| End-User Guide > Application Processing > Post-Decision > Approval > Funding |

When funding approved applications, users are able to allocate loan proceeds by selecting applicant deposit accounts, check payees, and voucher transactions to the General Ledger.

Users are able to complete the funding of an application by performing the following actions:

The generation of new loan account numbers and suffixes can be an automated process if the core supports account number auto-generation. This process is enabled by the Host supports account number auto-generation parameter within the System tab in the Solution.Origination page. For more information, please see the applicable Core Connector Guide.

User-defined Application screens can be created to allow users to update account numbers and fund approved applications. While account numbers can be generated by clicking  within the Application Toolbar and selecting Change Account/Loan Number, applications must be funded by navigating to an Application screen that contains the Funding panel.

within the Application Toolbar and selecting Change Account/Loan Number, applications must be funded by navigating to an Application screen that contains the Funding panel.

This topic provides the following information to assist users in funding an application:

In order to capture funding information within a loan application, system administrators can configure a user-defined Application screen to include different panels and fields that capture important funding data for a loan application.

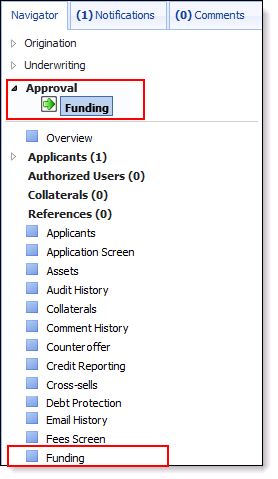

Depending on the configuration of the Workflow Model, this screen can be configured to appear within the Workflow and Screens section in the Application Navigator, as shown with the Funding screen in the below example:

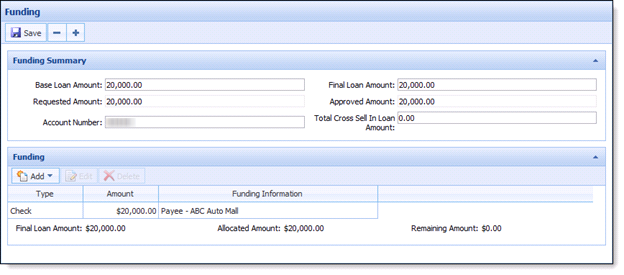

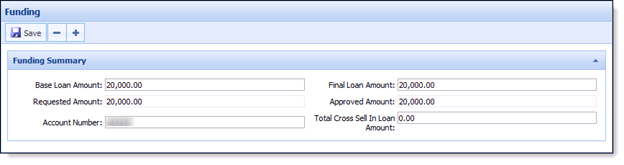

Depending on the configuration of the user-defined Application screen, users may be able to view a funding summary and allocate loan proceeds directly within the Funding Screen.

Depending on the configuration of the user-defined Application screen, a panel can be configured to capture loan information such as Base Loan Amount, Final Loan Amount, Approved Loan Amount, and Total Cross-sell In Loan Amount.

Additionally, fields may be configured to update the account numbers associated with the loan application. If the account number information is updated in the Funding screen, the loan is assigned the account numbers provided upon disbursement.

|

The Funding panel can be added to an Application screen in System Management > Origination > Screens. |

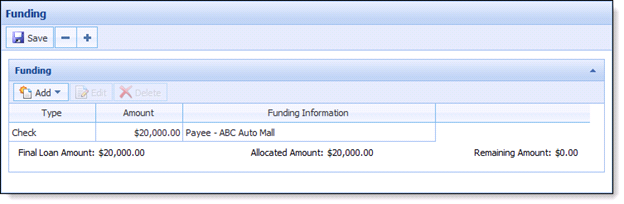

The Funding panel allows users to allocate loan proceeds by selecting applicant deposit accounts, check payees, ACH transfer to a third party, or voucher transactions to the General Ledger. Additionally, the Funding panel contains a grid that populates with loan proceed recipient records.

The Funding panel also tracks loan funding amounts, so users are able to see the remaining amount of funds to be allocated. Continue adding allocations until the Remaining Amount is $0.00.

The Funding panel contains a toolbar that allows users to perform the following functions:

| Icon | Description |

|

Allows a user to input a loan proceeds recipient. |

|

Allows a user to edit a loan proceeds recipient. |

|

Allows a user to remove a loan proceeds recipient. |

When  is clicked, a drop-down list populates with the available funding options. Select one the following funding options to allocate loan funds:

is clicked, a drop-down list populates with the available funding options. Select one the following funding options to allocate loan funds:

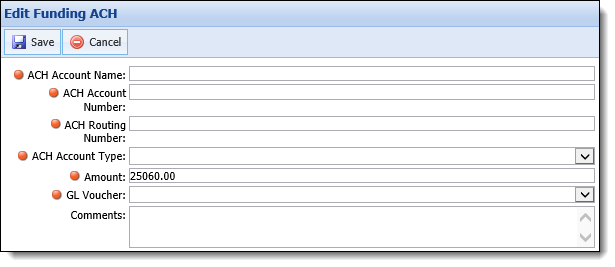

When a user selects ACH Transfer as a funding option, the Edit Funding ACH screen opens in a new window.

The Edit Funding ACH screen allows users to allocate the loan proceeds to be sent to a third party by completing the following fields:

|

When ACH Transfer is selected as the funding method in a vendor application, the funding information configured for the vendor by the system administrator pre-populates in the Edit Funding ACH screen.

|

| Field | Description | ||

| ACH Account Name | Enter the name of the financial institution to receive the allocation. | ||

| ACH Account Number | Enter the account number where the allocation is to be transferred. | ||

| ACH Routing Number | Enter the routing number for the receiving financial institution. | ||

| ACH Account Type | Select Checking or Savings to identify the type of account to receive the allocation. | ||

| Amount | This field defaults to the amount available to be funded. If desired, clear the default amount pre-populated in the field and enter the amount to be sent in the ACH Transfer. | ||

| GL Voucher | Select the General Ledger from which the allocation is to be made. This drop-down includes a list of the general vouchers identified within the Lending.GLVoucher database table. | ||

| Comments |

If desired, enter comments regarding the ACH transaction.

|

Once all fields are complete, click  to add the ACH Transfer funding record to the application.

to add the ACH Transfer funding record to the application.

|

With this funding option, information is placed in a formatted file and exported to the vendor via the NACHA - Origination connector. For more information, please see the NACHA - Origination Connector Guide. |

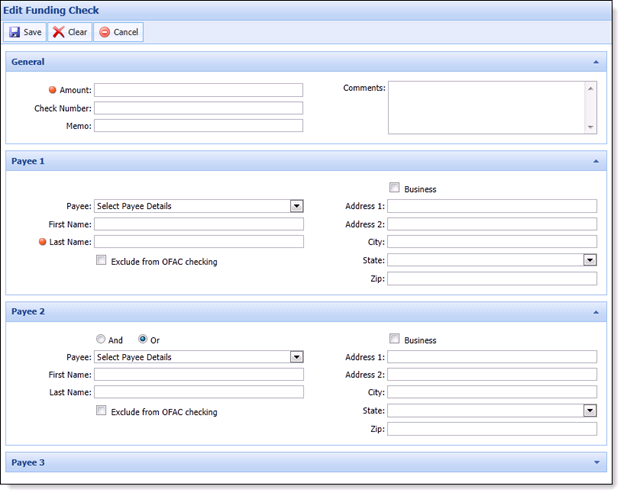

When a user selects Check as a funding option, the Edit Funding Check screen opens in a new window.

The Edit Funding Check screen contains a General Panel where users can enter the following information:

| Field | Description |

| Amount | Enter the value of the check being issued from the loan proceeds. |

| Check Number | Enter the number of the check being issued. |

| Memo | Enter the memo statement that appears on the check. |

| Comments | Enter any applicable funding comments. |

Once the check information is entered, identify a maximum of three check payees for each check used to fund a loan application. Starting with Payee 1, enter the names of the individuals or businesses checks to appear on the check(s).

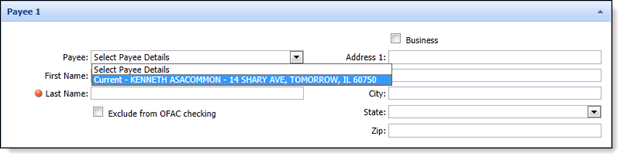

If the loan payees are also the applicants, the Payee fields contain a drop-down list that pre-populates with the name of each applicant on the application.

Each payee panel contains the following fields:

| Field | Description | ||

| Payee |

Using the drop-down, select the applicant who the check is to be made payable to.

|

||

| First Name | Enter the first name of the check payee. | ||

| Last Name |

Enter the last name of the check payee.

|

||

| Exclude from OFAC checking | If the payee is to be excluded from OFAC checking, select this check box | ||

| Business | Select this check box if the check payee is a business. | ||

| Address 1 | Enter the check payees's street address. | ||

| Address 2 | Enter the check payees's street address line 2. | ||

| City | Enter the check payees's city. | ||

| State | Enter the check payees's state. | ||

| Zip | Enter the check payees's postal code. |

If multiple payees are added to check, indicate if the check is made payable as an AND or OR relationship.

|

Checks made payable using an "And" relationship typically require the signatures of all payees. Checks made payable using an "Or" relationship typically require only one signature. |

Once all payee information has been entered, click  to finalize the payees. Click

to finalize the payees. Click  to remove all information that has been entered in the Edit Funding Check screen. Click

to remove all information that has been entered in the Edit Funding Check screen. Click  to return to the Funding panel without adding any payees.

to return to the Funding panel without adding any payees.

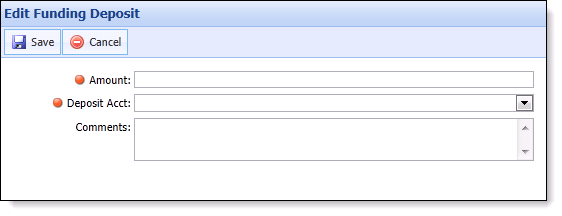

When a user selects Deposit as a funding option, the Edit Funding Deposit screen opens in a new window.

The Edit Funding Deposit screen allows users to allocate loan proceeds directly to the applicant's deposit accounts within the institution by completing the following fields:

| Fields | Description |

| Amount | In the Amount field, enter the amount that is to be deposited into the applicant’s account. |

| Deposit Acct |

Use the Deposit Account drop-down list to select the account where the application proceeds are to be deposited. This drop-down list contains the primary applicant's current account products at the institution. |

| Comments | Enter any applicable funding comments. |

Once the deposit allocation has been entered, click  to finalize the deposit allocation selection. Click

to finalize the deposit allocation selection. Click  to return to the Funding panel without selecting a deposit allocation.

to return to the Funding panel without selecting a deposit allocation.

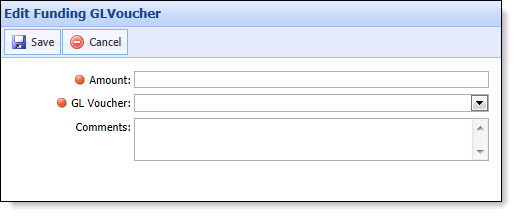

When a user selects GL Voucher as a funding option, the Edit Funding GL Voucher screen opens in a new window.

The Edit Funding GL Voucher screen allows users to allocate loan proceeds (such as fees and premiums that are financed into the loan) directly to an institution General Ledger account by completing the following fields:

| Field | Description |

| Amount | In the Amount field, enter the amount that is to be deposited into the General Ledger account. |

| GL Voucher |

The GL Voucher field contains a drop down list that pre-populates with the General Ledger account eligible for loan fund allocations. .

The GL Voucher drop-down populates with the general vouchers identified within the database's Lending.GLVoucher table. |

| Comments | Enter any applicable funding comments. |

Once the GL Voucher allocation has been entered, click  to finalize the GL voucher allocation selection. Click

to finalize the GL voucher allocation selection. Click  to return to the Funding panel without selecting a GL Voucher allocation.

to return to the Funding panel without selecting a GL Voucher allocation.

|

If an application contains internal liabilities, which are being refinanced, the Loan Origination module automatically creates funding records. Users cannot edit or delete these funding records. However, if an application contains external liabilities which are being refinanced, users must manually create the Check or GL funding records. |

|

Clicking OK within the Edit Funding window does not save the funding recipient to the application. The screen must be saved in order to permanently add the funding recipient to the application. |

The transactions within the Funding panel are processed when  is clicked within the Application Toolbar.

is clicked within the Application Toolbar.

|

For an overview of the Funding process at time of disbursement, please see the Disburse topic within this guide. |

|

All funding types are editable prior to disbursement. |

.

. to retain the changes.

to retain the changes. |

All funding types are able to be deleted prior to disbursement. |

.

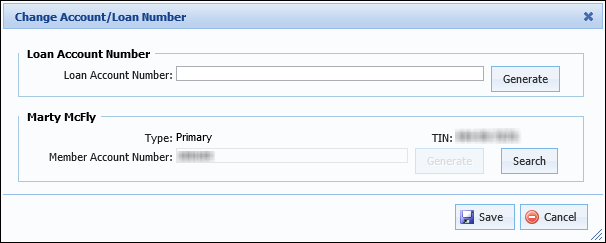

.At any time while processing an application, users are able to click  within the Application toolbar and select Change Account/Loan Number to determine the account number for the account holder or loan assigned to the application.

within the Application toolbar and select Change Account/Loan Number to determine the account number for the account holder or loan assigned to the application.

Selecting this opens the Change Account/Loan Numbers screen:

The Change Account/Loan Number screen is divided into the following sections:

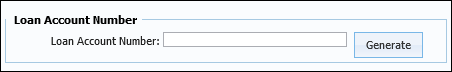

The Loan Account Number section enables users to create a new loan account numbers/suffixes for the loan the application. The Loan Account Number may be determined manually by users within the Change Account/Loan Numbers screen or automatically using Event Processing.

The Loan Account Number section allows users to manually enter or generate/reserve a new Loan Account Number (or suffix) in the core system.

|

The ability to manually enter a loan account number within this section is controlled by a module parameter within the Solution.Origination page. The Loan Number (suffix) is editable and required parameter within the System tab must be set to Yes in order for users to be able to manually enter a loan account number within this section. |

A user’s ability to enter or generate an account number depends on the loan type.

Once Generate is clicked within this section, a loan account number generates and automatically populates within the Loan Account Number field.

|

Please see the Generate section within this topic for more information on generating an account number. |

The Loan Account Number/Suffix may generate automatically, based on configurations made within Event Processing. If configured, the Loan Account Number/Suffix generates when the corresponding event occurs. The Generate Account Number action assigns a new loan and/or account number/suffix based on the following logic:

|

Queue routing rules execute if the application is not currently in process by a user. |

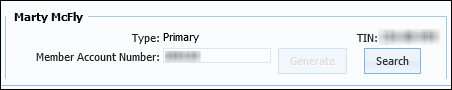

The Member Account Number section enables users to create a member account number for a new primary applicant, generate a new member account number for an existing primary applicant, or change the account number currently assigned to the application. The Member Account Number may be determined manually by users within the Change Account/Loan Number screen or automatically using Event Processing.

|

When processing loan applications that require escrow, users must create the customer/member record, base share and escrow account on the core prior to disbursing. |

At the bottom of the Change Account/Loan Number screen, the Member Account Number section populates with the name, applicant type, tax identification number, and member account number for the primary applicant assigned to the application.

Once Generate is clicked within this section, an account number for the primary applicant is generated and automatically populated within the Member Account Number field.

When the primary applicant is an existing account holder, and the user is granted the appropriate permission by the system administrator, the Generate button is enabled and provides the ability to create a new record for the applicant in the core system.

Users also have the ability to click Search to retrieve account numbers associated with the applicant’s TIN from the core system.

|

The Search function is only available for Member Account Numbers. |

The Search process enables users to change the member account number assigned to the application. If the applicant is a current account holder, theLoan Origination module searches the core for account numbers associated with the applicant’s TIN.

|

If the applicant is configured as a non-member, the Search function can be used to locate existing member accounts that may be associated with the TIN provided. |

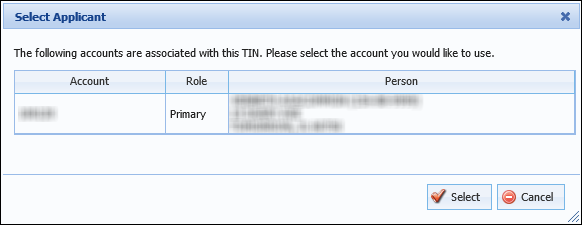

Search results return in the Select Applicant window.

Associated accounts populate in the grid with the following information:

| Column | Description |

| Account | Displays the account number associated with the applicant. |

| Role | Displays the applicant’s role on the account. |

| Person | Displays the applicant’s name and address. |

Highlight an account within the grid and click  to change the account number to that of the associated account.

to change the account number to that of the associated account.

The selected account number populates in the applicant’s Member Account Number field on the Change Account Numbers screen.

|

Please see the Generate section within this topic for more information on generating an account number. |

The Member Account Number may generate automatically, based on configurations made within Event Processing. If configured, the Member Account Number generates when the corresponding event occurs. The Create Member Account Number action creates and returns an account number to the module for the application's primary applicant based on the following logic:

|

If a rule to set the value of the NewMembership field to Create New Member Account has been authored by the system administrator, a new record for an existing primary applicant is automatically created in the core during the specified stage in the application process. For more information on rule configurations to automatically create an applicant record in the core, please see the Core section under Workspace Toolbar in the Administrator Guide's Application Processing Overview topic. |

|

Queue routing rules execute if the application is not currently in process by a user. |

|

From the Event Processing page in System Management, the following event/action pair can be configured to execute during the document generation process:

Upon clicking |

|

The Generate button is disabled when:

|

The generate account number process creates a record for the account holder in the core system and updates the information on the screen with the new account number(s).

|

If configured by the system administrator, a system-defined event may also execute upon clicking  to automatically create a record for the account holder in the core system and generate a member account number for the application’s primary applicant. This allows for the addition of account numbers to application documents before disbursement occurs. For more information, please see the Event Processing Event/Action Pair section within this topic. to automatically create a record for the account holder in the core system and generate a member account number for the application’s primary applicant. This allows for the addition of account numbers to application documents before disbursement occurs. For more information, please see the Event Processing Event/Action Pair section within this topic. |

Upon clicking Generate within the Loan Account Number, Member Account Number section, an account number from the core populates within the associated field.

When the primary applicant is an existing account holder, clicking Generate within the Member Account Number section creates a new record for the applicant in the core system. Upon clicking Generate, a message displays to alert that the primary applicant has an existing account and confirm that a new member account should be created. Click Yes to create a new record for the applicant in the core system or No to return to the Change Account/Loan number screen. Once generated, the new account number for the applicant populates within the Member Account Number field. Upon disbursement of the application, the new Member Account Number is created within the core and the primary applicant's account number is set to the new account number in the application.

Once all account numbers have been entered or generated, click  to retain the updated account numbers.

to retain the updated account numbers.

|

During disbursement, an account number is only generated when the account number for the is left blank. A Validation error is received to prevent an application from being disbursed if an account number for a is required and not present. For more information, please see the Disburse topic within this guide. |

Clicking  triggers the following processes:

triggers the following processes:

|

The behavior that occurs during this process may vary in each core. For core specific information, please see the applicable core connector guide for the institution. |