans

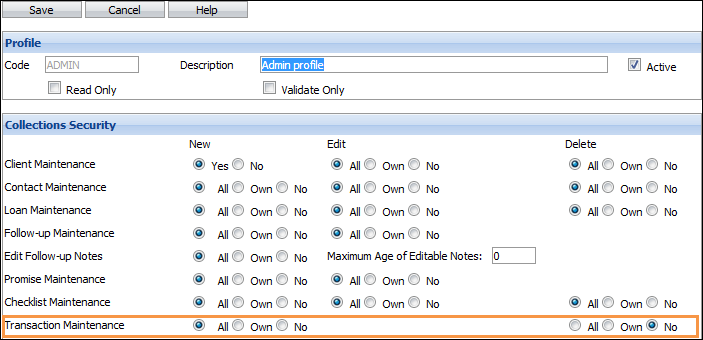

Your ability to post transactions is controlled by your Security Profile.

Create a New Transaction

- Select the loan in the Loan Grid.

- Click the Trans tab.

- All existing transactions are displayed in reverse chronological order. The total number of transactions for the loan is displayed in brackets on the Trans tab.

- Click the New Transaction button.

- Fill in the Transaction fields with the following information:

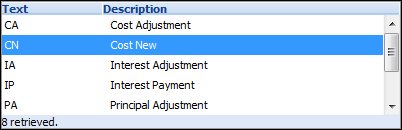

Fields Description Type Select the Transaction Type by either entering in the first three characters of the 10 character code or from the options displayed in the dropdown list. When entering in the three character code the list of codes will appear with the entry you entered highlighted. Press Enter to accept this selection or highlight the code you desire. Options will vary depending on the status of the loan.

Transaction Date Enter the effective Transaction Date - the current date is presented as the default date. Transactions cannot predate existing transactions.

Transaction Amount Enter the Transaction Amount.

- Charge-offs: You will not be able to enter an amount. The transaction amount will be equal to the Current Loan Balance. The Current Interest Balance, Current Principal Balance and Current Cost Balance values will be recorded in the transaction.

- Charge-off Reversal: You will not be able to enter an amount. All transactions posed against the loan since the Charge-off transaction will be reversed.

- Interest or Principal Payments: Values will always be negative. You will not be permitted to enter an amount greater than the current total outstanding amount (principal and interest).

- Interest Adjustments: Enter a negative amount to reduce the outstanding interest, a positive amount to increase the outstanding interest. You cannot reduce the interest by more than the current outstanding interest balance.

- Principal Adjustments: Enter a negative amount to reduce the outstanding principal, a positive amount to increase the outstanding principal. You cannot reduce the principal by more than the current outstanding principal balance.

- New Cost: Values must be positive.

- Cost Payment: Values must be negative. You will not be permitted to enter an amount greater than the current outstanding cost balance.

- Cost Adjustment: Enter a negative amount to reduce the outstanding cost balance, a positive amount to increase the outstanding cost balance. You cannot reduce the cost balance by more than the current outstanding cost balance.

- Reversal: You will not be able to enter an amount. Only the last transaction posted against the loan can be reversed.

- Close: You will not be able to enter an amount. The transaction amount will be the amount required to bring the Current Loan Balance to zero. This will include any new interest charged.

Description Enter a description.

Calculate Click Calculate. This serves several functions:

- If interest is being charged on the loan, interest will be Calculated from the last transaction date to the selected transaction date. The Rate type (fixed or for variable rate loans, the rate source), the interest rate (fixed rate or for variable rate loans, the percentage spread) and the Per Diem will also be displayed.

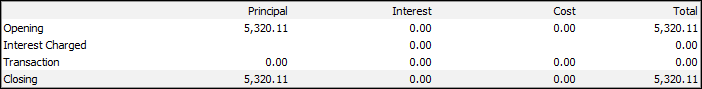

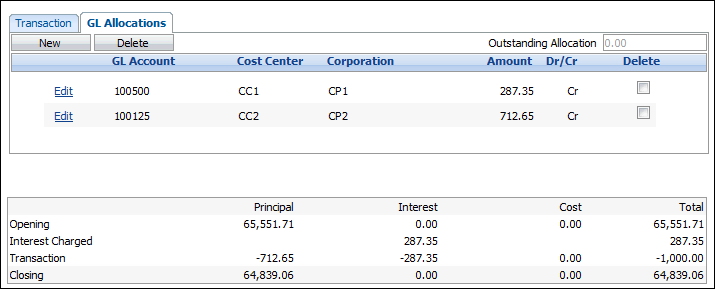

- The three lines at the bottom of the form (interest charged, transaction and closing) will display any interest calculated on the loan, how the transaction will be split between principal, interest and costs, and the closing balances after the transaction is applied.

- If the GL Module is being used and the default GL accounts have been specified, the default GL allocations will be created.

- Click the GL Allocations page to review the default GL allocations and modify them if required.

- Interest and principal payments and the reversals of such payments will update the status of any outstanding Promises to Pay.

If a client pays a specific amount and requests that the amount be split between two or more loans, you will need to enter a payment for the correct amount against each loan.

Edit a Transaction

View a Transaction

- Select the loan in the Loan Grid.

- Click the Trans tab. All existing transactions for the loan are displayed in reverse chronological order (the most-recent transaction at the top of the list). The total number of transactions for the loan are displayed in brackets on the Trans tab.

- Select the transaction you want to view.

- Click the View Transaction button.

- You can view the transaction and GL allocation details in a read-only window.

Delete a Transaction

The last transaction posted against a loan can be deleted provided the GL allocations have not already been exported. If they have, you will have to reverse the transaction instead.

- Select the loan in the Loan Grid.

- Click the Trans tab. All existing transactions for the loan are displayed in reverse chronological order (the most-recent transaction at the top of the list). The total number of transactions for the loan are displayed in brackets on the Trans tab.

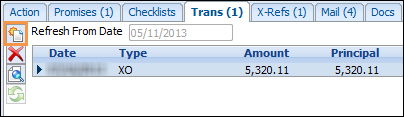

- Click the Delete Transaction button.

Reverse a Transaction

The last transaction posted against a loan can be reversed (as long as it is not a reversal transaction or a core-maintained transaction).

- Select the loan in the Loan Grid.

- Click the Trans tab. All existing transactions for the loan are displayed in reverse chronological order (the most-recent transaction at the top of the list). The total number of transactions for the loan are displayed in brackets on the Trans tab.

- Click the New Transaction button.

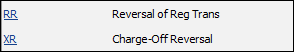

- Select the Reversal transaction type by entering the first three characters of the 10 character code or from the options displayed in the dropdown list.

Reversal Transaction Codes Description Reversing a regular transaction Returns the interest, principal, cost and balances to their pre-transaction values. If interest was accrued by the transaction being reversed, the interest charged will also be reversed and the interest date returned to its previous value. If the GL module is being used, a GL allocation will be posted that is the exact opposite of the original GL allocation.

Reversing a charge-off transaction Returns the loan to being host-maintained. This option is only available where the loan was originally host-maintained and it is still available in the download. This transaction will reverse the charge-off transactions AND any transactions that have been posted since the charge-off transaction. The interest, principal, cost and total balances are returned to their pre-charged off values. Any interest accrued since the loan was charged-off will be reversed. The interest date is cleared out and the Host flag is set to True. If the GL module is being used, GL allocations will be posted that are the exact opposite of each of the original GL allocations.

- Click Save.

From GL Allocations topic (deleted):

Access to this form is through Transaction Maintenance.

If you are posting a transaction to a locally-maintained loan and default GL accounts have been specified, the GL allocations will be created automatically.

- Click on the GL Allocations tab to display the default principal, interest and cost allocations.

- To override any of the values or allocations click Edit next to the allocation you want to change. Adjust the amount on any of the GL codes and click Save.

- To delete a GL allocation, click the Delete checkbox(es) next to the allocation(s) and click Delete.

- To add a new allocation, click New. A new allocation record will be added. The allocation amount will default to the amount needed to balance the transaction.

- You cannot save a transaction if the allocations do not balance.

- Whenever a GL Account, Cost Center or Corporation is used as a default setting within the GL Settings page, it will always show up in your GL Allocations page whether it is set as active or inactive.