| End-User Guide > Recovery Process > Recovery Accounts |

Once an account has been charged off, it becomes a recovery account. From this point, an institution is able to view details such as recovery account status, balance, charged-off date, and interest rate. Additionally, recovery accounts may enter into a repayment plan, where the debtor agrees to pay back the amount that has been charged off. If a formalized repayment plan cannot be arranged with the debtor, recovery agents are able to apply transactions directly to the recovery account should a payment be received.

Depending on an institution's configuration, one or more account screens and workflows may be employed to work recovery accounts.

Recovery account information is accessible on user-defined Account screens that are created by institutions in System Management > Screens. The following list encompasses the panels or logical field groupings that may be configured at an institution:

|

The aforementioned account information may be assigned to one or across multiple user-defined screens. Refer to the Screens section of the Administrator Guide for more information on configuring account screens and panels. |

|

The Recovery Overview screen is only available for customers who have upgraded to Lifecycle Management Suite release 15.05 and who have the Recovery module active at the time of the upgrade. If not an upgrade customer, please contact Temenos Customer Care to implement a similar screen. |

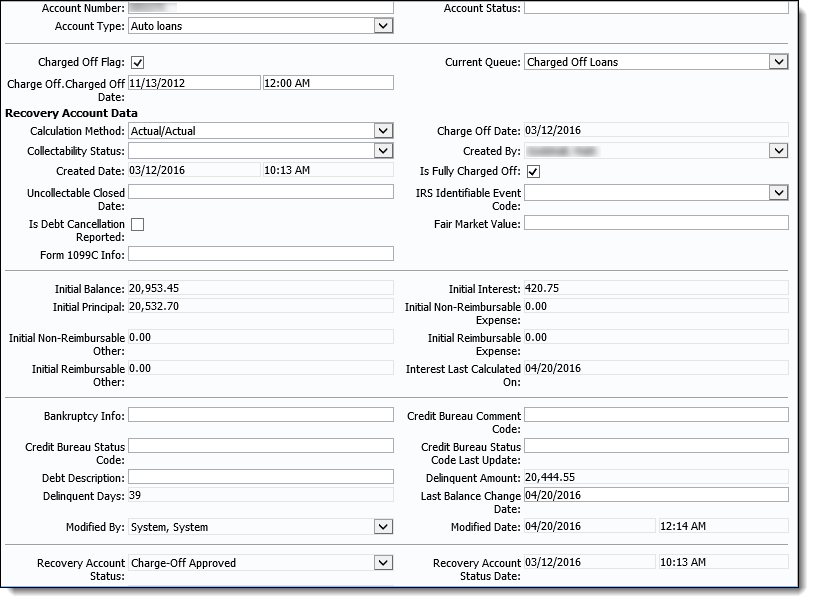

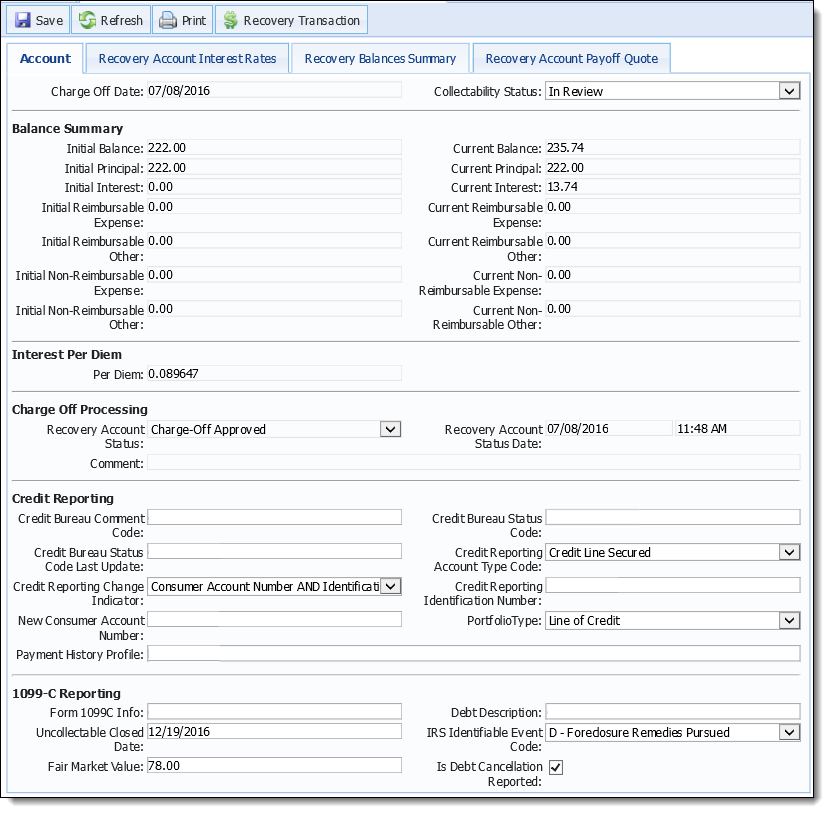

Basic Recovery Account Details consists of a variety of top-level recovery account fields organized within an account panel type.

These fields may consist of the following top-level fields:

Basic recovery account details may also consist of Initial fields, such as Initial Balance, Initial Interest, and Initial Principal. Additionally, this panel may also include 1099c fields, such as Debt Description, Fair Market Value, IRS Identifiable Event Code, and Is Debt Cancellation Reported.

In addition to the fields noted above, the Recovery fields included in the following section are automatically set each time data is modified on a recovery account:

Automatically Calculated Recovery Fields

Automatically Calculated Recovery Fields

The following fields are automatically calculated for a recovery account based on payment details and/or values set within Recovery fields:

| Field | Description | Example | |||||||||||||||||||||||||

| Days Since Last Payment |

Indicates the number of days since a payment was last made on the recovery account. This field is calculated based on the difference between the Last Payment Date and the current date.

|

If the Last Payment Date for a recovery account is 8/20/2015, and the current date is 8/27/2015, Days Since Last Payment is set to 7. |

|||||||||||||||||||||||||

| Delinquent Amount |

Indicates the total amount that the recovery account is delinquent. This field is calculated based on the sum of all General Ledger balances for the recovery account.

|

The following General Ledger Entries exist for a recovery account:

In this example, the Current Balance field is set to $5200 ($5000 + $500 - $300). |

|||||||||||||||||||||||||

| Delinquent Days | Indicates the number of days that the recovery account is delinquent. This field is calculated based on the difference between the Charge Off Date and the current date. | If the Charge Off Date for a recovery account is 7/21/2015 and the current date is 8/24/2015, Delinquent Days is set to 35. | |||||||||||||||||||||||||

| Is Fractional Amount | Indicates that a component GL balance for a recovery account includes an amount that is below a penny. This field is set to true when any of the component GL balances for a recovery account include a fractional amount that is below a penny. | If Principal has a balance of $800.2377, the Is Fractional Amount flag is set to true for the recovery account. | |||||||||||||||||||||||||

| Last Balance Change Date |

Indicates the date that the balance for the recovery account was last changed due to a transaction on the recovery account or any associated repayment plans.

This is a read-only field that is set based on the date of the most recent transaction that does not have a Transaction Code with a category of Interest. |

The following three transactions exist for a Recovery account:

The Transaction Codes for the above transactions are configured as follows:

In this example, the Last Balance Change Date is set to 8/20/2015 since that is the most recent transaction and the transaction code does not have a category of interest. |

|||||||||||||||||||||||||

| Last Payment Date | Indicates the date that a payment was last received for the recovery account. This field is set based on the most recent Effective Date for a payment that has a Transaction Code with a category of Payment/Recovery and a Posting Type of credit. |

The following three transactions exist for a Recovery account:

The Transaction Codes for the above transactions are configured as follows:

In this example, the Last Payment Date is set to 8/08/2015 since that transaction has the most recent Effective Date and includes the appropriate transaction code. |

|||||||||||||||||||||||||

| Per Diem |

Indicates the amount of interest being applied to the recovery account daily.

This field is calculated based on the interest rate and the value of the Default Calculation Method configured by the system administrator in the Recovery Settings tab of the Recovery page in System Management.

The Per Diem calculation for each Calculation Method is as follows:

|

If the interest rate for a recovery account is 15.000000 and the Default Calculation Method is set to ACTUAL / 365, the Per Diem field is set to 0.041096. |

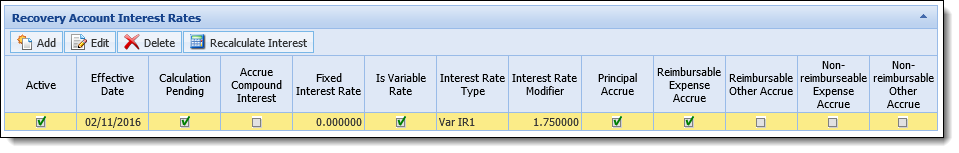

The Recovery Account Interest Rates panel provides recovery agents the ability to determine a recovery account's interest rate configuration. This panel displays all of a recovery account's interest rates or accounting rules. From this panel, users are able to easily view the interest rate details associated with a recovery account as well as quickly add and manage interest rates directly within the workspace.

|

For more information on this panel, please see the Recovery Account and Repayment Plan Interest Rates topic. |

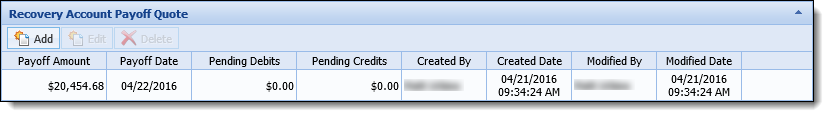

The Recovery Account Payoff Quote panel provides recovery agents with the ability to create and manage payoff quotes for a recovery account. A payoff quote is required in business situations, such as the debtor receiving a significant sum of money, wanting to pay off a single account or asking for a payoff towards the end of their repayment plan.

|

For more information on this panel, please see the Recovery Account and Repayment Plan Payoff Quotes topic. |

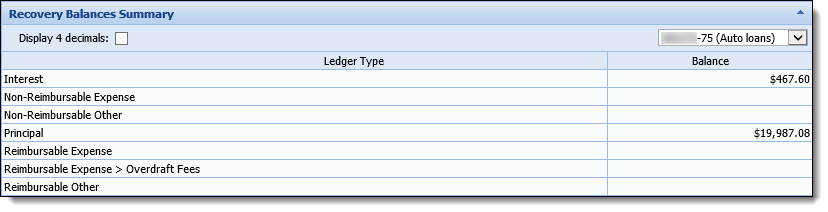

The Recovery Balances panel provides recovery agents the ability to view ledger and total balance information for Recovery Accounts and Repayment Plans (if associated).

|

For more information on this panel, please see the Recovery Balances Summary topic. |

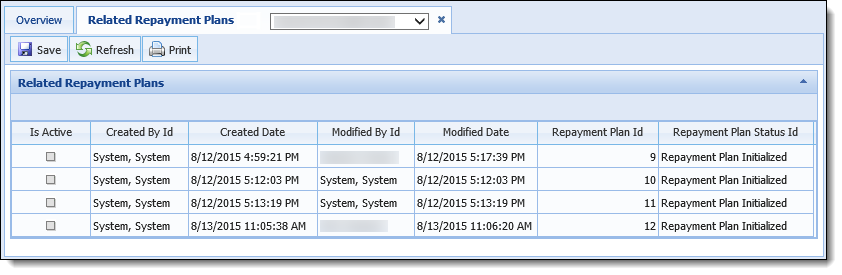

The Related Repayment Plans lists all of the Repayment plans for the Person or Account in context. This panel allows users to quickly access the existing repayment plans in order to allow the details to be viewed/modified.

|

For more information on this panel, please see the Related Payment Plans topic. |

|

The Recovery Overview screen is only available for customers who have upgraded to Lifecycle Management Suite release 15.05 and who have the Recovery module active at the time of the upgrade. If not an upgrade customer, please contact Temenos Customer Care to implement a similar screen. |

The Recovery Overview screen is a pre-configured screen that enables the ability to view high-level Recovery account details such as Recovery account status, balance, charged-off date, and interest rate. Additionally, this screen includes Initial fields, such as Initial Balance and Initial Interest, and 1099c fields, such as Debt Description and Fair Market Value. From this screen, users are able to easily view the top-level details associated with a recovery account as well as quickly add and manage interest rates and payoff quotes directly within the workspace.

|

This screen replaces the old Recovery Overview and Recovery Summary screens. |

This screen is comprised of four tabs:

|

For more information on each tab within this screen, please see the Basic Recovery Account Details, Recovery Account Interest Rate, Recovery Account Payoff Quote, and Recovery Balances Summary sections of this topic. |

Within Account screen types, the following buttons allow debt collectors to perform actions on recovery accounts:

Throughout the recovery process, payments from debtors can be applied to recovery accounts through transactions. The Recovery solution's transaction processing engine provides the ability for users to apply transactions to accounts at one time as well as generate General Ledger (GL) entries in a few simple steps. To process a transaction on a recovery account, click  .

.

|

For more information on processing recovery transactions, please see the Recovery Transactions topic. |

The recovery process is completed when an account is paid in full and has been finalized by a user with the appropriate permissions. To finalize a recovery account, click  .

.

|

|

Once clicked, a message appears to confirm that the repayment plan should be finalized. Click Yes to proceed with the finalization.

The finalization process performs the following validations:

If any of these validations fail, a message appears to the user containing suggestions for how to resolve the issue so the recovery account can be finalized.

Once the recovery account passes the aforementioned validations, it is finalized and the Recovery Account Completed Date is set to today's date. Additionally, a message appears to indicate that the finalization has been successful. Click OK to close the message and return to the recovery account screen.